Instructions For Completion Of Deed-874 Report

ADVERTISEMENT

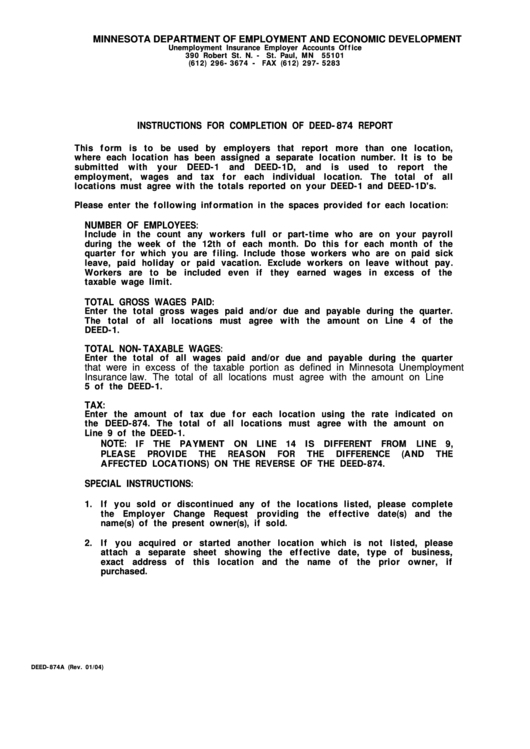

MINNESOTA DEPARTMENT OF EMPLOYMENT AND ECONOMIC DEVELOPMENT

Unemployment Insurance Employer Accounts Office

390 Robert St. N. - St. Paul, MN

55101

(612) 296-3674 - FAX (612) 297-5283

INSTRUCTIONS FOR COMPLETION OF DEED-874 REPORT

This form is to be used by employers that report more than one location,

where each location has been assigned a separate location number. It is to be

submitted

with

your

DEED-1

and

DEED-1D,

and

is

used

to

report

the

employment, wages and tax for each individual location. The total of all

locations must agree with the totals reported on your DEED-1 and DEED-1D's.

Please enter the following information in the spaces provided for each location:

NUMBER OF EMPLOYEES:

Include in the count any workers full or part-time who are on your payroll

during the week of the 12th of each month. Do this for each month of the

quarter for which you are filing. Include those workers who are on paid sick

leave, paid holiday or paid vacation. Exclude workers on leave without pay.

Workers are to be included even if they earned wages in excess of the

taxable wage limit.

TOTAL GROSS WAGES PAID:

Enter the total gross wages paid and/or due and payable during the quarter.

The total of all locations must agree with the amount on Line 4 of the

DEED-1.

TOTAL NON-TAXABLE WAGES:

Enter the total of all wages paid and/or due and payable during the quarter

that were in excess of the taxable portion as defined in Minnesota Unemployment

Insurance law. The total of all locations must agree with the amount on Line

5 of the DEED-1.

TAX:

Enter the amount of tax due for each location using the rate indicated on

the DEED-874. The total of all locations must agree with the amount on

Line 9 of the DEED-1.

NOTE:

IF THE PAYMENT ON LINE 14 IS DIFFERENT FROM LINE 9,

PLEASE

PROVIDE

THE

REASON

FOR

THE

DIFFERENCE

(AND

THE

AFFECTED LOCATIONS) ON THE REVERSE OF THE DEED-874.

SPECIAL INSTRUCTIONS:

1. If you sold or discontinued any of the locations listed, please complete

the Employer Change Request providing the effective date(s) and the

name(s) of the present owner(s), if sold.

2. If you acquired or started another location which is not listed, please

attach a separate sheet showing the effective date, type of business,

exact address of this location and the name of the prior owner, if

purchased.

DEED-874A (Rev. 01/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1