Instructions For Form Ct-709ext - Application For Extension Of Time To File Connecticut Gift Tax Return

ADVERTISEMENT

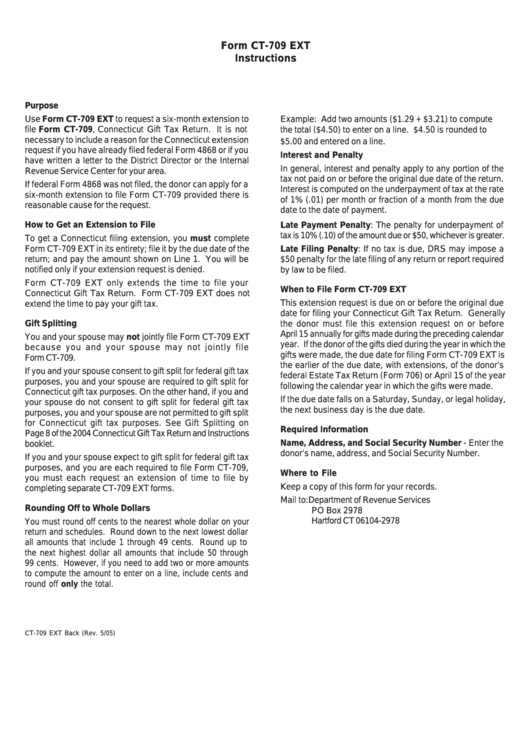

Form CT-709 EXT

Instructions

Purpose

Use Form CT-709 EXT to request a six-month extension to

Example: Add two amounts ($1.29 + $3.21) to compute

file Form CT-709, Connecticut Gift Tax Return. It is not

the total ($4.50) to enter on a line. $4.50 is rounded to

necessary to include a reason for the Connecticut extension

$5.00 and entered on a line.

request if you have already filed federal Form 4868 or if you

Interest and Penalty

have written a letter to the District Director or the Internal

In general, interest and penalty apply to any portion of the

Revenue Service Center for your area.

tax not paid on or before the original due date of the return.

If federal Form 4868 was not filed, the donor can apply for a

Interest is computed on the underpayment of tax at the rate

six-month extension to file Form CT-709 provided there is

of 1% (.01) per month or fraction of a month from the due

reasonable cause for the request.

date to the date of payment.

How to Get an Extension to File

Late Payment Penalty: The penalty for underpayment of

tax is 10% (.10) of the amount due or $50, whichever is greater.

To get a Connecticut filing extension, you must complete

Form CT-709 EXT in its entirety; file it by the due date of the

Late Filing Penalty: If no tax is due, DRS may impose a

return; and pay the amount shown on Line 1. You will be

$50 penalty for the late filing of any return or report required

notified only if your extension request is denied.

by law to be filed.

Form CT-709 EXT only extends the time to file your

When to File Form CT-709 EXT

Connecticut Gift Tax Return. Form CT-709 EXT does not

This extension request is due on or before the original due

extend the time to pay your gift tax.

date for filing your Connecticut Gift Tax Return. Generally

Gift Splitting

the donor must file this extension request on or before

April 15 annually for gifts made during the preceding calendar

You and your spouse may not jointly file Form CT-709 EXT

year. If the donor of the gifts died during the year in which the

because you and your spouse may not jointly file

gifts were made, the due date for filing Form CT-709 EXT is

Form CT-709.

the earlier of the due date, with extensions, of the donor’s

If you and your spouse consent to gift split for federal gift tax

federal Estate Tax Return (Form 706) or April 15 of the year

purposes, you and your spouse are required to gift split for

following the calendar year in which the gifts were made.

Connecticut gift tax purposes. On the other hand, if you and

If the due date falls on a Saturday, Sunday, or legal holiday,

your spouse do not consent to gift split for federal gift tax

the next business day is the due date.

purposes, you and your spouse are not permitted to gift split

for Connecticut gift tax purposes. See Gift Splitting on

Required Information

Page 8 of the 2004 Connecticut Gift Tax Return and Instructions

Name, Address, and Social Security Number - Enter the

booklet.

donor’s name, address, and Social Security Number.

If you and your spouse expect to gift split for federal gift tax

purposes, and you are each required to file Form CT-709,

Where to File

you must each request an extension of time to file by

Keep a copy of this form for your records.

completing separate CT-709 EXT forms.

Mail to: Department of Revenue Services

Rounding Off to Whole Dollars

PO Box 2978

Hartford CT 06104-2978

You must round off cents to the nearest whole dollar on your

return and schedules. Round down to the next lowest dollar

all amounts that include 1 through 49 cents. Round up to

the next highest dollar all amounts that include 50 through

99 cents. However, if you need to add two or more amounts

to compute the amount to enter on a line, include cents and

round off only the total.

CT-709 EXT Back (Rev. 5/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1