Soft Drink And Syrup Tax Application Form Page 2

ADVERTISEMENT

MAINE REVENUE SERVICES

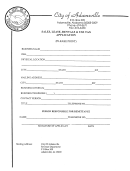

SOFT DRINK and SYRUP TAX

APPLICATION INSTRUCTIONS

Line 1 – BUSINESS INFORMATION

Legal Name - Enter the legal name of the entity, whether a sole proprietor, corporation, partnership, LLC etc.

Social

Security Number - For sole proprietors only! Enter the Social Security Number for the person on the Legal Name line.

Federal Employer ID No. (EIN) – All other type of entities enter the EIN for the name on the Legal Name line. Primary

Mailing Address – Enter the address for the entity listed on the Legal Name line. Email address – Enter the email

address for the entity on the Legal Name line. Business Trade Name – Enter the business name, if different from the

Legal Name. Business Phone Number – Enter the phone number on this line. Physical Location of Business – Enter

the physical location of the business operation or the address of rental property.

Line 2 – TYPE OF OWNERSHIP

Check only one box for type of ownership.

Mark the ownership type that best applies. If you marked “Other”, provide an explanation. Spouses must not check

“Partnership” unless the business files federal income tax returns (IRS form 1065) as a partnership. Corporations, limited

partnerships and limited liability companies must provide incorporation or registration information. For limited liability

companies, form 8832 is required, if filed with the IRS. Corporations must provide the Date Incorporated and the State of

Incorporation. Limited partnerships must provide the Date Registered and the State of Registration. Limited liability

companies must provide the Date Registered and the State of Registration.

Line 3 – REQUIRED OWNER INFORMATION

Sole proprietors skip this line.

Corporations, partnerships, associations, nonprofit organizations and others must provide the names of two officers,

partners, members, or responsible parties. One must be the person responsible for the finances of the company or

organization. Social security numbers are required. A list of all partners or officers is not required.

Line 4 – TYPE OF BUSINESS

Check only one box for type of business.

Check only the box appropriate for your type of business.

Line 5 – SOFT DRINK & SYRUP TAX ACCOUNT ADDRESS

Only if different than primary address.

If the returns and notices etc. will be mailed to the same address as Line 1, then check the box next to “Check if same as

primary mailing address above”. If the returns and notices etc. need to be mailed to a different address, enter the

address. If there is an email address include that, as well as the phone number.

The application must be signed by a responsible party, such as a director, partner, member, officer,

trustee, personal representative, or some other responsible party.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2