10-172

RESET FORM

PRINT FORM

(Rev.9-09/3)

b.

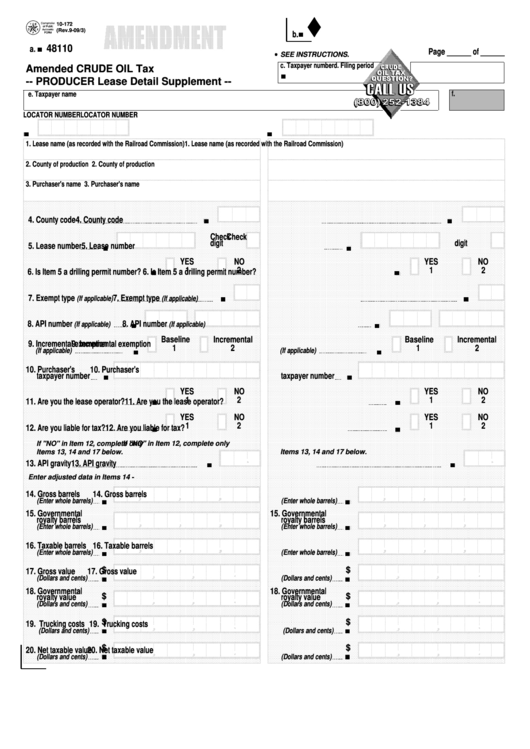

48110

a.

Page ______ of ______

SEE INSTRUCTIONS.

c. Taxpayer number

d. Filing period

Amended CRUDE OIL Tax

-- PRODUCER Lease Detail Supplement --

f.

e. Taxpayer name

LOCATOR NUMBER

LOCATOR NUMBER

1. Lease name (as recorded with the Railroad Commission)

1. Lease name (as recorded with the Railroad Commission)

2. County of production

2. County of production

3. Purchaser's name

3. Purchaser's name

4. County code

4. County code

Check

Check

digit

digit

5. Lease number

5. Lease number

YES

NO

YES

NO

1

2

1

2

6. Is Item 5 a drilling permit number?

6. Is Item 5 a drilling permit number?

7. Exempt type

7. Exempt type

(If applicable)

(If applicable)

8. API number

8. API number

(If applicable)

(If applicable)

Baseline

Incremental

Baseline

Incremental

9. Incremental exemption

9. Incremental exemption

1

2

1

2

(If applicable)

(If applicable)

10. Purchaser's

10. Purchaser's

taxpayer number

taxpayer number

YES

NO

YES

NO

1

2

1

2

11. Are you the lease operator?

11. Are you the lease operator?

YES

NO

YES

NO

1

2

1

2

12. Are you liable for tax?

12. Are you liable for tax?

If "NO" in Item 12, complete only

If "NO" in Item 12, complete only

Items 13, 14 and 17 below.

Items 13, 14 and 17 below.

13. API gravity

13. API gravity

Enter adjusted data in Items 14 - 20.

Enter adjusted data in Items 14 - 20.

14. Gross barrels

14. Gross barrels

(Enter whole barrels)

(Enter whole barrels)

15. Governmental

15. Governmental

royalty barrels

royalty barrels

(Enter whole barrels)

(Enter whole barrels)

16. Taxable barrels

16. Taxable barrels

(Enter whole barrels)

(Enter whole barrels)

$

$

17. Gross value

17. Gross value

(Dollars and cents)

(Dollars and cents)

18. Governmental

18. Governmental

$

$

royalty value

royalty value

(Dollars and cents)

(Dollars and cents)

$

$

19. Trucking costs

19. Trucking costs

(Dollars and cents)

(Dollars and cents)

$

$

20. Net taxable value

20. Net taxable value

(Dollars and cents)

(Dollars and cents)

1

1 2

2