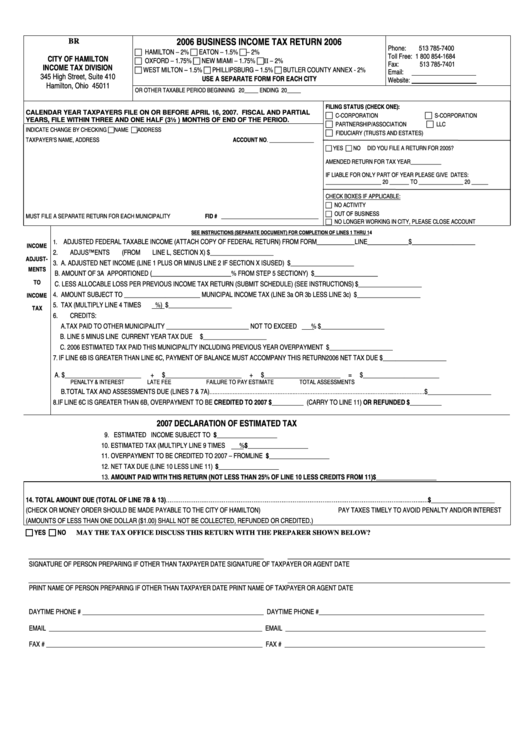

Form Br - Business Income Tax Return - 2006

ADVERTISEMENT

2006 BUSINESS INCOME TAX RETURN 2006

BR

Phone:

513 785-7400

HAMILTON – 2%

EATON – 1.5%

J.E.D.D. – 2%

Toll Free: 1 800 854-1684

CITY OF HAMILTON

OXFORD – 1.75%

NEW MIAMI – 1.75%

J.E.D.D. II – 2%

Fax:

513 785-7401

INCOME TAX DIVISION

WEST MILTON – 1.5%

PHILLIPSBURG – 1.5%

BUTLER COUNTY ANNEX - 2%

Email:

citytax@ci.hamilton.oh.us

345 High Street, Suite 410

USE A SEPARATE FORM FOR EACH CITY

Website:

Hamilton, Ohio 45011

OR OTHER TAXABLE PERIOD BEGINNING

20_____

ENDING

20_____

FILING STATUS (CHECK ONE):

CALENDAR YEAR TAXPAYERS FILE ON OR BEFORE APRIL 16, 2007. FISCAL AND PARTIAL

C-CORPORATION

S-CORPORATION

YEARS, FILE WITHIN THREE AND ONE HALF (3½ ) MONTHS OF END OF THE PERIOD.

PARTNERSHIP/ASSOCIATION

LLC

INDICATE CHANGE BY CHECKING

NAME

ADDRESS

FIDUCIARY (TRUSTS AND ESTATES)

TAXPAYER’S NAME, ADDRESS

ACCOUNT NO. ________________

YES

NO

DID YOU FILE A RETURN FOR 2005?

AMENDED RETURN FOR TAX YEAR___________

IF LIABLE FOR ONLY PART OF YEAR PLEASE GIVE DATES:

____________________ 20 _______ TO ________________ 20 ______

CHECK BOXES IF APPLICABLE:

NO ACTIVITY

OUT OF BUSINESS

MUST FILE A SEPARATE RETURN FOR EACH MUNICIPALITY

FID # ___________________________________

NO LONGER WORKING IN CITY, PLEASE CLOSE ACCOUNT

SEE INSTRUCTIONS (SEPARATE DOCUMENT) FOR COMPLETION OF LINES 1 THRU 14

ADJUSTED FEDERAL TAXABLE INCOME (ATTACH COPY OF FEDERAL RETURN) FROM FORM____________LINE_____________........... $____________________

1.

INCOME

2.

