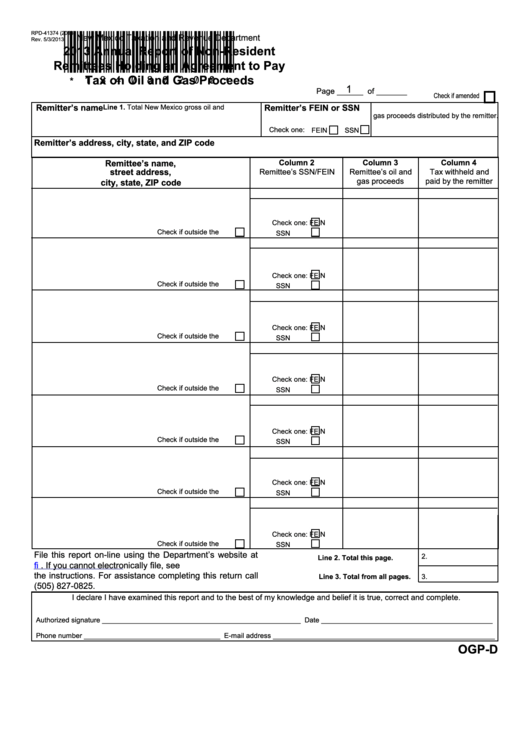

Form Rpd-41374 - Annual Report Of Non-Resident Remittees Holding An Agreement To Pay Tax On Oil And Gas Proceeds - 2013

ADVERTISEMENT

RPD-41374 (2013)

*134080200*

New Mexico Taxation and Revenue Department

Rev. 5/3/2013

2013 Annual Report of Non-Resident

Remittees Holding an Agreement to Pay

Tax on Oil and Gas Proceeds

1

Page ______ of _______

Check if amended

Remitter’s name

Remitter’s FEIN or SSN

Line 1. Total New Mexico gross oil and

gas proceeds distributed by the remitter.

Check one:

FEIN

SSN

Remitter’s address, city, state, and ZIP code

Column 2

Column 3

Column 4

Remittee’s name,

street address,

Remittee’s SSN/FEIN

Remittee’s oil and

Tax withheld and

gas proceeds

paid by the remitter

city, state, ZIP code

Check one:

FEIN

Check if outside the U.S.

SSN

Check one:

FEIN

Check if outside the U.S.

SSN

Check one:

FEIN

Check if outside the U.S.

SSN

Check one:

FEIN

Check if outside the U.S.

SSN

Check one:

FEIN

Check if outside the U.S.

SSN

Check one:

FEIN

Check if outside the U.S.

SSN

Check one:

FEIN

Check if outside the U.S.

SSN

File this report on-line using the Department’s website at

2.

Line 2. Total this page.

https://efile.state.nm.us. If you cannot electronically file, see

the instructions. For assistance completing this return call

Line 3. Total from all pages.

3.

(505) 827-0825.

I declare I have examined this report and to the best of my knowledge and belief it is true, correct and complete.

Authorized signature ___________________________________________________ Date ____________________________________________

Phone number ___________________________________ E-mail address _________________________________________________________

OGP-D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2