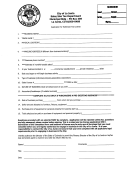

Voluntary Disclosure Questionnaire - Wyoming Department Of Revenue, Wyoming Voluntary Disclosure Agreement, Voluntary Disclosure Sales/use Tax License Application - Wyoming Department Of Revenue

ADVERTISEMENT

State of Wyoming

D

R

EPARTMENT OF

EVENUE

, Governor

D

F

122 West 25th Street, 2-West, Cheyenne, Wyoming 82002-0110

AVE

REUDENTHAL

, Director

E

J. S

Telephone:(307) 777-7961

Web:

E-mail:dor@wy.gov

DMUND

CHMIDT

Administration Fax (307)777-7722

Property Tax Division Fax (307)777-7527

Excise Division Fax (307)777-3632

Mineral Division Fax (307)777-7849

Liquor Division Fax (307)777-6255

Wyoming’s Sales Tax Voluntary Disclosure Program

Effective July 1, 1999, Wyoming Statute 39-15-107.2 authorized the Department of Revenue to

enter into a voluntary disclosure agreement with any person establishing sufficient contact with

the state to qualify the person as a vendor under statute. You can start the process of entering into

a Voluntary Disclosure Agreement by performing the following steps:

Step 1:

Complete the enclosed Voluntary Disclosure Questionnaire for the company.

Complete a Report of Taxable Transactions for a period of not more than three

Step 2:

years preceding the date of the Voluntary Disclosure Agreement. We need you to

break down the taxable sales by county, month and year.

Review and have an authorized representative sign the enclosed Wyoming

Step 3:

Voluntary Disclosure Agreement.

Step 4:

Return the following to:

Wyoming Department of Revenue

Voluntary Disclosure Program

122 W. 25

Street, Herschler Bldg 2

W.

th

nd

Cheyenne WY 82002-0110

• Completed/signed Voluntary Disclosure Questionnaire

• Report of Taxable Transactions

• Signed Voluntary Disclosure Agreement

After we review your submission and determine that everything is satisfactory, we

will fill out the specifics of the Voluntary Disclosure Agreement, sign the

Agreement and return a photocopy of the originals to you.

Complete and return the enclosed Voluntary Disclosure Licensing Application

Step 5:

Form, along with the one-time licensing fee of sixty dollars ($60) within the

agreed-upon timeframe.

Step 6:

Remit the applicable back taxes, penalties and interest within the agreed-upon timeframe.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5