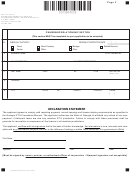

Form Crf-Ifta - Ifta Motor Carrier Registration Application Page 5

ADVERTISEMENT

Ownership/Relationship Section

Line

. & 23. Georgia IFTA Effective Date- Enter the date you first plan to do business as an interstate

22

carrier using the Georgia IFTA decal.

The Department of Revenue requires the following information on all related individuals or businesses

to determine the ownership of the applying business. This section must be completed for your

application to be accepted. Complete one Section for each related business or individual, check the

relationships that apply, and enter the effective date of that relationship. For all applications provide

information for the following:

A. Owner- The owner of the business, complete lines C, D and E.

B. Partner-If the business is a partnership, complete lines A through E for each partner.

C. Officer- If the business is a corporation, complete lines A through E for each officer.

D. LLC- If the business is a Manager Member complete lines A through E for each manager member.

E. Partner Company - If the business is a subsidiary branch or division or another business,

complete lines A through E.

INSTRUCTIONS FOR SIGNING:

The Declaration Statement must be signed by the owner, a partner or authorized officer of the

corporation before the registration can be accepted.

INSTRUCTIONS FOR PAYMENT:

Send a check or money order payable to the Georgia Revenue Collection Account for the total amount.

Georgia law stipulates that taxes and fees be paid in lawful money of U.S. and be free on any expense to

Georgia.

IMPORTANT NOTICE:

Your motor carrier license will not be issued, if there are any outstanding liabilities against your account, or

if you do not return the registration form with a proper signature on the Declaration Statement.

INSTRUCTIONS FOR MAILING AND REQUESTING INFROMATION:

The taxpayer should retain a copy of this application for his files and for inspection by the Revenue

Commissioner or his agents. Mail the original to the address shown below. Call 404-968-3800 or E- mail if

you have any questions or need assistance in completing the application.

DECLARATION STATEMENT:

The applicant agrees to comply with reporting payments record keeping and license requirements as

specified in the Georgia IFTA Procedures Manual. The applicant authorizes the State of Georgia to

withhold any refund or tax payment, if delinquent taxes are due any IFTA jurisdiction member. Failure to

comply with these provisions shall be grounds for Revocation or Suspension of the license in all member

jurisdictions.

Applicant certifies with his signature that to the best of his knowledge, the information is true,

accurate and complete and any falsification subjects him to the offense of making a written false

statement to a government official.

E-Mail: Commercialvehicles@dor.ga.gov.

P.O. Box 740382

Atlanta, Ga. 30374-0382

404-968-3800

THE PROCESSING OF THIS APPLICATION WILL BE DELAYED UNLESS IT IS PROPERLY

SIGNED, COMPLETED INFORMATION IS FURNISHED AND APPLICABLE QUESTIONS

ARE ANSWERED.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5