1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

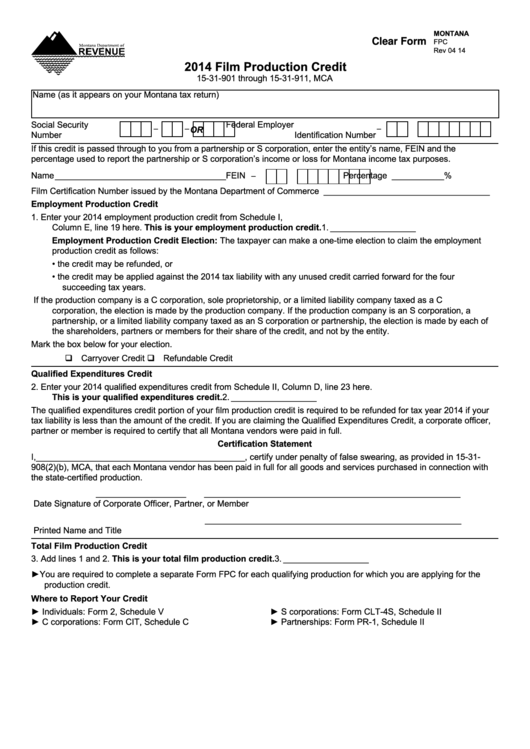

MONTANA

4

4

Clear Form

FPC

5

5

Rev 04 14

6

6

2014 Film Production Credit

7

7

8

8

15-31-901 through 15-31-911, MCA

9

9

Name (as it appears on your Montana tax return)

10

10

100

11

11

12

12

Social Security

Federal Employer

120

110

-

-

-

13

X X X X X X X X X

X X X X X X X X X

13

OR

Number

Identification Number

14

14

If this credit is passed through to you from a partnership or S corporation, enter the entity’s name, FEIN and the

15

15

percentage used to report the partnership or S corporation’s income or loss for Montana income tax purposes.

16

16

17

17

130

150

140

-

Name ____________________________________ FEIN

Percentage ___________ %

18

18

160

19

Film Certification Number issued by the Montana Department of Commerce ___________________________________

19

20

20

Employment Production Credit

21

21

1.

Enter your 2014 employment production credit from Schedule I,

22

170

22

Column E, line 19 here. This is your employment production credit. .............................. 1. __________________

23

23

Employment Production Credit Election: The taxpayer can make a one-time election to claim the employment

24

24

production credit as follows:

25

25

26

• the credit may be refunded, or

26

27

27

• the credit may be applied against the 2014 tax liability with any unused credit carried forward for the four

28

28

succeeding tax years.

29

29

If the production company is a C corporation, sole proprietorship, or a limited liability company taxed as a C

30

30

corporation, the election is made by the production company. If the production company is an S corporation, a

31

31

partnership, or a limited liability company taxed as an S corporation or partnership, the election is made by each of

32

32

the shareholders, partners or members for their share of the credit, and not by the entity.

33

33

Mark the box below for your election.

34

34

180

190

35

35

q Carryover Credit

q Refundable Credit

36

36

Qualified Expenditures Credit

37

37

2.

Enter your 2014 qualified expenditures credit from Schedule II, Column D, line 23 here.

38

38

200

This is your qualified expenditures credit. ........................................................................ 2. __________________

39

39

40

40

The qualified expenditures credit portion of your film production credit is required to be refunded for tax year 2014 if your

41

41

tax liability is less than the amount of the credit. If you are claiming the Qualified Expenditures Credit, a corporate officer,

42

42

partner or member is required to certify that all Montana vendors were paid in full.

43

43

Certification Statement

44

44

210

I, ____________________________________________ , certify under penalty of false swearing, as provided in 15-31-

45

45

908(2)(b), MCA, that each Montana vendor has been paid in full for all goods and services purchased in connection with

46

46

the state-certified production.

47

47

220

48

48

___________________

______________________________________________________

49

49

Date

Signature of Corporate Officer, Partner, or Member

50

50

230

______________________________________________________

51

51

Printed Name and Title

52

52

53

53

Total Film Production Credit

54

54

240

3.

Add lines 1 and 2. This is your total film production credit. ............................................. 3. __________________

55

55

►You are required to complete a separate Form FPC for each qualifying production for which you are applying for the

56

56

production credit.

57

57

58

58

Where to Report Your Credit

59

59

► Individuals: Form 2, Schedule V

► S corporations: Form CLT-4S, Schedule II

60

60

► C corporations: Form CIT, Schedule C

► Partnerships: Form PR-1, Schedule II

61

61

62

62

63

63

64

64

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84 85

66

66

1

1 2

2 3

3 4

4 5

5