Instructions For Form 2290 - Heavy Highway Vehicle Use Tax Return - 2001

ADVERTISEMENT

Department of the Treasury

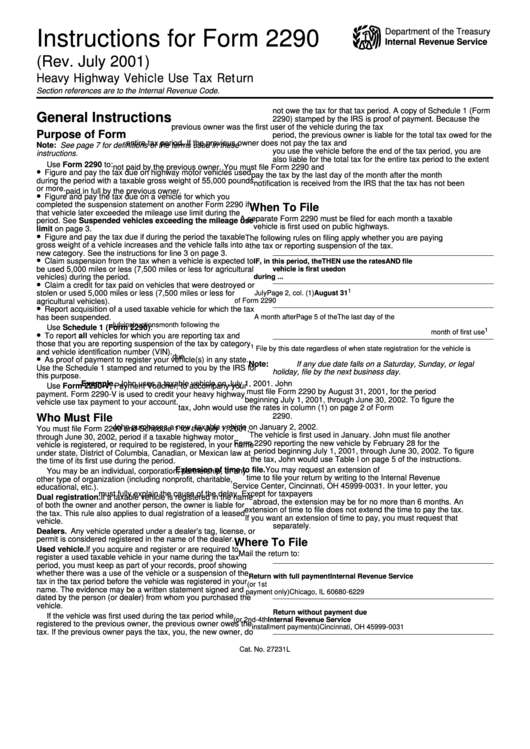

Instructions for Form 2290

Internal Revenue Service

(Rev. July 2001)

Heavy Highway Vehicle Use Tax Return

Section references are to the Internal Revenue Code.

not owe the tax for that tax period. A copy of Schedule 1 (Form

General Instructions

2290) stamped by the IRS is proof of payment. Because the

previous owner was the first user of the vehicle during the tax

Purpose of Form

period, the previous owner is liable for the total tax owed for the

entire tax period. If the previous owner does not pay the tax and

Note: See page 7 for definitions of the terms used in these

you use the vehicle before the end of the tax period, you are

instructions.

also liable for the total tax for the entire tax period to the extent

Use Form 2290 to:

not paid by the previous owner. You must file Form 2290 and

•

Figure and pay the tax due on highway motor vehicles used

pay the tax by the last day of the month after the month

during the period with a taxable gross weight of 55,000 pounds

notification is received from the IRS that the tax has not been

or more.

paid in full by the previous owner.

•

Figure and pay the tax due on a vehicle for which you

completed the suspension statement on another Form 2290 if

When To File

that vehicle later exceeded the mileage use limit during the

A separate Form 2290 must be filed for each month a taxable

period. See Suspended vehicles exceeding the mileage use

vehicle is first used on public highways.

limit on page 3.

•

Figure and pay the tax due if during the period the taxable

The following rules on filing apply whether you are paying

gross weight of a vehicle increases and the vehicle falls into a

the tax or reporting suspension of the tax.

new category. See the instructions for line 3 on page 3.

•

Claim suspension from the tax when a vehicle is expected to

IF, in this period, the

THEN use the rates

AND file

be used 5,000 miles or less (7,500 miles or less for agricultural

vehicle is first used

on ...

by ...

vehicles) during the period.

during ...

•

Claim a credit for tax paid on vehicles that were destroyed or

1

stolen or used 5,000 miles or less (7,500 miles or less for

July

Page 2, col. (1)

August 31

of Form 2290

agricultural vehicles).

•

Report acquisition of a used taxable vehicle for which the tax

has been suspended.

A month after

Page 5 of the

The last day of the

July

instructions

month following the

Use Schedule 1 (Form 2290):

1

•

month of first use

To report all vehicles for which you are reporting tax and

those that you are reporting suspension of the tax by category

1

File by this date regardless of when state registration for the vehicle is

and vehicle identification number (VIN).

•

due.

As proof of payment to register your vehicle(s) in any state.

Note: If any due date falls on a Saturday, Sunday, or legal

Use the Schedule 1 stamped and returned to you by the IRS for

holiday, file by the next business day.

this purpose.

Example. John uses a taxable vehicle on July 1, 2001. John

Use Form 2290-V, Payment Voucher, to accompany your

must file Form 2290 by August 31, 2001, for the period

payment. Form 2290-V is used to credit your heavy highway

beginning July 1, 2001, through June 30, 2002. To figure the

vehicle use tax payment to your account.

tax, John would use the rates in column (1) on page 2 of Form

2290.

Who Must File

John purchases a new, taxable vehicle on January 2, 2002.

You must file Form 2290 and Schedule 1 for the July 1, 2001,

The vehicle is first used in January. John must file another

through June 30, 2002, period if a taxable highway motor

Form 2290 reporting the new vehicle by February 28 for the

vehicle is registered, or required to be registered, in your name

period beginning July 1, 2001, through June 30, 2002. To figure

under state, District of Columbia, Canadian, or Mexican law at

the tax, John would use Table I on page 5 of the instructions.

the time of its first use during the period.

Extension of time to file. You may request an extension of

You may be an individual, corporation, partnership, or any

time to file your return by writing to the Internal Revenue

other type of organization (including nonprofit, charitable,

Service Center, Cincinnati, OH 45999-0031. In your letter, you

educational, etc.).

must fully explain the cause of the delay. Except for taxpayers

Dual registration. If a taxable vehicle is registered in the name

abroad, the extension may be for no more than 6 months. An

of both the owner and another person, the owner is liable for

extension of time to file does not extend the time to pay the tax.

the tax. This rule also applies to dual registration of a leased

If you want an extension of time to pay, you must request that

vehicle.

separately.

Dealers. Any vehicle operated under a dealer’s tag, license, or

permit is considered registered in the name of the dealer.

Where To File

Used vehicle. If you acquire and register or are required to

Mail the return to:

register a used taxable vehicle in your name during the tax

period, you must keep as part of your records, proof showing

whether there was a use of the vehicle or a suspension of the

Return with full payment

Internal Revenue Service

tax in the tax period before the vehicle was registered in your

(or 1st installment

P.O. Box 6229

name. The evidence may be a written statement signed and

payment only)

Chicago, IL 60680-6229

dated by the person (or dealer) from whom you purchased the

vehicle.

Return without payment due

If the vehicle was first used during the tax period while

(or 2nd-4th

Internal Revenue Service

registered to the previous owner, the previous owner owes the

installment payments)

Cincinnati, OH 45999-0031

tax. If the previous owner pays the tax, you, the new owner, do

Cat. No. 27231L

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8