Form Nc-478b - 2012 Tax Credit Investing In Machinery And Equipment - North Carolina Department Of Revenue

ADVERTISEMENT

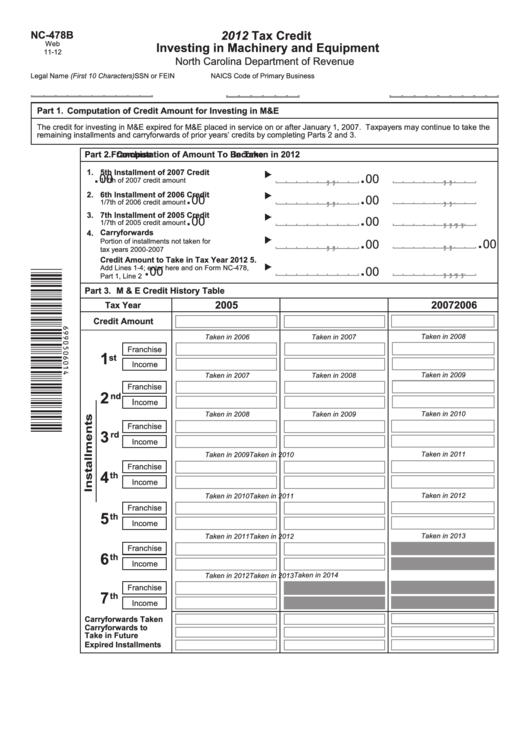

2012 Tax Credit

NC-478B

Web

Investing in Machinery and Equipment

11-12

North Carolina Department of Revenue

Legal Name (First 10 Characters)

NAICS Code of Primary Business

SSN or FEIN

Part 1.

Computation of Credit Amount for Investing in M&E

The credit for investing in M&E expired for M&E placed in service on or after January 1, 2007. Taxpayers may continue to take the

remaining installments and carryforwards of prior years’ credits by completing Parts 2 and 3.

Part 2.

Computation of Amount To Be Taken in 2012

Franchise

Income

,

,

.

,

,

.

1.

5th Installment of 2007 Credit

00

00

1/7th of 2007 credit amount

,

,

.

,

,

.

2.

6th Installment of 2006 Credit

00

00

1/7th of 2006 credit amount

,

,

.

,

,

.

3.

7th Installment of 2005 Credit

00

00

1/7th of 2005 credit amount

,

,

.

,

,

.

4.

Carryforwards

00

00

Portion of installments not taken for

tax years 2000-2007

,

,

.

,

,

.

5.

Credit Amount to Take in Tax Year 2012

Add Lines 1-4; enter here and on Form NC-478,

00

00

Part 1, Line 2

Part 3.

M & E Credit History Table

2005

2006

2007

Tax Year

Credit Amount

Taken in 2008

Taken in 2006

Taken in 2007

Franchise

1

st

Income

Taken in 2009

Taken in 2007

Taken in 2008

Franchise

2

nd

I

ncome

Taken in 2010

Taken in 2008

Taken in 2009

Franchise

3

rd

Income

Taken in 2011

Taken in 2009

Taken in 2010

Franchise

4

th

Income

Taken in 2012

Taken in 2010

Taken in 2011

Franchise

5

th

Income

Taken in 2013

Taken in 2011

Taken in 2012

Franchise

6

th

Income

Taken in 2014

Taken in 2012

Taken in 2013

Franchise

7

th

Income

Carryforwards Taken

Carryforwards to

Take in Future

Expired Installments

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1