Instructions For Form Ct-186-M - Utility Corporation Mta Surcharge Return - 2004

ADVERTISEMENT

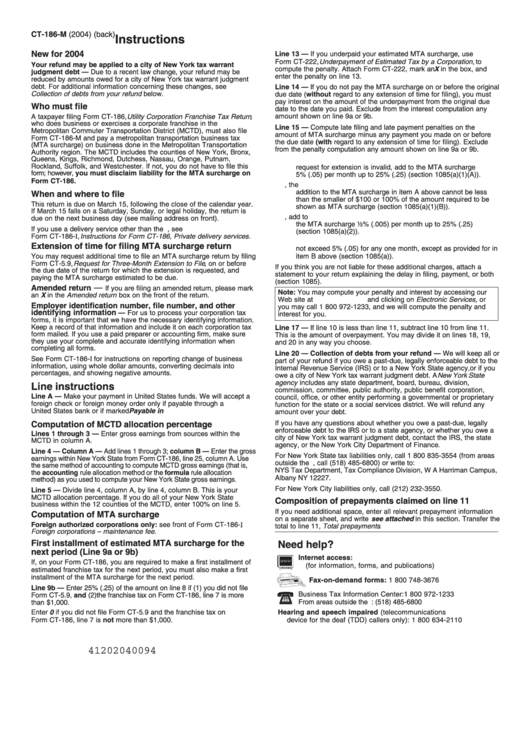

CT-186-M (2004) (back)

Instructions

New for 2004

Line 13 — If you underpaid your estimated MTA surcharge, use

Form CT-222, Underpayment of Estimated Tax by a Corporation, to

Your refund may be applied to a city of New York tax warrant

compute the penalty. Attach Form CT-222, mark an X in the box, and

judgment debt — Due to a recent law change, your refund may be

enter the penalty on line 13.

reduced by amounts owed for a city of New York tax warrant judgment

debt. For additional information concerning these changes, see

Line 14 — If you do not pay the MTA surcharge on or before the original

Collection of debts from your refund below.

due date (without regard to any extension of time for filing), you must

pay interest on the amount of the underpayment from the original due

Who must file

date to the date you paid. Exclude from the interest computation any

A taxpayer filing Form CT-186, Utility Corporation Franchise Tax Return ,

amount shown on line 9a or 9b.

who does business or exercises a corporate franchise in the

Line 15 — Compute late filing and late payment penalties on the

Metropolitan Commuter Transportation District (MCTD), must also file

amount of MTA surcharge minus any payment you made on or before

Form CT-186-M and pay a metropolitan transportation business tax

the due date (with regard to any extension of time for filing). Exclude

(MTA surcharge) on business done in the Metropolitan Transportation

from the penalty computation any amount shown on line 9a or 9b.

Authority region. The MCTD includes the counties of New York, Bronx,

Queens, Kings, Richmond, Dutchess, Nassau, Orange, Putnam,

A. If you do not file an MTA surcharge return when due or if the

Rockland, Suffolk, and Westchester. If not, you do not have to file this

request for extension is invalid, add to the MTA surcharge

form; however, you must disclaim liability for the MTA surcharge on

5% (.05) per month up to 25% (.25) (section 1085(a)(1)(A)).

Form CT-186.

B. If you do not file a return within 60 days of the due date, the

addition to the MTA surcharge in item A above cannot be less

When and where to file

than the smaller of $100 or 100% of the amount required to be

This return is due on March 15, following the close of the calendar year.

shown as MTA surcharge (section 1085(a)(1)(B)).

If March 15 falls on a Saturday, Sunday, or legal holiday, the return is

C. If you do not pay the MTA surcharge shown on a return, add to

due on the next business day (see mailing address on front).

the MTA surcharge ½% (.005) per month up to 25% (.25)

If you use a delivery service other than the U.S. Postal Service, see

(section 1085(a)(2)).

Form CT-186-I, Instructions for Form CT-186, Private delivery services.

D. The total of the additional charges in items A and C above may

Extension of time for filing MTA surcharge return

not exceed 5% (.05) for any one month, except as provided for in

item B above (section 1085(a)).