ADJUSTMENTS (FROM LINE L, SECTION X).............................................................................................................................................................. $____________________

ADJUST-

3. A. ADJUSTED NET INCOME (LINE 1 PLUS OR MINUS LINE 2 IF SECTION X IS USED) ............................................................................................ $____________________

MENTS

B. AMOUNT OF 3A APPORTIONED (_________________________% FROM STEP 5 SECTION Y) ......................................................................... $____________________

TO

C. LESS ALLOCABLE LOSS PER PREVIOUS INCOME TAX RETURN (SUBMIT SCHEDULE) (SEE INSTRUCTIONS)............................................. $____________________

4.

AMOUNT SUBJECT TO ________________________ MUNICIPAL INCOME TAX (LINE 3a OR 3b LESS LINE 3c) .............................................. $____________________

INCOME

5.

TAX (MULTIPLY LINE 4 TIMES

%) ....................................................................................................................................................................... $____________________

TAX

6.

CREDITS:

A. TAX PAID TO OTHER MUNICIPALITY __________________________ NOT TO EXCEED

%......................................................................... $____________________

B. LINE 5 MINUS LINE 6A ................................................................................................................................................ CURRENT YEAR TAX DUE

$____________________

C. 2006 ESTIMATED TAX PAID THIS MUNICIPALITY INCLUDING PREVIOUS YEAR OVERPAYMENT .................................................................... $____________________

7

IF LINE 6B IS GREATER THAN LINE 6C, PAYMENT OF BALANCE MUST ACCOMPANY THIS RETURN........................ 2006 NET TAX DUE

$____________________

.

A.

$________________________

+

$________________________

+

$________________________

=

$________________________

PENALTY & INTEREST

LATE FEE

FAILURE TO PAY ESTIMATE

TOTAL ASSESSMENTS

B.

TOTAL TAX AND ASSESSMENTS DUE (LINES 7 & 7A)

$____________________

………………………………………………………………………………………………...………….……

8.

IF LINE 6C IS GREATER THAN 6B, OVERPAYMENT TO BE CREDITED TO 2007 $__________ (CARRY TO LINE 11) OR REFUNDED $__________

2007 DECLARATION OF ESTIMATED TAX

9. ESTIMATED INCOME SUBJECT TO TAX ..................................................................$___________________

10. ESTIMATED TAX (MULTIPLY LINE 9 TIMES

%.................................................$___________________

11. OVERPAYMENT TO BE CREDITED TO 2007 – FROM LINE 8.................................$___________________

12. NET TAX DUE (LINE 10 LESS LINE 11) .....................................................................$___________________

13. AMOUNT PAID WITH THIS RETURN (NOT LESS THAN 25% OF LINE 10 LESS CREDITS FROM 11) .................................... $___________________

14. TOTAL AMOUNT DUE (TOTAL OF LINE 7B & 13)……………………………………………………………………………………………………………….………..…$____________________

(CHECK OR MONEY ORDER SHOULD BE MADE PAYABLE TO THE CITY OF HAMILTON)

PAY TAXES TIMELY TO AVOID PENALTY AND/OR INTEREST

(AMOUNTS OF LESS THAN ONE DOLLAR ($1.00) SHALL NOT BE COLLECTED, REFUNDED OR CREDITED.)

YES

NO

MAY THE TAX OFFICE DISCUSS THIS RETURN WITH THE PREPARER SHOWN BELOW?

__________________________________________________________________________

______________________________________________________________________

SIGNATURE OF PERSON PREPARING IF OTHER THAN TAXPAYER

DATE

SIGNATURE OF TAXPAYER OR AGENT

DATE

__________________________________________________________________________

______________________________________________________________________

PRINT NAME OF PERSON PREPARING IF OTHER THAN TAXPAYER

DATE

PRINT NAME OF TAXPAYER OR AGENT

DATE

DAYTIME PHONE # _________________________________________________________

DAYTIME PHONE # ____________________________________________________

EMAIL ___________________________________________________________________

EMAIL _______________________________________________________________

FAX # ____________________________________________________________________

FAX # _______________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2