Form D1-B - Dayton Business Declaration Of Estimated Tax

ADVERTISEMENT

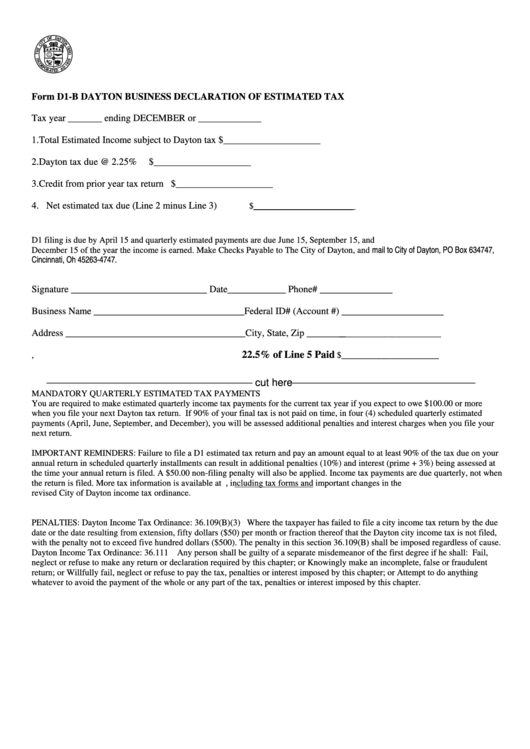

Form D1-B DAYTON BUSINESS DECLARATION OF ESTIMATED TAX

Tax year _______ ending DECEMBER or _____________

1. Total Estimated Income subject to Dayton tax

$____________________

2. Dayton tax due @ 2.25%

$____________________

3. Credit from prior year tax return

$____________________

4. Net estimated tax due (Line 2 minus Line 3)

$_______________________

D1 filing is due by April 15 and quarterly estimated payments are due June 15, September 15, and

December 15 of the year the income is earned. Make Checks Payable to The City of Dayton, and mail to City of Dayton, PO Box 634747,

Cincinnati, Oh 45263-4747.

Signature ____________________________ Date____________ Phone# _______________

Business Name _______________________________Federal ID# (Account #) _____________________

Address _____________________________________City, State, Zip ________

_______________________

22.5% of Line 5 Paid

,

$______________________

____________________________________ cut here ________________________________

MANDATORY QUARTERLY ESTIMATED TAX PAYMENTS

You are required to make estimated quarterly income tax payments for the current tax year if you expect to owe $100.00 or more

when you file your next Dayton tax return. If 90% of your final tax is not paid on time, in four (4) scheduled quarterly estimated

payments (April, June, September, and December), you will be assessed additional penalties and interest charges when you file your

next return.

IMPORTANT REMINDERS: Failure to file a D1 estimated tax return and pay an amount equal to at least 90% of the tax due on your

annual return in scheduled quarterly installments can result in additional penalties (10%) and interest (prime + 3%) being assessed at

the time your annual return is filed. A $50.00 non-filing penalty will also be applied. Income tax payments are due quarterly, not when

the return is filed. More tax information is available at , including tax forms and important changes in the

revised City of Dayton income tax ordinance.

PENALTIES: Dayton Income Tax Ordinance: 36.109(B)(3) Where the taxpayer has failed to file a city income tax return by the due

date or the date resulting from extension, fifty dollars ($50) per month or fraction thereof that the Dayton city income tax is not filed,

with the penalty not to exceed five hundred dollars ($500). The penalty in this section 36.109(B) shall be imposed regardless of cause.

Dayton Income Tax Ordinance: 36.111

Any person shall be guilty of a separate misdemeanor of the first degree if he shall: Fail,

neglect or refuse to make any return or declaration required by this chapter; or Knowingly make an incomplete, false or fraudulent

return; or Willfully fail, neglect or refuse to pay the tax, penalties or interest imposed by this chapter; or Attempt to do anything

whatever to avoid the payment of the whole or any part of the tax, penalties or interest imposed by this chapter.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2