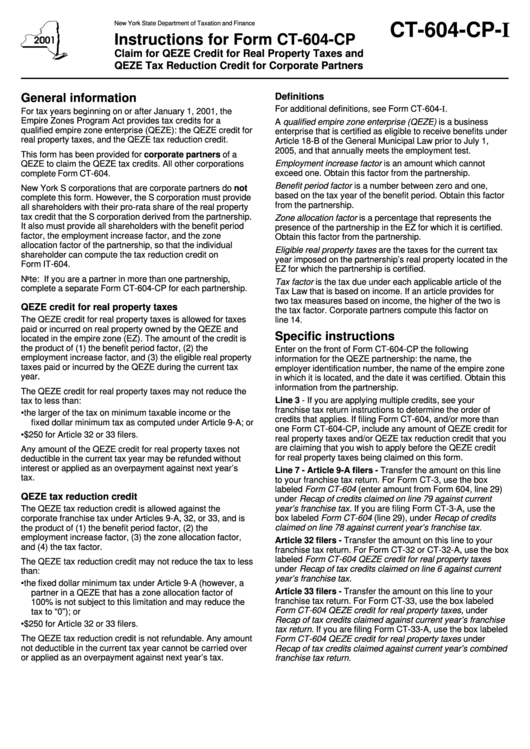

Instructions For Form Ct-604-Cp - Claim For Qeze Credit For Real Property Taxes And Qeze Tax Reduction Credit For Corporate Partners - 2001

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-604-CP-I

Instructions for Form CT-604-CP

Claim for QEZE Credit for Real Property Taxes and

QEZE Tax Reduction Credit for Corporate Partners

Definitions

General information

For additional definitions, see Form CT-604-I.

For tax years beginning on or after January 1, 2001, the

Empire Zones Program Act provides tax credits for a

A qualified empire zone enterprise (QEZE) is a business

qualified empire zone enterprise (QEZE): the QEZE credit for

enterprise that is certified as eligible to receive benefits under

real property taxes, and the QEZE tax reduction credit.

Article 18-B of the General Municipal Law prior to July 1,

2005, and that annually meets the employment test.

This form has been provided for corporate partners of a

Employment increase factor is an amount which cannot

QEZE to claim the QEZE tax credits. All other corporations

exceed one. Obtain this factor from the partnership.

complete Form CT-604.

Benefit period factor is a number between zero and one,

New York S corporations that are corporate partners do not

based on the tax year of the benefit period. Obtain this factor

complete this form. However, the S corporation must provide

from the partnership.

all shareholders with their pro-rata share of the real property

tax credit that the S corporation derived from the partnership.

Zone allocation factor is a percentage that represents the

It also must provide all shareholders with the benefit period

presence of the partnership in the EZ for which it is certified.

factor, the employment increase factor, and the zone

Obtain this factor from the partnership.

allocation factor of the partnership, so that the individual

Eligible real property taxes are the taxes for the current tax

shareholder can compute the tax reduction credit on

year imposed on the partnership’s real property located in the

Form IT-604.

EZ for which the partnership is certified.

Note: If you are a partner in more than one partnership,

Tax factor is the tax due under each applicable article of the

complete a separate Form CT-604-CP for each partnership.

Tax Law that is based on income. If an article provides for

two tax measures based on income, the higher of the two is

QEZE credit for real property taxes

the tax factor. Corporate partners compute this factor on

The QEZE credit for real property taxes is allowed for taxes

line 14.

paid or incurred on real property owned by the QEZE and

Specific instructions

located in the empire zone (EZ). The amount of the credit is

the product of (1) the benefit period factor, (2) the

Enter on the front of Form CT-604-CP the following

employment increase factor, and (3) the eligible real property

information for the QEZE partnership: the name, the

taxes paid or incurred by the QEZE during the current tax

employer identification number, the name of the empire zone

year.

in which it is located, and the date it was certified. Obtain this

information from the partnership.

The QEZE credit for real property taxes may not reduce the

Line 3 - If you are applying multiple credits, see your

tax to less than:

franchise tax return instructions to determine the order of

• the larger of the tax on minimum taxable income or the

credits that applies. If filing Form CT-604, and/or more than

fixed dollar minimum tax as computed under Article 9-A; or

one Form CT-604-CP, include any amount of QEZE credit for

• $250 for Article 32 or 33 filers.

real property taxes and/or QEZE tax reduction credit that you

are claiming that you wish to apply before the QEZE credit

Any amount of the QEZE credit for real property taxes not

for real property taxes being claimed on this form.

deductible in the current tax year may be refunded without

interest or applied as an overpayment against next year’s

Line 7 - Article 9-A filers - Transfer the amount on this line

tax.

to your franchise tax return. For Form CT-3, use the box

labeled Form CT-604 (enter amount from Form 604, line 29)

QEZE tax reduction credit

under Recap of credits claimed on line 79 against current

year’s franchise tax. If you are filing Form CT-3-A, use the

The QEZE tax reduction credit is allowed against the

corporate franchise tax under Articles 9-A, 32, or 33, and is

box labeled Form CT-604 (line 29), under Recap of credits

claimed on line 78 against current year’s franchise tax.

the product of (1) the benefit period factor, (2) the

employment increase factor, (3) the zone allocation factor,

Article 32 filers - Transfer the amount on this line to your

and (4) the tax factor.

franchise tax return. For Form CT-32 or CT-32-A, use the box

labeled Form CT-604 QEZE credit for real property taxes

The QEZE tax reduction credit may not reduce the tax to less

under Recap of tax credits claimed on line 6 against current

than:

year’s franchise tax.

• the fixed dollar minimum tax under Article 9-A (however, a

Article 33 filers - Transfer the amount on this line to your

partner in a QEZE that has a zone allocation factor of

franchise tax return. For Form CT-33, use the box labeled

100% is not subject to this limitation and may reduce the

Form CT-604 QEZE credit for real property taxes, under

tax to “0”); or

Recap of tax credits claimed against current year’s franchise

• $250 for Article 32 or 33 filers.

tax return. If you are filing Form CT-33-A, use the box labeled

The QEZE tax reduction credit is not refundable. Any amount

Form CT-604 QEZE credit for real property taxes under

not deductible in the current tax year cannot be carried over

Recap of tax credits claimed against current year’s combined

or applied as an overpayment against next year’s tax.

franchise tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2