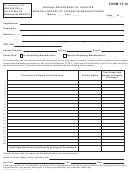

Form Tt-14 - Monthly Report Of Non-Resident Cigarette Stamping Agent Page 7

ADVERTISEMENT

SUPPORTING SCHEDULES

Column B: Enter the name and address of the

supplier from whom the cigarette packs were

Schedules A, B, C and D must be completed and

purchased.

submitted with the Form TT-14. The TT-14 is

not considered complete until all schedules have

Column C: Enter the number of cigarette packs to

been received.

which you affi xed the Virginia Cigarette Revenue

Stamp.

Do not include cigarette packs you

Late fi ling penalties will be assessed for incomplete

purchased with the Virginia Cigarette Revenue

reports.

Stamp already affi xed.

Existing in-house computer reports containing

Column D: Indicate if stamped packs were packs

the same information in the same format as the

of 20 or 25.

schedules are acceptable, provided they are

printed on 8 ½ x 11 paper (no legal paper or “green

When to File

bar” paper).

Form TT-14 and supporting schedules must

Schedule A: List packages of Virginia stamped

be received by the Department of Taxation by

cigarettes shipped into Virginia. Additional sheets

the twentieth of each month to report stamping

may be attached if necessary, provided that they

activity for the previous month. Reports received

use the same format and include all information

after the 20th of the month are subject to a $250

requested on the schedule.

late fi ling penalty. A stamping agent’s permit is

Schedule B: List the details of each purchase of

subject to revocation if two or more reports are

Virginia cigarette revenue stamps received during

fi led late within a calendar year.

the month.

Where to File

Schedule C: Enter Virginia customers to whom

unstamped cigarette packs were sold during the

Mail your completed Form TT-14 to:

month. For Tax-Exempt Entities, list names and

Tobacco Unit

address of all Virginia Tax-Exempt customers

Department of Taxation

to whom unstamped cigarette packs were sold

P.O. Box 715

during the month.

Tax-exempt customers are

Richmond, VA 23218-0715

those specifi cally identifi ed by the Code of Virginia

§58.1-1010.

Assistance

Schedule D: List details of all packs of cigarettes

For Form TT-14 information and assistance,

affi xed with a Virginia Cigarette Revenue Stamp

contact the Tobacco Unit at 804-371-0730, or

during the month.

e-mail your inquiry to: tobacco@tax.virginia.gov.

Column A: Enter the full brand family name. Do

not list brand style or abbreviate. For example, a

cigarette named Alpha Bravo Gold Menthol Lights

should be listed as Alpha Bravo Gold. Do not

report as AB Gold or AB Gold Menthol Lights.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7