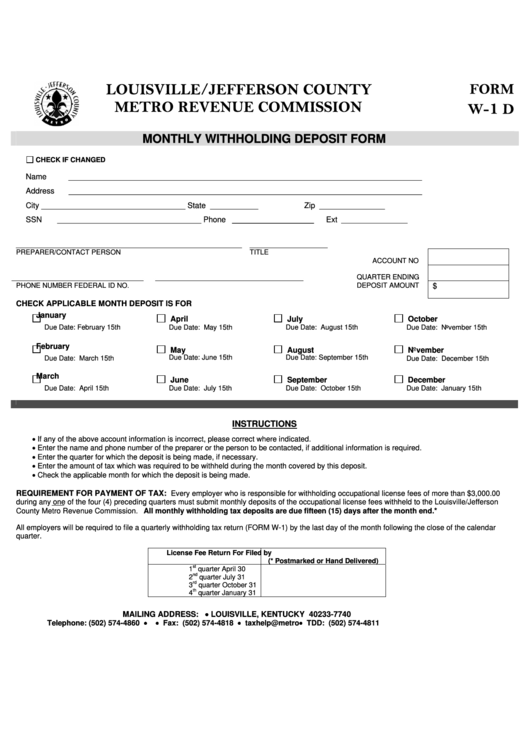

LOUISVILLE/JEFFERSON COUNTY

FORM

1

METRO REVENUE COMMISSION

W-

D

MONTHLY WITHHOLDING DEPOSIT FORM

CHECK IF CHANGED

Name

_________________________________________________________________________________

Address

_________________________________________________________________________________

City

_________________________________

State ___________

Zip _______________

SSN

_________________________________

Phone

Ext

_____________________

_________________

__________________________________________________________

____________________

PREPARER/CONTACT PERSON

TITLE

ACCOUNT NO

QUARTER ENDING

PHONE NUMBER

FEDERAL ID NO.

DEPOSIT AMOUNT

$

CHECK APPLICABLE MONTH DEPOSIT IS FOR

January

April

July

October

Due Date: February 15th

Due Date: August 15th

Due Date: May 15th

Due Date: November 15th

February

May

August

November

Due Date: March 15th

Due Date: June 15th

Due Date: September 15th

Due Date: December 15th

March

June

September

December

Due Date: April 15th

Due Date: July 15th

Due Date: October 15th

Due Date: January 15th

INSTRUCTIONS

•

If any of the above account information is incorrect, please correct where indicated.

•

Enter the name and phone number of the preparer or the person to be contacted, if additional information is required.

•

Enter the quarter for which the deposit is being made, if necessary.

•

Enter the amount of tax which was required to be withheld during the month covered by this deposit.

•

Check the applicable month for which the deposit is being made.

REQUIREMENT FOR PAYMENT OF TAX:

Every employer who is responsible for withholding occupational license fees of more than $3,000.00

during any one of the four (4) preceding quarters must submit monthly deposits of the occupational license fees withheld to the Louisville/Jefferson

*

County Metro Revenue Commission. All monthly withholding tax deposits are due fifteen (15) days after the month end.

All employers will be required to file a quarterly withholding tax return (FORM W-1) by the last day of the month following the close of the calendar

quarter.

License Fee Return For

Filed by

(* Postmarked or Hand Delivered)

st

1

quarter

April 30

nd

2

quarter

July 31

rd

3

quarter

October 31

th

4

quarter

January 31

MAILING ADDRESS: P.O. BOX 37740 • LOUISVILLE, KENTUCKY 40233-7740

Telephone: (502) 574-4860 •

• Fax: (502) 574-4818 • • TDD: (502) 574-4811

1

1