Instructions

This agreement must be signed and filed in triplicate. If more than one taxpayer (party) enters into and signs this closing agreement, two additional copies of the

agreement are required for each additional party. (All copies must have original signatures.)

The original and copies of the agreement must be identical.

The name of the taxpayer must be stated accurately.

The agreement may relate to one or more taxable periods.

The liability must be separately stated as to taxable periods and kinds of taxes. Each kind of tax or penalty must reflect the Chapter Number and Subchapter

Letter of the Internal Revenue Code under which each tax was levied, as shown in the following examples:

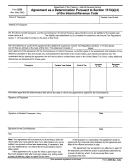

Chapter Number and

Total Tax

Taxable

Kind of Tax

Subchapter Letter of

Liability

Period

or Penalty

Internal Revenue Code

for Period

Calendar Year 1978

Income

1A

$ 3,000.00

Calendar Year 1978

Personal Holding Co.

1G

6,000.00

Date of Death, March 1, 1978

Estate

11A

100,000.00

Fiscal Year Ending March 31, 1978

Income

1A

9,000.00

If an attorney or agent signs the agreement for the taxpayer, the power of attorney (or a copy) authorizing that person to sign must be attached to the

agreement. If the agreement is made for a year in which a joint income tax return was filed by a husband and wife, it should be signed by or for both. One

spouse may sign as agent for the other if the document (or a copy) specifically authorizing that spouse to sign is attached to the agreement.

If the fiduciary signs the agreement for a decedent or an estate, an attested copy of the letters testamentary or the court order authorizing the

fiduciary to sign, and a recently dated certificate that the authority remains in effect must be attached to the agreement. If a trustee signs, a certified copy of

the trust instrument or a certified copy of extracts from the instrument must be attached showing:

(1)

the date of the instrument;

(2)

that it is or is not of record in any court;

(3)

the names of the beneficiaries;

(4)

the appointment of the trustee, the authority granted, and other information necessary to show that the authority extends to Federal tax matters; and

(5)

that the trust has not been terminated and the trustee appointed is still acting.

If a fiduciary is a party, Form 56, Notice Concerning Fiduciary Relationship, is usually required.

If the taxpayer is a corporation, the agreement must be dated and signed with the name of the corporation, followed by the signature and title of an

authorized officer, or officers, or the signature of an authorized attorney or agent. It is not necessary that a copy of an enabling corporate resolution be attached.

See 26 C.F.R. 601.504(b)(2)(ii) as to dissolved corporations.

Use additional pages if necessary, and identify them as part of this agreement.

Please see Revenue Procedure 68-16, 1968-1 C.B. 770, for a detailed description of practices and procedures applicable to most closing agreements.

866

Cat. No. 16889B

Form

(Rev. 7-81)

jU.S. Government Printing Office: 1986-161-175/59187

1

1 2

2 3

3 4

4 5

5 6

6