Form 1034 - Virginia Forest Products Tax Return - 2005

ADVERTISEMENT

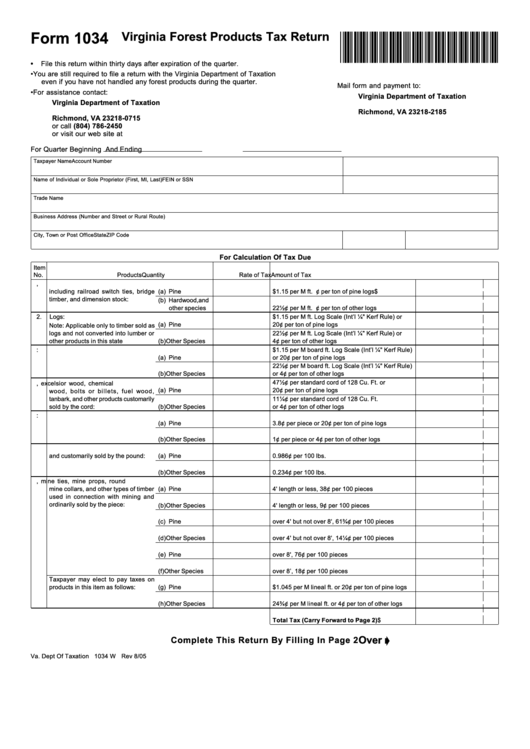

Form 1034

Virginia Forest Products Tax Return

*VA1034105888*

•

File this return within thirty days after expiration of the quarter.

•

You are still required to file a return with the Virginia Department of Taxation

even if you have not handled any forest products during the quarter.

Mail form and payment to:

•

For assistance contact:

Virginia Department of Taxation

Virginia Department of Taxation

P.O. Box 2185

P.O. Box 715

Richmond, VA 23218-2185

Richmond, VA 23218-0715

or call (804) 786-2450

or visit our web site at

For Quarter Beginning

And Ending

Taxpayer Name

Account Number

Name of Individual or Sole Proprietor (First, MI, Last)

FEIN or SSN

Trade Name

Business Address (Number and Street or Rural Route)

City, Town or Post Office

State

ZIP Code

For Calculation Of Tax Due

Item

No.

Products

Quantity

Rate of Tax

Amount of Tax

1.

Lumber in various sizes and forms,

including railroad switch ties, bridge

(a) Pine

$1.15 per M ft. B.M. or 20¢ per ton of pine logs

$

timber, and dimension stock:

(b) Hardwood,and

other species

22½¢ per M ft. B.M. or 4¢ per ton of other logs

2.

Logs:

$1.15 per M ft. Log Scale (Int’l ¼" Kerf Rule) or

(a) Pine

20¢ per ton of pine logs

Note: Applicable only to timber sold as

logs and not converted into lumber or

22½¢ per M ft. Log Scale (Int’l ¼" Kerf Rule) or

other products in this state

(b) Other Species

4¢ per ton of other logs

3.

Veneer Logs:

$1.15 per M board ft. Log Scale (Int’l ¼" Kerf Rule)

(a) Pine

or 20¢ per ton of pine logs

22½¢ per M board ft. Log Scale (Int’l ¼" Kerf Rule)

(b) Other Species

or 4¢ per ton of other logs

47½¢ per standard cord of 128 Cu. Ft. or

4.

Pulpwood, excelsior wood, chemical

(a) Pine

20¢ per ton of pine logs

wood, bolts or billets, fuel wood,

tanbark, and other products customarily

11¼¢ per standard cord of 128 Cu. Ft.

sold by the cord:

(b) Other Species

or 4¢ per ton of other logs

5.

Railroad Crossties:

(a) Pine

3.8¢ per piece or 20¢ per ton of pine logs

(b) Other Species

1¢ per piece or 4¢ per ton of other logs

6.

Chips manufactured from round wood

and customarily sold by the pound:

(a) Pine

0.986¢ per 100 lbs.

(b) Other Species

0.234¢ per 100 lbs.

7.

Posts, mine ties, mine props, round

mine collars, and other types of timber

(a) Pine

4' length or less, 38¢ per 100 pieces

used in connection with mining and

ordinarily sold by the piece:

(b) Other Species

4' length or less, 9¢ per 100 pieces

(c) Pine

over 4' but not over 8', 61¾¢ per 100 pieces

(d) Other Species

over 4' but not over 8', 14¼¢ per 100 pieces

(e) Pine

over 8', 76¢ per 100 pieces

(f) Other Species

over 8’, 18¢ per 100 pieces

Taxpayer may elect to pay taxes on

products in this item as follows:

(g) Pine

$1.045 per M lineal ft. or 20¢ per ton of pine logs

(h) Other Species

24¾¢ per M lineal ft. or 4¢ per ton of other logs

Total Tax (Carry Forward to Page 2)

$

Over g

Complete This Return By Filling In Page 2

Va. Dept Of Taxation 1034 W Rev 8/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2