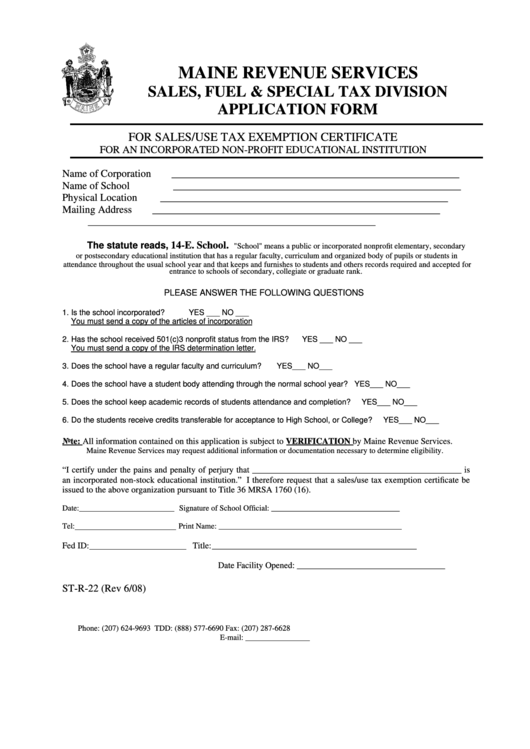

Form St-R-22 - For Sales/use Tax Exemption Certificate

ADVERTISEMENT

MAINE REVENUE SERVICES

SALES, FUEL & SPECIAL TAX DIVISION

APPLICATION FORM

FOR SALES/USE TAX EXEMPTION CERTIFICATE

FOR AN INCORPORATED NON-PROFIT EDUCATIONAL INSTITUTION

Name of Corporation

_______________________________________________________

Name of School

_______________________________________________________

Physical Location

_______________________________________________________

Mailing Address

_______________________________________________________

_______________________________________________________

14-E. School.

The statute reads,

"School" means a public or incorporated nonprofit elementary, secondary

or postsecondary educational institution that has a regular faculty, curriculum and organized body of pupils or students in

attendance throughout the usual school year and that keeps and furnishes to students and others records required and accepted for

entrance to schools of secondary, collegiate or graduate rank.

PLEASE ANSWER THE FOLLOWING QUESTIONS

1. Is the school incorporated?

YES ___ NO ___

You must send a copy of the articles of incorporation

2. Has the school received 501(c)3 nonprofit status from the IRS?

YES ___ NO ___

You must send a copy of the IRS determination letter.

3. Does the school have a regular faculty and curriculum?

YES___ NO___

4. Does the school have a student body attending through the normal school year?

YES___ NO___

5. Does the school keep academic records of students attendance and completion?

YES___ NO___

6. Do the students receive credits transferable for acceptance to High School, or College?

YES___ NO___

Note: All information contained on this application is subject to VERIFICATION by Maine Revenue Services.

Maine Revenue Services may request additional information or documentation necessary to determine eligibility.

“I certify under the pains and penalty of perjury that ________________________________________________ is

an incorporated non-stock educational institution.” I therefore request that a sales/use tax exemption certificate be

issued to the above organization pursuant to Title 36 MRSA 1760 (16).

Date:

Signature of School Official: _________________________________

Tel:

Print Name: _______________________________________________

Fed ID:

Title: _______________________________________________

Date Facility Opened: __________________________________

ST-R-22 (Rev 6/08)

Phone: (207) 624-9693

TDD: (888) 577-6690

Fax: (207) 287-6628

E-mail: salestax@maine.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1