10-166

(Rev.6-12/3)

RESET FORM

PRINT FORM

b.

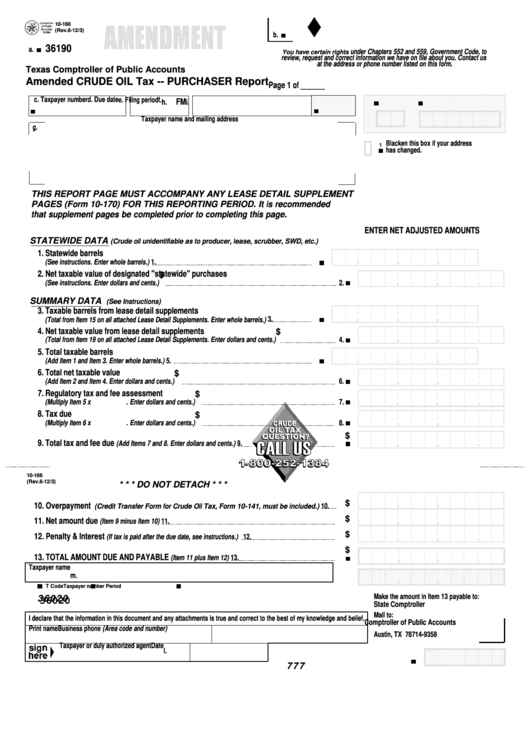

36190

a.

under Chapters 552 and 559, Government Code, to

You have certain rights

review, request and correct information we have on file about you. Contact us

at the address or phone number listed on this form.

Texas Comptroller of Public Accounts

Amended CRUDE OIL Tax -- PURCHASER Report

Page 1 of ______

c. Taxpayer number

d. Due date

e. Filing period

f.

FM

h.

i.

Taxpayer name and mailing address

g.

Blacken this box if your address

1

has changed.

THIS REPORT PAGE MUST ACCOMPANY ANY LEASE DETAIL SUPPLEMENT

PAGES (Form 10-170) FOR THIS REPORTING PERIOD. It is recommended

that supplement pages be completed prior to completing this page.

ENTER NET ADJUSTED AMOUNTS

STATEWIDE DATA

(Crude oil unidentifiable as to producer, lease, scrubber, SWD, etc.)

1. Statewide barrels

(See instructions. Enter whole barrels.)

1.

2. Net taxable value of designated "statewide" purchases

$

(See instructions. Enter dollars and cents.)

2.

SUMMARY DATA

(See Instructions)

3. Taxable barrels from lease detail supplements

3.

(Total from Item 15 on all attached Lease Detail Supplements. Enter whole barrels.)

4. Net taxable value from lease detail supplements

$

4.

(Total from Item 19 on all attached Lease Detail Supplements. Enter dollars and cents.)

5. Total taxable barrels

(Add Item 1 and Item 3. Enter whole barrels.)

5.

6. Total net taxable value

$

6.

(Add Item 2 and Item 4. Enter dollars and cents.)

7. Regulatory tax and fee assessment

$

7.

(Multiply Item 5 x

. Enter dollars and cents.)

8. Tax due

$

8.

(Multiply Item 6 x

. Enter dollars and cents.)

$

9. Total tax and fee due

(Add Items 7 and 8. Enter dollars and cents.)

9.

10-166

(Rev.6-12/3)

* * * DO NOT DETACH * * *

$

10. Overpayment

10.

(Credit Transfer Form for Crude Oil Tax, Form 10-141, must be included.)

$

11. Net amount due

11.

(Item 9 minus Item 10)

$

12. Penalty & Interest

12.

(If tax is paid after the due date, see instructions.)

$

13. TOTAL AMOUNT DUE AND PAYABLE

(Item 11 plus Item 12)

13.

Taxpayer name

m.

T Code

Taxpayer number

Period

Make the amount in Item 13 payable to:

36020

36020

State Comptroller

Mail to:

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and belief.

Comptroller of Public Accounts

Print name

Business phone (Area code and number)

P.O. Box 149358

Austin, TX 78714-9358

Taxpayer or duly authorized agent

Date

l.

777

1

1 2

2 3

3 4

4