You may request additional time to file an MTA surcharge return by filing

Form CT-5.9, Request for Three-Month Extension to File , on or before

If you think you are not liable for these additional charges, attach a

the due date of the return for which the extension is requested, and

statement to your return explaining the delay in filing, payment, or both

paying the MTA surcharge estimated to be due.

(section 1085).

—

Amended return

If you are filing an amended return, please mark

Note: You may compute your penalty and interest by accessing our

an X in the Amended return box on the front of the return.

Web site at and clicking on Electronic Services, or

Employer identification number, file number, and other

you may call 1 800 972-1233, and we will compute the penalty and

identifying information

— For us to process your corporation tax

interest for you.

forms, it is important that we have the necessary identifying information.

Keep a record of that information and include it on each corporation tax

Line 17 — If line 10 is less than line 11, subtract line 10 from line 11.

form mailed. If you use a paid preparer or accounting firm, make sure

This is the amount of overpayment. You may divide it on lines 18, 19,

they use your complete and accurate identifying information when

and 20 in any way you choose.

completing all forms.

Line 20 — Collection of debts from your refund — We will keep all or

See Form CT-186-I for instructions on reporting change of business

part of your refund if you owe a past-due, legally enforceable debt to the

information, using whole dollar amounts, converting decimals into

Internal Revenue Service (IRS) or to a New York State agency, or if you

percentages, and showing negative amounts.

owe a city of New York tax warrant judgment debt. A New York State

agency includes any state department, board, bureau, division,

Line instructions

commission, committee, public authority, public benefit corporation,

Line A — Make your payment in United States funds. We will accept a

council, office, or other entity performing a governmental or proprietary

foreign check or foreign money order only if payable through a

function for the state or a social services district. We will refund any

United States bank or if marked Payable in U.S. funds.

amount over your debt.

If you have any questions about whether you owe a past-due, legally

Computation of MCTD allocation percentage

enforceable debt to the IRS or to a state agency, or whether you owe a

Lines 1 through 3 — Enter gross earnings from sources within the

city of New York tax warrant judgment debt, contact the IRS, the state

MCTD in column A.

agency, or the New York City Department of Finance.

Line 4 — Column A — Add lines 1 through 3; column B — Enter the gross

For New York State tax liabilities only, call 1 800 835-3554 (from areas

earnings within New York State from Form CT-186, line 25, column A. Use

outside the U.S. and outside Canada, call (518) 485-6800) or write to:

the same method of accounting to compute MCTD gross earnings (that is,

NYS Tax Department, Tax Compliance Division, W A Harriman Campus,

the accounting rule allocation method or the formula rule allocation

Albany NY 12227.

method) as you used to compute your New York State gross earnings.

For New York City liabilities only, call (212) 232-3550.

Line 5 — Divide line 4, column A, by line 4, column B. This is your

MCTD allocation percentage. If you do all of your New York State

Composition of prepayments claimed on line 11

business within the 12 counties of the MCTD, enter 100% on line 5.

If you need additional space, enter all relevant prepayment information

Computation of MTA surcharge

on a separate sheet, and write see attached in this section. Transfer the

Foreign authorized corporations only: see front of Form CT-186-I ,

total to line 11, Total prepayments .

Foreign corporations – maintenance fee.

First installment of estimated MTA surcharge for the

Need help?

next period (Line 9a or 9b)

Internet access:

If, on your Form CT-186, you are required to make a first installment of

(for information, forms, and publications)

estimated franchise tax for the next period, you must also make a first

installment of the MTA surcharge for the next period.

Fax-on-demand forms: 1 800 748-3676

Line 9b — Enter 25% (.25) of the amount on line 8 if (1) you did not file

Business Tax Information Center:

1 800 972-1233

Form CT-5.9, and (2) the franchise tax on Form CT-186, line 7 is more

From areas outside the U.S. and outside Canada: (518) 485-6800

than $1,000.

Enter 0 if you did not file Form CT-5.9 and the franchise tax on

Hearing and speech impaired (telecommunications

Form CT-186, line 7 is not more than $1,000.

device for the deaf (TDD) callers only):

1 800 634-2110

41202040094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1