Form Tr-199 - Surrender Of Authority - Foreign Corporation - New York Business Corporation Law - Section 1310

ADVERTISEMENT

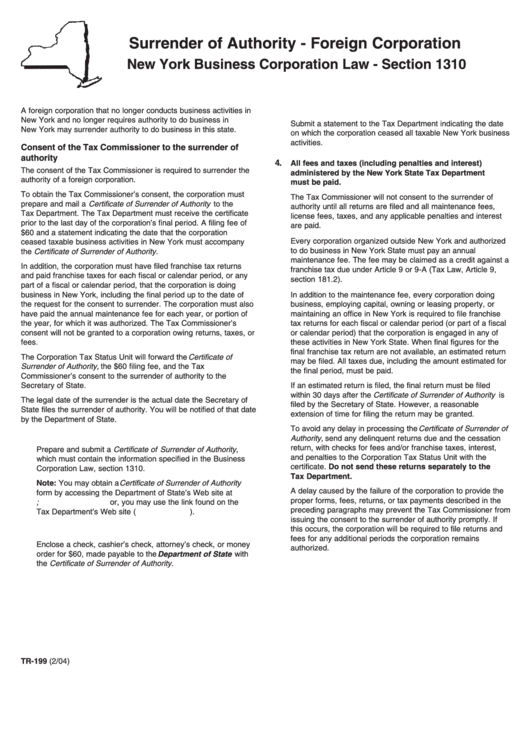

Surrender of Authority - Foreign Corporation

New York Business Corporation Law - Section 1310

A foreign corporation that no longer conducts business activities in

3. Termination of business activities

New York and no longer requires authority to do business in

Submit a statement to the Tax Department indicating the date

New York may surrender authority to do business in this state.

on which the corporation ceased all taxable New York business

activities.

Consent of the Tax Commissioner to the surrender of

authority

4.

All fees and taxes (including penalties and interest)

The consent of the Tax Commissioner is required to surrender the

administered by the New York State Tax Department

authority of a foreign corporation.

must be paid.

To obtain the Tax Commissioner’s consent, the corporation must

The Tax Commissioner will not consent to the surrender of

prepare and mail a Certificate of Surrender of Authority to the

authority until all returns are filed and all maintenance fees,

Tax Department. The Tax Department must receive the certificate

license fees, taxes, and any applicable penalties and interest

prior to the last day of the corporation’s final period. A filing fee of

are paid.

$60 and a statement indicating the date that the corporation

Every corporation organized outside New York and authorized

ceased taxable business activities in New York must accompany

to do business in New York State must pay an annual

the Certificate of Surrender of Authority.

maintenance fee. The fee may be claimed as a credit against a

In addition, the corporation must have filed franchise tax returns

franchise tax due under Article 9 or 9-A (Tax Law, Article 9,

and paid franchise taxes for each fiscal or calendar period, or any

section 181.2).

part of a fiscal or calendar period, that the corporation is doing

business in New York, including the final period up to the date of

In addition to the maintenance fee, every corporation doing

the request for the consent to surrender. The corporation must also

business, employing capital, owning or leasing property, or

have paid the annual maintenance fee for each year, or portion of

maintaining an office in New York is required to file franchise

the year, for which it was authorized. The Tax Commissioner’s

tax returns for each fiscal or calendar period (or part of a fiscal

consent will not be granted to a corporation owing returns, taxes, or

or calendar period) that the corporation is engaged in any of

fees.

these activities in New York State. When final figures for the

final franchise tax return are not available, an estimated return

The Corporation Tax Status Unit will forward the Certificate of

may be filed. All taxes due, including the amount estimated for

Surrender of Authority, the $60 filing fee, and the Tax

the final period, must be paid.

Commissioner’s consent to the surrender of authority to the

Secretary of State.

If an estimated return is filed, the final return must be filed

within 30 days after the Certificate of Surrender of Authority is

The legal date of the surrender is the actual date the Secretary of

filed by the Secretary of State. However, a reasonable

State files the surrender of authority. You will be notified of that date

extension of time for filing the return may be granted.

by the Department of State.

To avoid any delay in processing the Certificate of Surrender of

1. Certificate of Surrender

Authority, send any delinquent returns due and the cessation

return, with checks for fees and/or franchise taxes, interest,

Prepare and submit a Certificate of Surrender of Authority,

and penalties to the Corporation Tax Status Unit with the

which must contain the information specified in the Business

certificate. Do not send these returns separately to the

Corporation Law, section 1310.

Tax Department.

Note: You may obtain a Certificate of Surrender of Authority

A delay caused by the failure of the corporation to provide the

form by accessing the Department of State’s Web site at

proper forms, fees, returns, or tax payments described in the

or, you may use the link found on the

preceding paragraphs may prevent the Tax Commissioner from

Tax Department’s Web site ( ).

issuing the consent to the surrender of authority promptly. If

this occurs, the corporation will be required to file returns and

2. Filing fee

fees for any additional periods the corporation remains

Enclose a check, cashier’s check, attorney’s check, or money

authorized.

order for $60, made payable to the Department of State with

the Certificate of Surrender of Authority.

TR-199 (2/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2