Instructions For Form 2290 - Heavy Highway Vehicle Use Tax Return - 2009

ADVERTISEMENT

Department of the Treasury

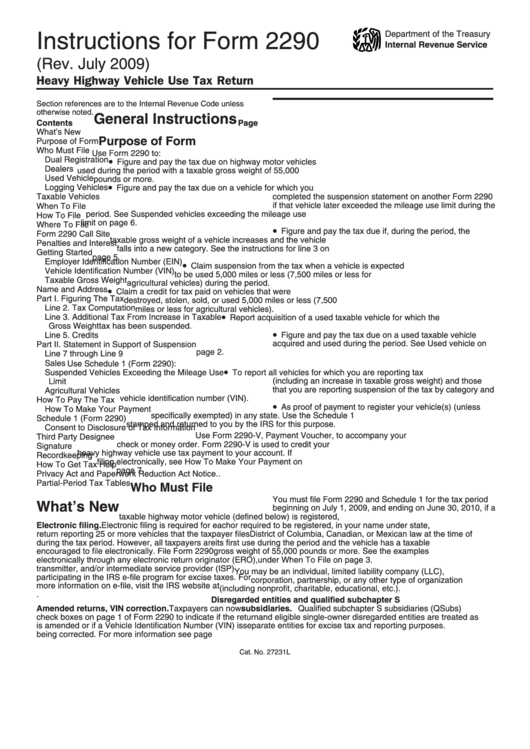

Instructions for Form 2290

Internal Revenue Service

(Rev. July 2009)

Heavy Highway Vehicle Use Tax Return

Section references are to the Internal Revenue Code unless

otherwise noted.

General Instructions

Contents

Page

What’s New . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Purpose of Form

Purpose of Form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Who Must File . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Use Form 2290 to:

•

Dual Registration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Figure and pay the tax due on highway motor vehicles

Dealers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

used during the period with a taxable gross weight of 55,000

Used Vehicle . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

pounds or more.

•

Logging Vehicles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Figure and pay the tax due on a vehicle for which you

Taxable Vehicles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

completed the suspension statement on another Form 2290

if that vehicle later exceeded the mileage use limit during the

When To File . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

period. See Suspended vehicles exceeding the mileage use

How To File . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

limit on page 6.

Where To File . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

•

Figure and pay the tax due if, during the period, the

Form 2290 Call Site . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

taxable gross weight of a vehicle increases and the vehicle

Penalties and Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

falls into a new category. See the instructions for line 3 on

Getting Started . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

page 5.

Employer Identification Number (EIN) . . . . . . . . . . . . . . 4

•

Claim suspension from the tax when a vehicle is expected

Vehicle Identification Number (VIN) . . . . . . . . . . . . . . . . 4

to be used 5,000 miles or less (7,500 miles or less for

Taxable Gross Weight . . . . . . . . . . . . . . . . . . . . . . . . . 4

agricultural vehicles) during the period.

•

Name and Address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Claim a credit for tax paid on vehicles that were

Part I. Figuring The Tax . . . . . . . . . . . . . . . . . . . . . . . . . . 5

destroyed, stolen, sold, or used 5,000 miles or less (7,500

Line 2. Tax Computation . . . . . . . . . . . . . . . . . . . . . . . 5

miles or less for agricultural vehicles).

•

Line 3. Additional Tax From Increase in Taxable

Report acquisition of a used taxable vehicle for which the

Gross Weight . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

tax has been suspended.

•

Line 5. Credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Figure and pay the tax due on a used taxable vehicle

acquired and used during the period. See Used vehicle on

Part II. Statement in Support of Suspension . . . . . . . . . . . 6

page 2.

Line 7 through Line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Use Schedule 1 (Form 2290):

•

Suspended Vehicles Exceeding the Mileage Use

To report all vehicles for which you are reporting tax

Limit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

(including an increase in taxable gross weight) and those

that you are reporting suspension of the tax by category and

Agricultural Vehicles . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

vehicle identification number (VIN).

How To Pay The Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

•

As proof of payment to register your vehicle(s) (unless

How To Make Your Payment . . . . . . . . . . . . . . . . . . . . 7

specifically exempted) in any state. Use the Schedule 1

Schedule 1 (Form 2290) . . . . . . . . . . . . . . . . . . . . . . . . . 7

stamped and returned to you by the IRS for this purpose.

Consent to Disclosure of Tax Information . . . . . . . . . . . 7

Use Form 2290-V, Payment Voucher, to accompany your

Third Party Designee . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

check or money order. Form 2290-V is used to credit your

Signature . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

heavy highway vehicle use tax payment to your account. If

Recordkeeping . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

filing electronically, see How To Make Your Payment on

How To Get Tax Help . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

page 7.

Privacy Act and Paperwork Reduction Act Notice . . . . . . . 9

Partial-Period Tax Tables . . . . . . . . . . . . . . . . . . . . . . . 10

Who Must File

You must file Form 2290 and Schedule 1 for the tax period

What’s New

beginning on July 1, 2009, and ending on June 30, 2010, if a

taxable highway motor vehicle (defined below) is registered,

Electronic filing. Electronic filing is required for each

or required to be registered, in your name under state,

return reporting 25 or more vehicles that the taxpayer files

District of Columbia, Canadian, or Mexican law at the time of

during the tax period. However, all taxpayers are

its first use during the period and the vehicle has a taxable

encouraged to file electronically. File Form 2290

gross weight of 55,000 pounds or more. See the examples

electronically through any electronic return originator (ERO),

under When To File on page 3.

transmitter, and/or intermediate service provider (ISP)

You may be an individual, limited liability company (LLC),

participating in the IRS e-file program for excise taxes. For

corporation, partnership, or any other type of organization

more information on e-file, visit the IRS website at

(including nonprofit, charitable, educational, etc.).

Disregarded entities and qualified subchapter S

Amended returns, VIN correction. Taxpayers can now

subsidiaries. Qualified subchapter S subsidiaries (QSubs)

check boxes on page 1 of Form 2290 to indicate if the return

and eligible single-owner disregarded entities are treated as

is amended or if a Vehicle Identification Number (VIN) is

separate entities for excise tax and reporting purposes.

being corrected. For more information see page 5.

QSubs and eligible single-owner disregarded entities must

Cat. No. 27231L

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10