Form Nc-478b - Tax Credit Investing In Machinery And Equipment - 2005

ADVERTISEMENT

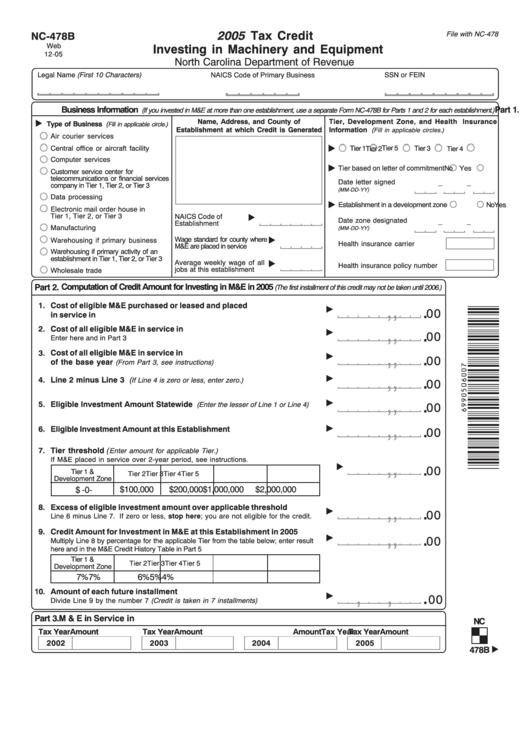

2005 Tax Credit

NC-478B

File with NC-478

Web

Investing in Machinery and Equipment

12-05

North Carolina Department of Revenue

Legal Name (First 10 Characters)

SSN or FEIN

NAICS Code of Primary Business

Part 1.

Business Information

(If you invested in M&E at more than one establishment, use a separate Form NC-478B for Parts 1 and 2 for each establishment.)

Name, Address, and County of

Tier, Development Zone, and Health Insurance

Type of Business (

Fill in applicable circle.)

Establishment at which Credit is Generated

Information (

Fill in applicable circles.)

Air courier services

Tier 5

Central office or aircraft facility

Tier 1

Tier 3

Tier 2

Tier 4

Computer services

Tier based on letter of commitment

Yes

No

Customer service center for

telecommunications or financial services

Date letter signed

company in Tier 1, Tier 2, or Tier 3

(MM-DD-YY)

Data processing

Establishment in a development zone

Yes

No

Electronic mail order house in

Tier 1, Tier 2, or Tier 3

NAICS Code of

Date zone designated

Establishment

Manufacturing

(MM-DD-YY)

Wage standard for county where

Warehousing if primary business

Health insurance carrier

M&E are placed in service

Warehousing if primary activity of an

establishment in Tier 1, Tier 2, or Tier 3

Average weekly wage of all

Health insurance policy number

jobs at this establishment

Wholesale trade

Part 2.

Computation of Credit Amount for Investing in M&E in 2005

(The first installment of this credit may not be taken until 2006.)

,

,

.

1.

Cost of eligible M&E purchased or leased and placed

00

in service in N.C. during 2005

,

,

.

2.

Cost of all eligible M&E in service in N.C. on the last day of 2005

00

Enter here and in Part 3

,

,

.

3.

Cost of all eligible M&E in service in N.C. on the last day

00

of the base year

(From Part 3, see instructions)

,

,

.

4.

Line 2 minus Line 3 (

If Line 4 is zero or less, enter zero.)

00

,

,

.

5.

Eligible Investment Amount Statewide

(Enter the lesser of Line 1 or Line 4)

00

,

,

.

6.

Eligible Investment Amount at this Establishment

00

7.

Tier threshold (

Enter amount for applicable Tier.)

If M&E placed in service over 2-year period, see instructions.

,

,

.

00

Tier 1 &

Tier 2

Tier 3

Tier 4

Tier 5

Development Zone

$100,000

$200,000

$1,000,000

$2,000,000

$ -0-

,

,

.

8.

Excess of eligible investment amount over applicable threshold

00

Line 6 minus Line 7. If zero or less, stop here; you are not eligible for the credit.

,

,

.

9.

Credit Amount for Investment in M&E at this Establishment in 2005

00

Multiply Line 8 by percentage for the applicable Tier from the table below; enter result

here and in the M&E Credit History Table in Part 5

Tier 1 &

Tier 2

Tier 3

Tier 4

Tier 5

Development Zone

7%

7%

6%

5%

4%

,

,

.

10.

Amount of each future installment

00

Divide Line 9 by the number 7 (Credit is taken in 7 installments)

Part 3. M & E in Service in N.C. on Last Day of Tax Year

NC

Tax Year

Amount

Tax Year

Amount

Tax Year

Amount

Tax Year

Amount

2002

2003

2004

2005

478B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2