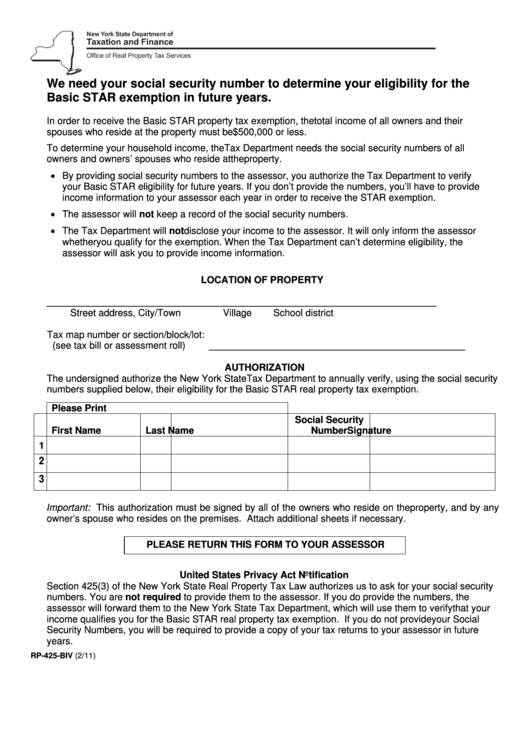

Form Rp-425-Biv - Basic Star Exemption Eligibility Determination

ADVERTISEMENT

We need your social security number to determine your eligibility for the

Basic STAR exemption in future years.

In order to receive the Basic STAR property tax exemption, the total income of all owners and their

spouses who reside at the property must be $500,000 or less.

To determine your household income, the Tax Department needs the social security numbers of all

owners and owners’ spouses who reside at the property.

• By providing social security numbers to the assessor, you authorize the Tax Department to verify

your Basic STAR eligibility for future years. If you don’t provide the numbers, you’ll have to provide

income information to your assessor each year in order to receive the STAR exemption.

• The assessor will not keep a record of the social security numbers.

• The Tax Department will not disclose your income to the assessor. It will only inform the assessor

whether you qualify for the exemption. When the Tax Department can’t determine eligibility, the

assessor will ask you to provide income information.

LOCATION OF PROPERTY

___________________________________

____________________

__________________

Street address, City/Town

Village

School district

Tax map number or section/block/lot:

(see tax bill or assessment roll)

________________________________________________

AUTHORIZATION

The undersigned authorize the New York State Tax Department to annually verify, using the social security

numbers supplied below, their eligibility for the Basic STAR real property tax exemption.

Please Print

Social Security

First Name

M.I.

Last Name

Number

Signature

1

2

3

Important: This authorization must be signed by all of the owners who reside on the property, and by any

owner’s spouse who resides on the premises. Attach additional sheets if necessary.

PLEASE RETURN THIS FORM TO YOUR ASSESSOR

United States Privacy Act Notification

Section 425(3) of the New York State Real Property Tax Law authorizes us to ask for your social security

numbers. You are not required to provide them to the assessor. If you do provide the numbers, the

assessor will forward them to the New York State Tax Department, which will use them to verify that your

income qualifies you for the Basic STAR real property tax exemption. If you do not provide your Social

Security Numbers, you will be required to provide a copy of your tax returns to your assessor in future

years.

RP-425-BIV (2/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1