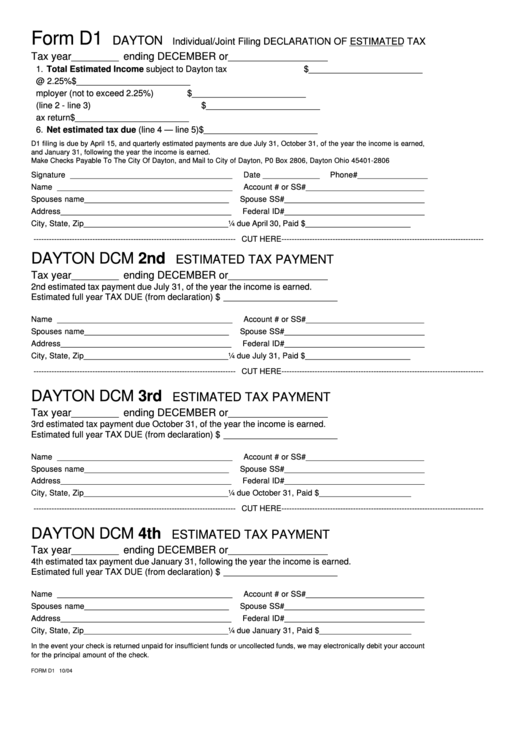

Form D1 - Individual/joint Filing Declaration Of Estimated Tax

ADVERTISEMENT

Form D1

DAYTON

Individual/Joint Filing DECLARATION OF ESTIMATED TAX

Tax year

ending DECEMBER or

__________

_____________________

1. Total Estimated Income subject to Dayton tax

$ ________________________

2. Dayton tax due @ 2.25%

$ ________________________

3. Estimated tax withheld by employer (not to exceed 2.25%)

$ ________________________

4. Total estimated tax due (line 2 - line 3)

$ ________________________

5. Credit from prior year tax return

$ ________________________

6. Net estimated tax due (line 4 — line 5)

$ ________________________

D1 filing is due by April 15, and quarterly estimated payments are due July 31, October 31, of the year the income is earned,

and January 31, following the year the income is earned.

Make Checks Payable To The City Of Dayton, and Mail to City of Dayton, P0 Box 2806, Dayton Ohio 45401-2806

Signature _____________________________________

Date _____________

Phone# ________________

Name ________________________________________

Account # or SS# ___________________________

Spouses name _________________________________

Spouse SS# ________________________________

Address _______________________________________

Federal ID# ________________________________

City, State, Zip _________________________________

¼ due April 30, Paid $ ________________________

------------------------------------------------------------------------------- CUT HERE -------------------------------------------------------------------------------

DAYTON DCM 2nd

ESTIMATED TAX PAYMENT

Tax year

ending DECEMBER or

__________

_____________________

2nd estimated tax payment due July 31, of the year the income is earned.

Estimated full year TAX DUE (from declaration) $ ________________________

Name ________________________________________

Account # or SS# ___________________________

Spouses name _________________________________

Spouse SS# ________________________________

Address _______________________________________

Federal ID# ________________________________

City, State, Zip _________________________________

¼ due July 31, Paid $ ________________________

------------------------------------------------------------------------------- CUT HERE -------------------------------------------------------------------------------

DAYTON DCM 3rd

ESTIMATED TAX PAYMENT

Tax year

ending DECEMBER or

__________

_____________________

3rd estimated tax payment due October 31, of the year the income is earned.

Estimated full year TAX DUE (from declaration) $ ________________________

Name ________________________________________

Account # or SS# ___________________________

Spouses name _________________________________

Spouse SS# ________________________________

Address _______________________________________

Federal ID# ________________________________

City, State, Zip _________________________________

¼ due October 31, Paid $ _____________________

------------------------------------------------------------------------------- CUT HERE -------------------------------------------------------------------------------

DAYTON DCM 4th

ESTIMATED TAX PAYMENT

Tax year

ending DECEMBER or

__________

_____________________

4th estimated tax payment due January 31, following the year the income is earned.

Estimated full year TAX DUE (from declaration) $ ________________________

Name ________________________________________

Account # or SS# ___________________________

Spouses name _________________________________

Spouse SS# ________________________________

Address _______________________________________

Federal ID# ________________________________

City, State, Zip _________________________________

¼ due January 31, Paid $ _____________________

In the event your check is returned unpaid for insufficient funds or uncollected funds, we may electronically debit your account

for the principal amount of the check.

FORM D1 10/04

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1