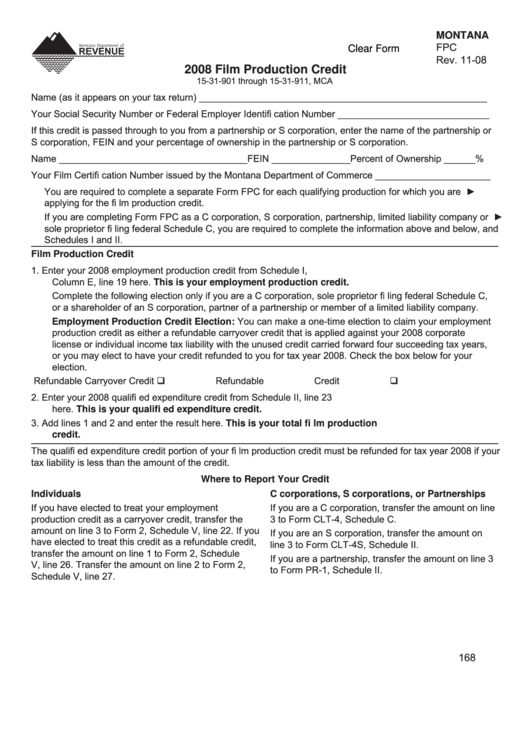

MONTANA

FPC

Clear Form

Rev. 11-08

2008 Film Production Credit

15-31-901 through 15-31-911, MCA

Name (as it appears on your tax return) _______________________________________________________

Your Social Security Number or Federal Employer Identifi cation Number _____________________________

If this credit is passed through to you from a partnership or S corporation, enter the name of the partnership or

S corporation, FEIN and your percentage of ownership in the partnership or S corporation.

Name ____________________________________ FEIN _______________ Percent of Ownership ______ %

Your Film Certifi cation Number issued by the Montana Department of Commerce ______________________

►

You are required to complete a separate Form FPC for each qualifying production for which you are

applying for the fi lm production credit.

►

If you are completing Form FPC as a C corporation, S corporation, partnership, limited liability company or

sole proprietor fi ling federal Schedule C, you are required to complete the information above and below, and

Schedules I and II.

Film Production Credit

1.

Enter your 2008 employment production credit from Schedule I,

Column E, line 19 here. This is your employment production credit. .................1. ________________

Complete the following election only if you are a C corporation, sole proprietor fi ling federal Schedule C,

or a shareholder of an S corporation, partner of a partnership or member of a limited liability company.

Employment Production Credit Election: You can make a one-time election to claim your employment

production credit as either a refundable carryover credit that is applied against your 2008 corporate

license or individual income tax liability with the unused credit carried forward four succeeding tax years,

or you may elect to have your credit refunded to you for tax year 2008. Check the box below for your

election.

Refundable Carryover Credit

Refundable Credit

2.

Enter your 2008 qualifi ed expenditure credit from Schedule II, line 23

here. This is your qualifi ed expenditure credit. ...................................................2. ________________

3.

Add lines 1 and 2 and enter the result here. This is your total fi lm production

credit. .......................................................................................................................3. ________________

The qualifi ed expenditure credit portion of your fi lm production credit must be refunded for tax year 2008 if your

tax liability is less than the amount of the credit.

Where to Report Your Credit

Individuals

C corporations, S corporations, or Partnerships

If you have elected to treat your employment

If you are a C corporation, transfer the amount on line

production credit as a carryover credit, transfer the

3 to Form CLT-4, Schedule C.

amount on line 3 to Form 2, Schedule V, line 22. If you

If you are an S corporation, transfer the amount on

have elected to treat this credit as a refundable credit,

line 3 to Form CLT-4S, Schedule II.

transfer the amount on line 1 to Form 2, Schedule

If you are a partnership, transfer the amount on line 3

V, line 26. Transfer the amount on line 2 to Form 2,

to Form PR-1, Schedule II.

Schedule V, line 27.

168

1

1 2

2 3

3