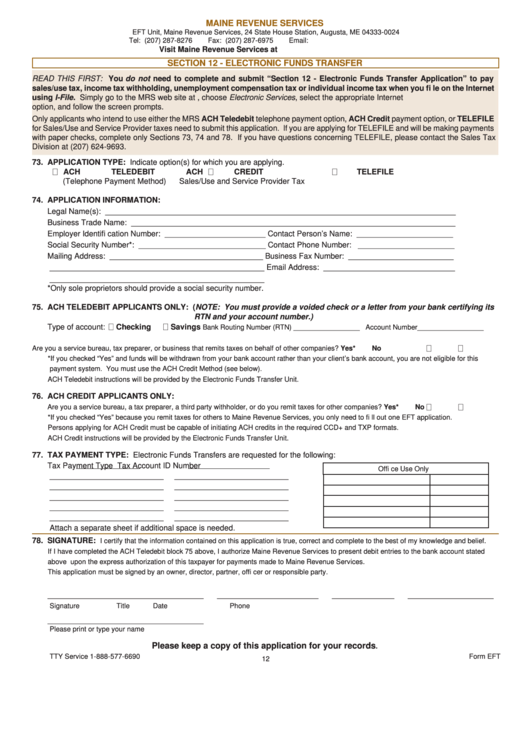

MAINE REVENUE SERVICES

EFT Unit, Maine Revenue Services, 24 State House Station, Augusta, ME 04333-0024

Tel: (207) 287-8276

Fax: (207) 287-6975

Email:

efunds.transfer@maine.gov

Visit Maine Revenue Services at

SECTION 12 - ELECTRONIC FUNDS TRANSFER

READ THIS FIRST: You do not need to complete and submit “Section 12 - Electronic Funds Transfer Application” to pay

sales/use tax, income tax withholding, unemployment compensation tax or individual income tax when you fi le on the Internet

using I-File. Simply go to the MRS web site at , choose Electronic Services, select the appropriate Internet

option, and follow the screen prompts.

Only applicants who intend to use either the MRS ACH Teledebit telephone payment option, ACH Credit payment option, or TELEFILE

for Sales/Use and Service Provider taxes need to submit this application. If you are applying for TELEFILE and will be making payments

with paper checks, complete only Sections 73, 74 and 78. If you have questions concerning TELEFILE, please contact the Sales Tax

Division at (207) 624-9693.

73. APPLICATION TYPE: Indicate option(s) for which you are applying.

ACH TELEDEBIT

ACH CREDIT

TELEFILE

(Telephone Payment Method)

Sales/Use and Service Provider Tax

74. APPLICATION INFORMATION:

Legal Name(s): ________________________________________________________________________________

Business Trade Name: __________________________________________________________________________

Employer Identifi cation Number: _______________________ Contact Person’s Name: ______________________

Social Security Number*: _____________________________ Contact Phone Number: ______________________

Mailing Address: ___________________________________ Business Fax Number: ________________________

_________________________________________________ Email Address: ______________________________

_________________________________________________

*Only sole proprietors should provide a social security number.

75. ACH TELEDEBIT APPLICANTS ONLY: (NOTE: You must provide a voided check or a letter from your bank certifying its

RTN and your account number.)

Type of account:

Checking

Savings

Bank Routing Number (RTN) _________________ Account Number_________________

Are you a service bureau, tax preparer, or business that remits taxes on behalf of other companies?.............................

Yes*

No

*If you checked “Yes” and funds will be withdrawn from your bank account rather than your client’s bank account, you are not eligible for this

payment system. You must use the ACH Credit Method (see below).

ACH Teledebit instructions will be provided by the Electronic Funds Transfer Unit.

76. ACH CREDIT APPLICANTS ONLY:

Are you a service bureau, a tax preparer, a third party withholder, or do you remit taxes for other companies?...................

Yes*

No

*If you checked “Yes” because you remit taxes for others to Maine Revenue Services, you only need to fi ll out one EFT application.

Persons applying for ACH Credit must be capable of initiating ACH credits in the required CCD+ and TXP formats.

ACH Credit instructions will be provided by the Electronic Funds Transfer Unit.

77. TAX PAYMENT TYPE: Electronic Funds Transfers are requested for the following:

Tax Payment Type

Tax Account ID Number

Offi ce Use Only

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

__________________________

Attach a separate sheet if additional space is needed.

78. SIGNATURE:

I certify that the information contained on this application is true, correct and complete to the best of my knowledge and belief.

If I have completed the ACH Teledebit block 75 above, I authorize Maine Revenue Services to present debit entries to the bank account stated

above upon the express authorization of this taxpayer for payments made to Maine Revenue Services.

This application must be signed by an owner, director, partner, offi cer or responsible party.

________________________________________

__________________________

________________

______________________

Signature

Title

Date

Phone

________________________________________

Please print or type your name

Please keep a copy of this application for your records

.

TTY Service 1-888-577-6690

Form EFT

12

1

1