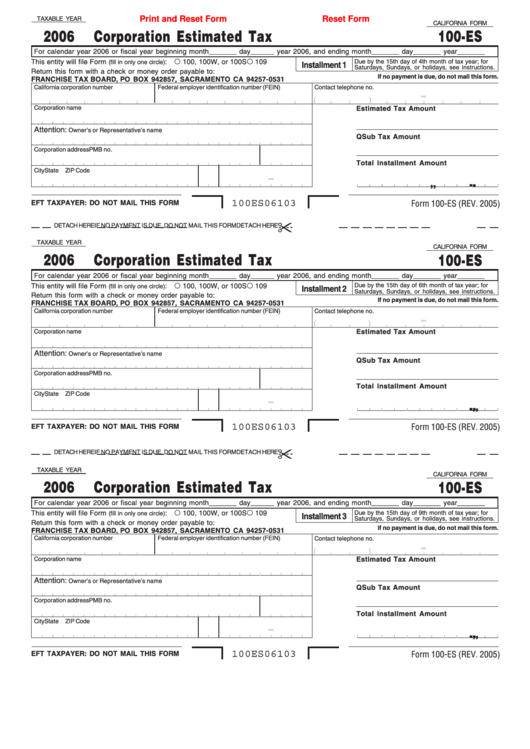

Print and Reset Form

Reset Form

TAXABLE YEAR

CALIFORNIA FORM

2006

Corporation Estimated Tax

100-ES

For calendar year 2006 or fiscal year beginning month_______ day______ year 2006, and ending month_______ day_______ year_______

Due by the 15th day of 4th month of tax year; for

This entity will file Form

:

100, 100W, or 100S

109

(fill in only one circle)

Installment 1

Saturdays, Sundays, or holidays, see instructions.

Return this form with a check or money order payable to:

If no payment is due, do not mail this form.

FRANCHISE TAX BOARD, PO BOX 942857, SACRAMENTO CA 94257-0531

California corporation number

Federal employer identification number (FEIN)

Contact telephone no.

(

)

Corporation name

Estimated Tax Amount

Attention:

Owner’s or Representative’s name

QSub Tax Amount

Corporation address

PMB no.

Total Installment Amount

City

State

ZIP Code

. . . . .

,

,

100ES06103

EFT TAXPAYER: DO NOT MAIL THIS FORM

Form 100-ES (REV. 2005)

¤

§

DETACH HERE

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM

DETACH HERE

TAXABLE YEAR

CALIFORNIA FORM

2006

Corporation Estimated Tax

100-ES

For calendar year 2006 or fiscal year beginning month_______ day______ year 2006, and ending month_______ day_______ year_______

This entity will file Form

:

100, 100W, or 100S

109

Due by the 15th day of 6th month of tax year; for

(fill in only one circle)

Installment 2

Saturdays, Sundays, or holidays, see instructions.

Return this form with a check or money order payable to:

If no payment is due, do not mail this form.

FRANCHISE TAX BOARD, PO BOX 942857, SACRAMENTO CA 94257-0531

California corporation number

Federal employer identification number (FEIN)

Contact telephone no.

(

)

Estimated Tax Amount

Corporation name

Attention:

Owner’s or Representative’s name

QSub Tax Amount

Corporation address

PMB no.

Total Installment Amount

City

State

ZIP Code

. . . . .

,

,

100ES06103

EFT TAXPAYER: DO NOT MAIL THIS FORM

Form 100-ES (REV. 2005)

¤

§

DETACH HERE

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM

DETACH HERE

TAXABLE YEAR

CALIFORNIA FORM

2006

Corporation Estimated Tax

100-ES

For calendar year 2006 or fiscal year beginning month_______ day______ year 2006, and ending month_______ day_______ year_______

Due by the 15th day of 9th month of tax year; for

This entity will file Form

:

100, 100W, or 100S

109

(fill in only one circle)

Installment 3

Saturdays, Sundays, or holidays, see instructions.

Return this form with a check or money order payable to:

If no payment is due, do not mail this form.

FRANCHISE TAX BOARD, PO BOX 942857, SACRAMENTO CA 94257-0531

California corporation number

Federal employer identification number (FEIN)

Contact telephone no.

(

)

Estimated Tax Amount

Corporation name

Attention:

Owner’s or Representative’s name

QSub Tax Amount

Corporation address

PMB no.

Total Installment Amount

City

State

ZIP Code

. . . . .

,

,

100ES06103

EFT TAXPAYER: DO NOT MAIL THIS FORM

Form 100-ES (REV. 2005)

1

1 2

2