Form Dr-18 - Application For Amusement Machine Certificate - Florida Department Of Revenue

ADVERTISEMENT

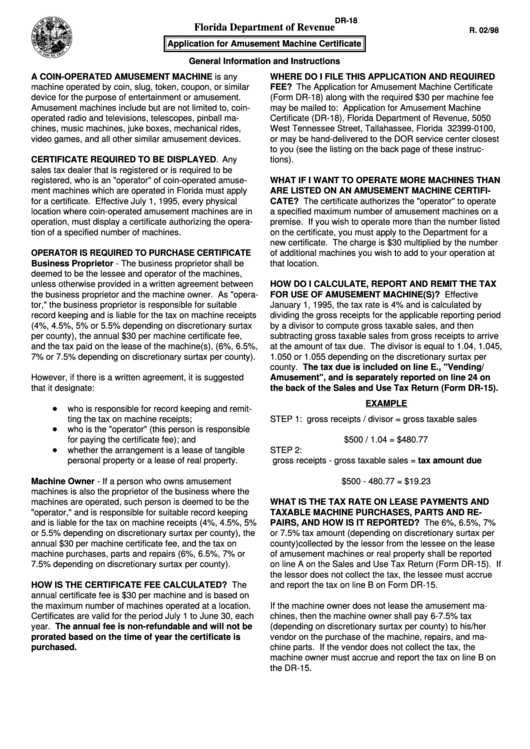

DR-18

Florida Department of Revenue

R. 02/98

Application for Amusement Machine Certificate

General Information and Instructions

A COIN-OPERATED AMUSEMENT MACHINE is any

WHERE DO I FILE THIS APPLICATION AND REQUIRED

machine operated by coin, slug, token, coupon, or similar

FEE? The Application for Amusement Machine Certificate

device for the purpose of entertainment or amusement.

(Form DR-18) along with the required $30 per machine fee

Amusement machines include but are not limited to, coin-

may be mailed to: Application for Amusement Machine

operated radio and televisions, telescopes, pinball ma-

Certificate (DR-18), Florida Department of Revenue, 5050

chines, music machines, juke boxes, mechanical rides,

West Tennessee Street, Tallahassee, Florida 32399-0100,

video games, and all other similar amusement devices.

or may be hand-delivered to the DOR service center closest

to you (see the listing on the back page of these instruc-

CERTIFICATE REQUIRED TO BE DISPLAYED. Any

tions).

sales tax dealer that is registered or is required to be

registered, who is an "operator" of coin-operated amuse-

WHAT IF I WANT TO OPERATE MORE MACHINES THAN

ment machines which are operated in Florida must apply

ARE LISTED ON AN AMUSEMENT MACHINE CERTIFI-

for a certificate. Effective July 1, 1995, every physical

CATE? The certificate authorizes the "operator" to operate

location where coin-operated amusement machines are in

a specified maximum number of amusement machines on a

operation, must display a certificate authorizing the opera-

premise. If you wish to operate more than the number listed

tion of a specified number of machines.

on the certificate, you must apply to the Department for a

new certificate. The charge is $30 multiplied by the number

OPERATOR IS REQUIRED TO PURCHASE CERTIFICATE

of additional machines you wish to add to your operation at

Business Proprietor - The business proprietor shall be

that location.

deemed to be the lessee and operator of the machines,

unless otherwise provided in a written agreement between

HOW DO I CALCULATE, REPORT AND REMIT THE TAX

the business proprietor and the machine owner. As "opera-

FOR USE OF AMUSEMENT MACHINE(S)? Effective

tor," the business proprietor is responsible for suitable

January 1, 1995, the tax rate is 4% and is calculated by

record keeping and is liable for the tax on machine receipts

dividing the gross receipts for the applicable reporting period

(4%, 4.5%, 5% or 5.5% depending on discretionary surtax

by a divisor to compute gross taxable sales, and then

per county), the annual $30 per machine certificate fee,

subtracting gross taxable sales from gross receipts to arrive

and the tax paid on the lease of the machine(s), (6%, 6.5%,

at the amount of tax due. The divisor is equal to 1.04, 1.045,

7% or 7.5% depending on discretionary surtax per county).

1.050 or 1.055 depending on the discretionary surtax per

county. The tax due is included on line E., "Vending/

However, if there is a written agreement, it is suggested

Amusement", and is separately reported on line 24 on

that it designate:

the back of the Sales and Use Tax Return (Form DR-15).

EXAMPLE

•

who is responsible for record keeping and remit-

ting the tax on machine receipts;

STEP 1: gross receipts / divisor = gross taxable sales

•

who is the "operator" (this person is responsible

for paying the certificate fee); and

$500 / 1.04 = $480.77

•

whether the arrangement is a lease of tangible

STEP 2:

personal property or a lease of real property.

gross receipts - gross taxable sales = tax amount due

Machine Owner - If a person who owns amusement

$500 - 480.77 = $19.23

machines is also the proprietor of the business where the

machines are operated, such person is deemed to be the

WHAT IS THE TAX RATE ON LEASE PAYMENTS AND

"operator," and is responsible for suitable record keeping

TAXABLE MACHINE PURCHASES, PARTS AND RE-

and is liable for the tax on machine receipts (4%, 4.5%, 5%

PAIRS, AND HOW IS IT REPORTED? The 6%, 6.5%, 7%

or 5.5% depending on discretionary surtax per county), the

or 7.5% tax amount (depending on discretionary surtax per

annual $30 per machine certificate fee, and the tax on

county)collected by the lessor from the lessee on the lease

machine purchases, parts and repairs (6%, 6.5%, 7% or

of amusement machines or real property shall be reported

7.5% depending on discretionary surtax per county).

on line A on the Sales and Use Tax Return (Form DR-15). If

the lessor does not collect the tax, the lessee must accrue

HOW IS THE CERTIFICATE FEE CALCULATED? The

and report the tax on line B on Form DR-15.

annual certificate fee is $30 per machine and is based on

the maximum number of machines operated at a location.

If the machine owner does not lease the amusement ma-

Certificates are valid for the period July 1 to June 30, each

chines, then the machine owner shall pay 6-7.5% tax

year. The annual fee is non-refundable and will not be

(depending on discretionary surtax per county) to his/her

prorated based on the time of year the certificate is

vendor on the purchase of the machine, repairs, and ma-

purchased.

chine parts. If the vendor does not collect the tax, the

machine owner must accrue and report the tax on line B on

the DR-15.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2