Form St-140 - Individual Purchaser'S Annual Report Of Sales And Use Tax (2005)

ADVERTISEMENT

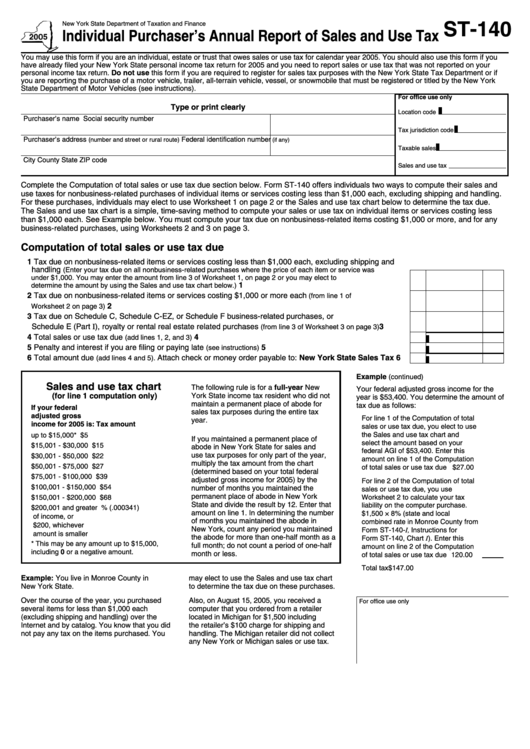

ST-140

New York State Department of Taxation and Finance

Individual Purchaser’s Annual Report of Sales and Use Tax

You may use this form if you are an individual, estate or trust that owes sales or use tax for calendar year 2005. You should also use this form if you

have already filed your New York State personal income tax return for 2005 and you need to report sales or use tax that was not reported on your

personal income tax return. Do not use this form if you are required to register for sales tax purposes with the New York State Tax Department or if

you are reporting the purchase of a motor vehicle, trailer, all-terrain vehicle, vessel, or snowmobile that must be registered or titled by the New York

State Department of Motor Vehicles (see instructions).

For office use only

Type or print clearly

Location code

Purchaser’s name

Social security number

Tax jurisdiction code

Purchaser’s address

Federal identification number

(number and street or rural route)

(if any)

Taxable sales

City

County

State

ZIP code

Sales and use tax

Complete the Computation of total sales or use tax due section below. Form ST-140 offers individuals two ways to compute their sales and

use taxes for nonbusiness-related purchases of individual items or services costing less than $1,000 each, excluding shipping and handling.

For these purchases, individuals may elect to use Worksheet 1 on page 2 or the Sales and use tax chart below to determine the tax due.

The Sales and use tax chart is a simple, time-saving method to compute your sales or use tax on individual items or services costing less

than $1,000 each. See Example below. You must compute your tax due on nonbusiness-related items costing $1,000 or more, and for any

business-related purchases, using Worksheets 2 and 3 on page 3.

Computation of total sales or use tax due

1 Tax due on nonbusiness-related items or services costing less than $1,000 each, excluding shipping and

handling

(Enter your tax due on all nonbusiness‑related purchases where the price of each item or service was

under $1,000. You may enter the amount from line 3 of Worksheet 1, on page 2 or you may elect to

1

........................................................................

determine the amount by using the Sales and use tax chart below.)

2 Tax due on nonbusiness-related items or services costing $1,000 or more each

(from line 1 of

.....................................................................................................................................

2

Worksheet 2 on page 3)

3 Tax due on Schedule C, Schedule C-EZ, or Schedule F business-related purchases, or

3

Schedule E (Part I), royalty or rental real estate related purchases

.......

(from line 3 of Worksheet 3 on page 3)

4 Total sales or use tax due

4

..................................................................................................

(add lines 1, 2, and 3)

5 Penalty and interest if you are filing or paying late

...................................................................

5

(see instructions)

6 Total amount due

Attach check or money order payable to: New York State Sales Tax ......

6

(add lines 4 and 5).

Example

(continued)

Sales and use tax chart

The following rule is for a full-year New

Your federal adjusted gross income for the

(for line 1 computation only)

York State income tax resident who did not

year is $53,400. You determine the amount of

maintain a permanent place of abode for

tax due as follows:

If your federal

sales tax purposes during the entire tax

adjusted gross

For line 1 of the Computation of total

year.

income for 2005 is:

Tax amount

sales or use tax due, you elect to use

the Sales and use tax chart and

up to $15,000* ................ $5

If you maintained a permanent place of

select the amount based on your

$15,001 - $30,000 .......... $15

abode in New York State for sales and

federal AGI of $53,400. Enter this

use tax purposes for only part of the year,

$30,001 - $50,000 .......... $22

amount on line 1 of the Computation

multiply the tax amount from the chart

$50,001 - $75,000 .......... $27

of total sales or use tax due ................ $27.00

(determined based on your total federal

$75,001 - $100,000 ........ $39

adjusted gross income for 2005) by the

For line 2 of the Computation of total

$100,001 - $150,000 ...... $54

number of months you maintained the

sales or use tax due, you use

permanent place of abode in New York

$150,001 - $200,000 ...... $68

Worksheet 2 to calculate your tax

State and divide the result by 12. Enter that

liability on the computer purchase.

$200,001 and greater ..... .0341% (.000341)

amount on line 1. In determining the number

$1,500 × 8% (state and local

of income, or

of months you maintained the abode in

combined rate in Monroe County from

$200, whichever

New York, count any period you maintained

Form ST‑140‑I, Instructions for

amount is smaller

the abode for more than one-half month as a

Form ST-140, Chart I). Enter this

* This may be any amount up to $15,000,

full month; do not count a period of one-half

amount on line 2 of the Computation

including 0 or a negative amount.

month or less.

of total sales or use tax due ............... 120.00

Total tax .............................................. $147.00

Example: You live in Monroe County in

may elect to use the Sales and use tax chart

New York State.

to determine the tax due on these purchases.

Over the course of the year, you purchased

Also, on August 15, 2005, you received a

For office use only

several items for less than $1,000 each

computer that you ordered from a retailer

(excluding shipping and handling) over the

located in Michigan for $1,500 including

Internet and by catalog. You know that you did

the retailer’s $100 charge for shipping and

not pay any tax on the items purchased. You

handling. The Michigan retailer did not collect

any New York or Michigan sales or use tax.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4