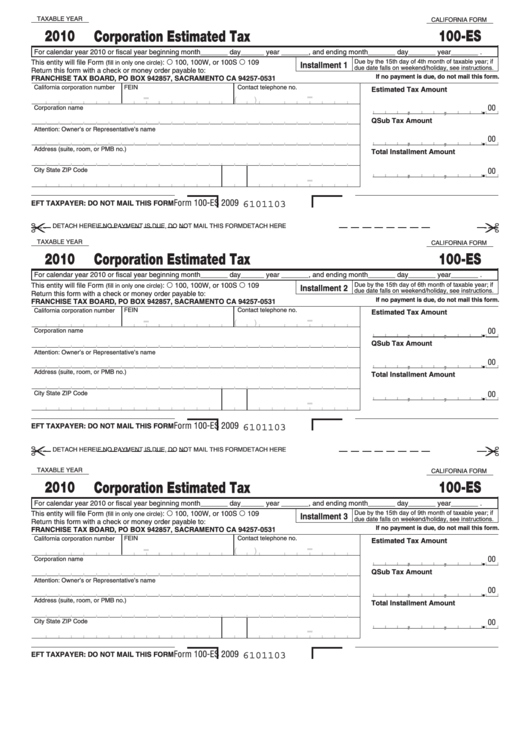

TAXABLE YEAR

CALIFORNIA FORM

2010

100-ES

Corporation Estimated Tax

For calendar year 2010 or fiscal year beginning month_______ day______ year _______, and ending month_______ day_______ year_______ .

This entity will file Form

:

100, 100W, or 100S

109

Due by the 15th day of 4th month of taxable year; if

(fill in only one circle)

Installment 1

due date falls on weekend/holiday, see instructions.

Return this form with a check or money order payable to:

If no payment is due, do not mail this form.

FRANCHISE TAX BOARD, PO BOX 942857, SACRAMENTO CA 94257-0531

California corporation number

FEIN

Contact telephone no.

Estimated Tax Amount

(

)

00

Corporation name

.

,

,

QSub Tax Amount

Attention: Owner’s or Representative’s name

00

.

,

,

Address (suite, room, or PMB no.)

Total Installment Amount

City

State

ZIP Code

00

.

,

,

Form 100-ES 2009

EFT TAXPAYER: DO NOT MAIL THIS FORM

6101103

DETACH HERE

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM

DETACH HERE

TAXABLE YEAR

CALIFORNIA FORM

2010

100-ES

Corporation Estimated Tax

For calendar year 2010 or fiscal year beginning month_______ day______ year _______, and ending month_______ day_______ year_______ .

Due by the 15th day of 6th month of taxable year; if

This entity will file Form

:

100, 100W, or 100S

109

(fill in only one circle)

Installment 2

due date falls on weekend/holiday, see instructions.

Return this form with a check or money order payable to:

If no payment is due, do not mail this form.

FRANCHISE TAX BOARD, PO BOX 942857, SACRAMENTO CA 94257-0531

California corporation number

FEIN

Contact telephone no.

Estimated Tax Amount

(

)

00

Corporation name

.

,

,

QSub Tax Amount

Attention: Owner’s or Representative’s name

00

.

,

,

Address (suite, room, or PMB no.)

Total Installment Amount

City

State

ZIP Code

00

.

,

,

Form 100-ES 2009

EFT TAXPAYER: DO NOT MAIL THIS FORM

6101103

DETACH HERE

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM

DETACH HERE

TAXABLE YEAR

CALIFORNIA FORM

2010

100-ES

Corporation Estimated Tax

For calendar year 2010 or fiscal year beginning month_______ day______ year _______, and ending month_______ day_______ year_______ .

This entity will file Form

:

100, 100W, or 100S

109

Due by the 15th day of 9th month of taxable year; if

(fill in only one circle)

Installment 3

due date falls on weekend/holiday, see instructions.

Return this form with a check or money order payable to:

If no payment is due, do not mail this form.

FRANCHISE TAX BOARD, PO BOX 942857, SACRAMENTO CA 94257-0531

California corporation number

FEIN

Contact telephone no.

Estimated Tax Amount

(

)

00

Corporation name

.

,

,

QSub Tax Amount

Attention: Owner’s or Representative’s name

00

.

,

,

Address (suite, room, or PMB no.)

Total Installment Amount

City

State

ZIP Code

00

.

,

,

Form 100-ES 2009

EFT TAXPAYER: DO NOT MAIL THIS FORM

6101103

1

1 2

2