Instructions For Gifting Shares

ADVERTISEMENT

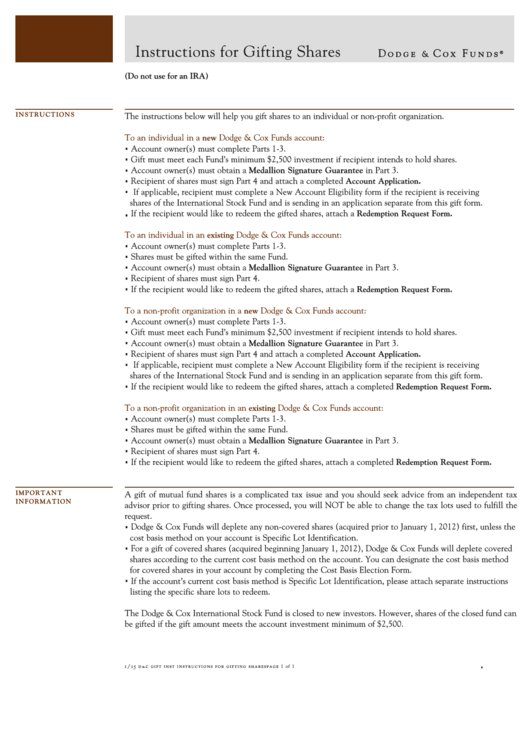

Instructions for Gifting Shares

D o d g e

D o d g e

C o x F u n d s

C o x F u n d s

&

&

®

®

(Do not use for an IRA)

INSTRUCTIONS

The instructions below will help you gift shares to an individual or non-profit organization.

To an individual in a

new

Dodge & Cox Funds account:

Account owner(s) must complete Parts 1-3.

Gift must meet each Fund’s minimum $2,500 investment if recipient intends to hold shares.

Account owner(s) must obtain a Medallion Signature Guarantee in Part 3.

Recipient of shares must sign Part 4 and attach a completed

Account Application.

If applicable, recipient must complete a New Account Eligibility form if the recipient is receiving

shares of the International Stock Fund and is sending in an application separate from this gift form.

If the recipient would like to redeem the gifted shares, attach a

Redemption Request Form.

To an individual in an

existing

Dodge & Cox Funds account:

Account owner(s) must complete Parts 1-3.

Shares must be gifted within the same Fund.

Account owner(s) must obtain a Medallion Signature Guarantee in Part 3.

Recipient of shares must sign Part 4.

If the recipient would like to redeem the gifted shares, attach a

Redemption Request Form.

To a non-profit organization in a

Dodge & Cox Funds account:

new

Account owner(s) must complete Parts 1-3.

Gift must meet each Fund’s minimum $2,500 investment if recipient intends to hold shares.

Account owner(s) must obtain a Medallion Signature Guarantee in Part 3.

Recipient of shares must sign Part 4 and attach a completed

Account Application.

If applicable, recipient must complete a New Account Eligibility form if the recipient is receiving

shares of the International Stock Fund and is sending in an application separate from this gift form.

If the recipient would like to redeem the gifted shares, attach a completed

Redemption Request Form.

To a non-profit organization in an

Dodge & Cox Funds account:

existing

Account owner(s) must complete Parts 1-3.

Shares must be gifted within the same Fund.

Account owner(s) must obtain a Medallion Signature Guarantee in Part 3.

Recipient of shares must sign Part 4.

If the recipient would like to redeem the gifted shares, attach a completed

Redemption Request Form.

IMPORTANT

A gift of mutual fund shares is a complicated tax issue and you should seek advice from an independent tax

INFORMATION

advisor prior to gifting shares. Once processed, you will NOT be able to change the tax lots used to fulfill the

request.

Dodge & Cox Funds will deplete any non-covered shares (acquired prior to January 1, 2012) first, unless the

cost basis method on your account is Specific Lot Identification.

For a gift of covered shares (acquired beginning January 1, 2012), Dodge & Cox Funds will deplete covered

shares according to the current cost basis method on the account. You can designate the cost basis method

for covered shares in your account by completing the Cost Basis Election Form.

If the account’s current cost basis method is Specific Lot Identification, please attach separate instructions

listing the specific share lots to redeem.

The Dodge & Cox International Stock Fund is closed to new investors. However, shares of the closed fund can

be gifted if the gift amount meets the account investment minimum of $2,500.

1 of 1

1/ 15 d

c g ift inst

in s t r u c t io n s f o r gi ft i n g sh a r e s

p a g e

&

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Letters

1

1 2

2 3

3