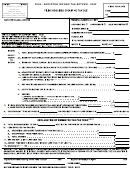

Form Br - Business Income Tax Return - 2006 Page 2

ADVERTISEMENT

PAGE 2

SECTION X

RECONCILIATION WITH FEDERAL INCOME TAX RETURN AS REQUIRED BY ORC SECTION 718

ITEMS NOT DEDUCTIBLE

ADD

ITEMS NOT TAXABLE

DEDUCT

A. CAPITAL / ORDINARY SECTION

H. CAPITAL GAINS ......................................................................

$___________________

SECTION 1231 LOSSES

(EXCLUDING ORDINARY GAINS)

....................................................................$___________________

B. TAXES ON OR MEASURED BY NET INCOME............................

I. INTANGIBLE INCOME ............................................................

$___________________

$___________________

C. GUARANTEED PAYMENTS TO PARTNERS, RETIRED

(INTEREST, DIVIDENDS, ROYALTIES)

PARTNERS, MEMBERS OR OTHER OWNERS

J. OTHER INCOME EXEMPT (EXPLAIN BELOW) ....................

............................$___________________

$___________________

D. EXPENSES ATTRIBUTABLE TO NONTAXABLE INCOME

K. TOTAL DEDUCTIONS ............................................................

$___________________

(5% OF LINE I) ..........................................................................................$___________________

E. REAL ESTATE INVESTMENT TRUST DISTRIBUTIONS

..............$___________________

L. COMBINE LINES G AND K, ENTER NET ON LINE 2...........

$___________________

F. OTHER

.....................................................................................................$___________________

G. TOTAL ADDITIONS .......................................................................$_________________

SECTION Y

BUSINESS APPORTIONMENT FORMULA

A. LOCATED

B. LOCATED IN THIS C. PERCENTAGE (B/A)

EVERYWHERE

CITY

STEP 1. ORIGINAL COST OF REAL & TANGIBLE PERSONAL PROPERTY

GROSS ANNUAL RENTALS PAID MULTIPLIED BY 8

%

TOTAL STEP 1.

%

STEP 2. GROSS RECEIPTS FROM SALES MADE AND/OR WORK OR SERVICES PERFORMED

%

STEP 3. WAGES, SALARIES AND OTHER COMPENSATION PAID (*SEE SECTION Z)

%

STEP 4. TOTAL PERCENTAGE

Divide Total Percentages by Number of Percentages Used. Carry to Line 3B, Page 1

STEP 5. AVERAGE PERCENTAGE

_____________%

SECTION Z

RECONCILIATION TO WITHHOLDING TAX RECONCILIATION

TOTAL WAGES ALLOCATED TO THIS CITY (FROM FEDERAL RETURN OR APPORTIONMENT FORMULA)…………………………………………………………….$_________________

1.

2. TOTAL WAGES SHOWN ON WITHHOLDING TAX RECONCILIATION……………………………………………………………………………………………………………$_________________

3. PLEASE EXPLAIN ANY DIFFERENCE:

YES

NO

ARE ANY EMPLOYEES LEASED IN THE YEAR COVERED BY THIS RETURN?

IF YES, PLEASE PROVIDE THE NAME, ADDRESS AND FID NUMBER OF THE LEASING COMPANY.

NAME_____________________________________________________________________

ADDRESS__________________________________________________________________

FID NUMBER________________________________________________________________

EXTENSION POLICY: EXTENSIONS MAY, UPON REQUEST, BE GRANTED FOR FILING OF THE ANNUAL RETURN, PROVIDED AN IRS EXTENSION HAS BEEN SECURED.

EXTENSION REQUEST MUST BE MADE IN WRITING AND RECEIVED BY THIS TAX OFFICE BEFORE THE ORIGINAL DUE DATE OF THE RETURN. ONLY THOSE EXTENSION

REQUESTS RECEIVED IN DUPLICATE WITH A SELF-ADDRESSED, POSTPAID ENVELOPE WILL HAVE A COPY RETURNED AFTER BEING APPROPRIATELY MARKED.

YES

NO

HAS YOUR FEDERAL TAX LIABILITY FOR ANY PRIOR YEAR BEEN CHANGED IN THE YEAR COVERED BY THIS RETURN AS A RESULT OF AN EXAMINATION

BY THE INTERNAL REVENUE SERVICE?

YES

NO

IF YES, HAS AN AMENDED RETURN BEEN FILED FOR SUCH YEAR OR YEARS?

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS

TRUE, CORRECT AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THE DECLARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS

ANY KNOWLEDGE.

NOTE: UNLESS ACCOMPANIED BY COPIES OF APPROPRIATE FEDERAL SCHEDULES AND BY PAYMENT OF THE TOTAL AMOUNT DUE (LINE 14) THIS FORM IS NOT A LEGAL

FINAL RETURN.

YES

NO

DO YOU USE SUBCONTRACT LABOR TO PERFORM WORK IN THIS CITY?

IF YES, COPIES OF 1099’S ISSUED MUST BE SUBMITTED TO THIS OFFICE WITHIN 2 MONTHS AFTER THE END OF TAX YEAR.

YES

NO

DO YOU HAVE EMPLOYEES WORKING IN THE CITY?

IF YES, COPIES OF EMPLOYEE W-2 FORMS MUST BE SUBMITTED BY FEBRUARY 28, 2007.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2