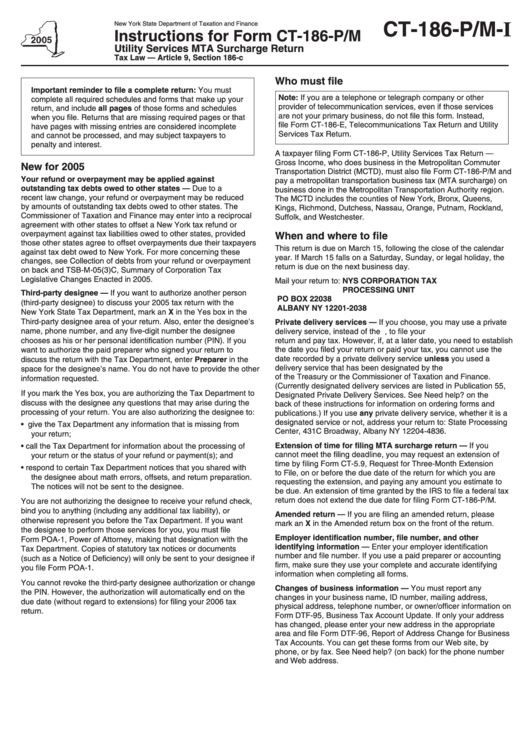

Instructions For Form Ct-186-P/m - Utility Services Mta Surcharge Return - 2005

ADVERTISEMENT

CT-186-P/M-I

New York State Department of Taxation and Finance

Instructions for Form CT-186-P/M

Utility Services MTA Surcharge Return

Tax Law — Article 9, Section 186-c

Who must file

Important reminder to file a complete return: You must

Note: If you are a telephone or telegraph company or other

complete all required schedules and forms that make up your

provider of telecommunication services, even if those services

return, and include all pages of those forms and schedules

are not your primary business, do not file this form. Instead,

when you file. Returns that are missing required pages or that

file Form CT-186-E, Telecommunications Tax Return and Utility

have pages with missing entries are considered incomplete

Services Tax Return.

and cannot be processed, and may subject taxpayers to

penalty and interest.

A taxpayer filing Form CT-186-P, Utility Services Tax Return —

Gross Income, who does business in the Metropolitan Commuter

New for 2005

Transportation District (MCTD), must also file Form CT-186-P/M and

Your refund or overpayment may be applied against

pay a metropolitan transportation business tax (MTA surcharge) on

outstanding tax debts owed to other states — Due to a

business done in the Metropolitan Transportation Authority region.

recent law change, your refund or overpayment may be reduced

The MCTD includes the counties of New York, Bronx, Queens,

by amounts of outstanding tax debts owed to other states. The

Kings, Richmond, Dutchess, Nassau, Orange, Putnam, Rockland,

Commissioner of Taxation and Finance may enter into a reciprocal

Suffolk, and Westchester.

agreement with other states to offset a New York tax refund or

overpayment against tax liabilities owed to other states, provided

When and where to file

those other states agree to offset overpayments due their taxpayers

This return is due on March 15, following the close of the calendar

against tax debt owed to New York. For more concerning these

year. If March 15 falls on a Saturday, Sunday, or legal holiday, the

changes, see Collection of debts from your refund or overpayment

return is due on the next business day.

on back and TSB-M-05(3)C, Summary of Corporation Tax

Legislative Changes Enacted in 2005.

Mail your return to: NYS CORPORATION TAX

PROCESSING UNIT

Third-party designee — If you want to authorize another person

PO BOX 22038

(third-party designee) to discuss your 2005 tax return with the

ALBANY NY 12201-2038

New York State Tax Department, mark an X in the Yes box in the

Third-party designee area of your return. Also, enter the designee’s

Private delivery services — If you choose, you may use a private

name, phone number, and any five-digit number the designee

delivery service, instead of the U.S. Postal Service, to file your

chooses as his or her personal identification number (PIN). If you

return and pay tax. However, if, at a later date, you need to establish

want to authorize the paid preparer who signed your return to

the date you filed your return or paid your tax, you cannot use the

date recorded by a private delivery service unless you used a

discuss the return with the Tax Department, enter Preparer in the

delivery service that has been designated by the U.S. Secretary

space for the designee’s name. You do not have to provide the other

of the Treasury or the Commissioner of Taxation and Finance.

information requested.

(Currently designated delivery services are listed in Publication 55,

If you mark the Yes box, you are authorizing the Tax Department to

Designated Private Delivery Services. See Need help? on the

discuss with the designee any questions that may arise during the

back of these instructions for information on ordering forms and

processing of your return. You are also authorizing the designee to:

publications.) If you use any private delivery service, whether it is a

designated service or not, address your return to: State Processing

• give the Tax Department any information that is missing from

Center, 431C Broadway, Albany NY 12204-4836.

your return;

Extension of time for filing MTA surcharge return — If you

• call the Tax Department for information about the processing of

cannot meet the filing deadline, you may request an extension of

your return or the status of your refund or payment(s); and

time by filing Form CT-5.9, Request for Three-Month Extension

• respond to certain Tax Department notices that you shared with

to File, on or before the due date of the return for which you are

the designee about math errors, offsets, and return preparation.

requesting the extension, and paying any amount you estimate to

The notices will not be sent to the designee.

be due. An extension of time granted by the IRS to file a federal tax

return does not extend the due date for filing Form CT-186-P/M.

You are not authorizing the designee to receive your refund check,

bind you to anything (including any additional tax liability), or

Amended return — If you are filing an amended return, please

otherwise represent you before the Tax Department. If you want

mark an X in the Amended return box on the front of the return.

the designee to perform those services for you, you must file

Employer identification number, file number, and other

Form POA-1, Power of Attorney, making that designation with the

identifying information — Enter your employer identification

Tax Department. Copies of statutory tax notices or documents

number and file number. If you use a paid preparer or accounting

(such as a Notice of Deficiency) will only be sent to your designee if

firm, make sure they use your complete and accurate identifying

you file Form POA-1.

information when completing all forms.

You cannot revoke the third-party designee authorization or change

Changes of business information — You must report any

the PIN. However, the authorization will automatically end on the

changes in your business name, ID number, mailing address,

due date (without regard to extensions) for filing your 2006 tax

physical address, telephone number, or owner/officer information on

return.

Form DTF-95, Business Tax Account Update. If only your address

has changed, please enter your new address in the appropriate

area and file Form DTF-96, Report of Address Change for Business

Tax Accounts. You can get these forms from our Web site, by

phone, or by fax. See Need help? (on back) for the phone number

and Web address.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2