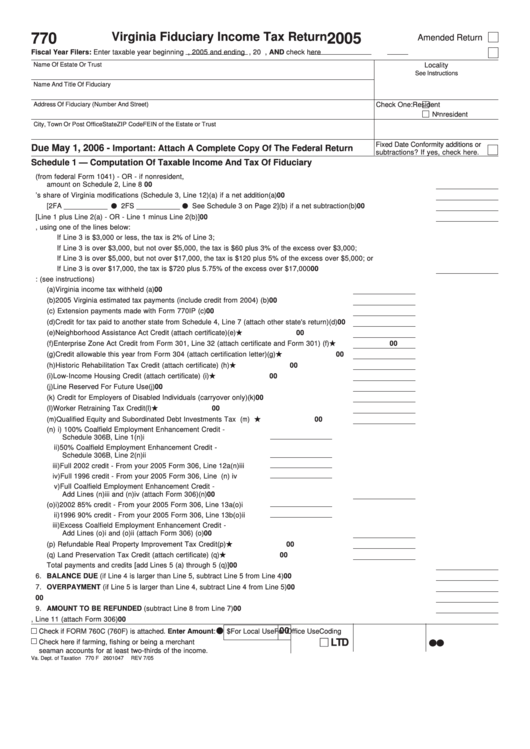

Form 770 - Virginia Fiduciary Income Tax Return - 2005

ADVERTISEMENT

Virginia Fiduciary Income Tax Return

770

2005

Amended Return

Fiscal Year Filers: Enter taxable year beginning

, 2005 and ending

, 20

, AND check here

Name Of Estate Or Trust

Locality

See Instructions

Name And Title Of Fiduciary

Address Of Fiduciary (Number And Street)

Check One:

Resident

Nonresident

City, Town Or Post Office

State

ZIP Code

FEIN of the Estate or Trust

Fixed Date Conformity additions or

Due May 1, 2006 -

Important: Attach A Complete Copy Of The Federal Return

subtractions? If yes, check here.

Schedule 1 — Computation Of Taxable Income And Tax Of Fiduciary

1. Federal taxable income of the estate or trust (from federal Form 1041) - OR - if nonresident,

amount on Schedule 2, Line 8 ..................................................................................................................................................... 1

00

2. Fiduciary’s share of Virginia modifications (Schedule 3, Line 12)

(a) if a net addition ............... 2 (a)

00

[2FA ___________ v 2FS ___________ v See Schedule 3 on Page 2]

(b) if a net subtraction ......... 2 (b)

00

3. Virginia taxable income of fiduciary [Line 1 plus Line 2(a) - OR - Line 1 minus Line 2(b)] ....................................................... 3

00

4. Compute tax on Virginia taxable income, using one of the lines below:

If Line 3 is $3,000 or less, the tax is 2% of Line 3;

If Line 3 is over $3,000, but not over $5,000, the tax is $60 plus 3% of the excess over $3,000;

If Line 3 is over $5,000, but not over $17,000, the tax is $120 plus 5% of the excess over $5,000; or

If Line 3 is over $17,000, the tax is $720 plus 5.75% of the excess over $17,000 ............................................................. 4

00

5. PAYMENTS AND CREDITS: (see instructions)

(a) Virginia income tax withheld ................................................................................................ (a)

00

(b) 2005 Virginia estimated tax payments (include credit from 2004) ..................................... (b)

00

(c) Extension payments made with Form 770IP ...................................................................... (c)

00

(d) Credit for tax paid to another state from Schedule 4, Line 7 (attach other state's return) (d)

00

.

(e) Neighborhood Assistance Act Credit (attach certificate) .................................................... (e)

00

.

(f) Enterprise Zone Act Credit from Form 301, Line 32 (attach certificate and Form 301) .... (f)

00

.

(g) Credit allowable this year from Form 304 (attach certification letter) ................................ (g)

00

.

(h) Historic Rehabilitation Tax Credit (attach certificate) ......................................................... (h)

00

.

(i) Low-Income Housing Credit (attach certificate) .................................................................. (i)

00

(j) Line Reserved For Future Use ............................................................................................. (j)

00

(k) Credit for Employers of Disabled Individuals (carryover only) ........................................... (k)

00

.

(l) Worker Retraining Tax Credit ................................................................................................ (l)

00

.

(m) Qualified Equity and Subordinated Debt Investments Tax Credit ..................................... (m)

00

(n) i) 100% Coalfield Employment Enhancement Credit -

Schedule 306B, Line 1 ......................................................... (n)i

ii) 50% Coalfield Employment Enhancement Credit -

Schedule 306B, Line 2 ........................................................ (n)ii

iii) Full 2002 credit - From your 2005 Form 306, Line 12a ..... (n)iii

iv) Full 1996 credit - From your 2005 Form 306, Line 12b ... (n) iv

v) Full Coalfield Employment Enhancement Credit -

Add Lines (n)iii and (n)iv (attach Form 306) ..................................................................... (n)

00

(o)i) 2002 85% credit - From your 2005 Form 306, Line 13a ..... (o)i

ii) 1996 90% credit - From your 2005 Form 306, Line 13b .... (o)ii

iii) Excess Coalfield Employment Enhancement Credit -

Add Lines (o)i and (o)ii (attach Form 306) ........................................................................ (o)

00

.

(p) Refundable Real Property Improvement Tax Credit ............................................................ (p)

00

.

(q) Land Preservation Tax Credit (attach certificate) ................................................................ (q)

00

Total payments and credits [add Lines 5 (a) through 5 (q)] ........................................................................................................ 5

00

6. BALANCE DUE (if Line 4 is larger than Line 5, subtract Line 5 from Line 4) ........................................................................... 6

00

7. OVERPAYMENT (if Line 5 is larger than Line 4, subtract Line 4 from Line 5) .......................................................................... 7

00

8. Amount of overpayment to be CREDITED to 2006 Estimated Income Tax .............................................................................. 8

00

9. AMOUNT TO BE REFUNDED (subtract Line 8 from Line 7) ..................................................................................................... 9

00

10. Coalfield Employment Enhancement Tax Credit earned in 2005 Form 306, Line 11 (attach Form 306) ............................... 10

00

v

00

Check if FORM 760C (760F) is attached. Enter Amount:

$

For Local Use

For Office Use

Coding

j

LTD

v v v v v

Check here if farming, fishing or being a merchant

seaman accounts for at least two-thirds of the income.

Va. Dept. of Taxation 770 F 2601047

REV 7/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3