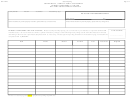

Form St-L-137fa - Commercial Agriculture Application Form Page 2

ADVERTISEMENT

SPECIFIC REQUIREMENTS

Which form do you file WITH IRS to report your farming income and expenses?

(Refer to the business types below to determine what additional supporting documents are required.)

Please be aware that these documents are not returnable unless specifically

requested.

IF YOU FILE A:

INDIVIDUAL 1040

Please submit the most recent copy of the following forms along with the application:

•

Page 1 & 2 of Federal Personal Income Tax Return

•

All copies of any schedules C and/or F

Partnership 1065

Please submit the most recent copy of the following forms along with the application:

•

Pages 1 through 4 of your Federal Partnership Tax Return

Corporate 1120 OR 1120S

Please submit the most recent copy of the following forms along with the application:

•

Pages 1 through 4 of your Federal Corporate Tax Return

NOTE

Please be sure to submit all supporting documents to avoid a delay in processing.

Please be aware that these documents are not returnable unless specifically

requested.

Phone: (207) 624-9693

E-mail: sales.tax@maine.gov

Fax: (207) 287-6628

2

TTY 888-577-6690

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3