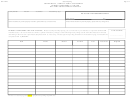

Form St-L-137fa - Commercial Agriculture Application Form Page 3

ADVERTISEMENT

GENERAL REQUIREMENTS AND RESTRICTIONS

REQUIREMENTS

Applicant must be engaged in commercial agricultural production. A copy of the most recent applicable tax

return and related schedules shall serve as the basis for evaluating if the purchaser is in fact engaged in commercial

agricultural production.

The exemption certificate can only be issued when the above information is available, first year applicants

shall not be issued an exemption certificate until such time that the appropriate schedules can be produced. Dual

purpose farmers, meaning those who are engaged in multiple activities using similar machinery and equipment who

are not primarily (more than 50% of the time) engaged in commercial agriculture shall not be issued

exemption certificates.

Those qualifying for commercial agricultural activities, but not qualifying for an exemption card are eligible for a

sales tax refund for any sales tax paid on any qualifying depreciable machinery, electricity and equipment. The

depreciable machinery equipment, (1) must be used directly in commercial agriculture (2) must be used primarily in

commercial agriculture and (3) must be depreciable for federal income tax purposes. A refund application available

by contacting Maine Revenue Services or it can be obtain from our web site at:

RESTRICTIONS

The exemption certificate may be used to purchase depreciable machinery and equipment, including repair

parts for such machinery and equipment, used directly and primarily in commercial agricultural production, exempt

from tax.

The exemption certificate CAN NOT be used for the purchase of motor vehicles (including trailers, all

terrain vehicles and snowmobiles) and attachments or accessories to motor vehicles, materials incorporated into real

property such as lumber and building supplies, consumable items, machinery and equipment not 100% depreciable

for Federal Income Tax purposes and for items not commonly used in commercial agriculture.

For a more complete listing of items that do or do not meet qualification requirements, please see

Instructional Bulletin 45 and Rule 323 at:

and

ADDITIONAL INFORMATION

Requests for more information on specific situations should be in writing, contain full details as to the situation in

question and should be directed to:

Maine Revenue Services

Sales Tax Division

P. O. Box 1065

Augusta, Maine 04332-1065

ST-L-137FA (Rev. 03/2010)

Phone: (207) 624-9693

E-mail: sales.tax@maine.gov

Fax: (207) 287-6628

3

TTY 888-577-6690

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3