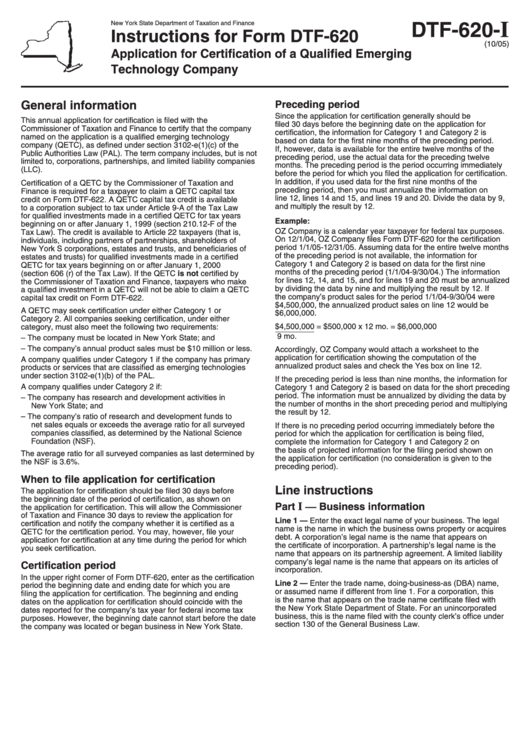

Instructions For Form Dtf-620 - Application For Certification Of A Qualified Emerging Technology Company

ADVERTISEMENT

I

DTF-620-

New York State Department of Taxation and Finance

Instructions for Form DTF-620

(10/05)

Application for Certification of a Qualified Emerging

Technology Company

General information

Preceding period

Since the application for certification generally should be

This annual application for certification is filed with the

filed 30 days before the beginning date on the application for

Commissioner of Taxation and Finance to certify that the company

certification, the information for Category 1 and Category 2 is

named on the application is a qualified emerging technology

based on data for the first nine months of the preceding period.

company (QETC), as defined under section 3102-e(1)(c) of the

If, however, data is available for the entire twelve months of the

Public Authorities Law (PAL). The term company includes, but is not

preceding period, use the actual data for the preceding twelve

limited to, corporations, partnerships, and limited liability companies

months. The preceding period is the period occurring immediately

(LLC).

before the period for which you filed the application for certification.

In addition, if you used data for the first nine months of the

Certification of a QETC by the Commissioner of Taxation and

preceding period, then you must annualize the information on

Finance is required for a taxpayer to claim a QETC capital tax

line 12, lines 14 and 15, and lines 19 and 20. Divide the data by 9,

credit on Form DTF-622. A QETC capital tax credit is available

and multiply the result by 12.

to a corporation subject to tax under Article 9-A of the Tax Law

for qualified investments made in a certified QETC for tax years

Example:

beginning on or after January 1, 1999 (section 210.12-F of the

OZ Company is a calendar year taxpayer for federal tax purposes.

Tax Law). The credit is available to Article 22 taxpayers (that is,

On 12/1/04, OZ Company files Form DTF-620 for the certification

individuals, including partners of partnerships, shareholders of

period 1/1/05-12/31/05. Assuming data for the entire twelve months

New York S corporations, estates and trusts, and beneficiaries of

of the preceding period is not available, the information for

estates and trusts) for qualified investments made in a certified

Category 1 and Category 2 is based on data for the first nine

QETC for tax years beginning on or after January 1, 2000

months of the preceding period (1/1/04-9/30/04.) The information

(section 606 (r) of the Tax Law). If the QETC is not certified by

for lines 12, 14, and 15, and for lines 19 and 20 must be annualized

the Commissioner of Taxation and Finance, taxpayers who make

by dividing the data by nine and multiplying the result by 12. If

a qualified investment in a QETC will not be able to claim a QETC

the company’s product sales for the period 1/1/04-9/30/04 were

capital tax credit on Form DTF-622.

$4,500,000, the annualized product sales on line 12 would be

A QETC may seek certification under either Category 1 or

$6,000,000.

Category 2. All companies seeking certification, under either

category, must also meet the following two requirements:

$4,500,000 = $500,000 x 12 mo. = $6,000,000

9 mo.

– The company must be located in New York State; and

– The company’s annual product sales must be $10 million or less.

Accordingly, OZ Company would attach a worksheet to the

application for certification showing the computation of the

A company qualifies under Category 1 if the company has primary

annualized product sales and check the Yes box on line 12.

products or services that are classified as emerging technologies

under section 3102-e(1)(b) of the PAL.

If the preceding period is less than nine months, the information for

A company qualifies under Category 2 if:

Category 1 and Category 2 is based on data for the short preceding

period. The information must be annualized by dividing the data by

– The company has research and development activities in

the number of months in the short preceding period and multiplying

New York State; and

the result by 12.

– The company’s ratio of research and development funds to

net sales equals or exceeds the average ratio for all surveyed

If there is no preceding period occurring immediately before the

companies classified, as determined by the National Science

period for which the application for certification is being filed,

Foundation (NSF).

complete the information for Category 1 and Category 2 on

the basis of projected information for the filing period shown on

The average ratio for all surveyed companies as last determined by

the application for certification (no consideration is given to the

the NSF is 3.6%.

preceding period).

When to file application for certification

Line instructions

The application for certification should be filed 30 days before

the beginning date of the period of certification, as shown on

I —

Part

Business information

the application for certification. This will allow the Commissioner

of Taxation and Finance 30 days to review the application for

Line 1 — Enter the exact legal name of your business. The legal

certification and notify the company whether it is certified as a

name is the name in which the business owns property or acquires

QETC for the certification period. You may, however, file your

debt. A corporation’s legal name is the name that appears on

application for certification at any time during the period for which

the certificate of incorporation. A partnership’s legal name is the

you seek certification.

name that appears on its partnership agreement. A limited liability

company’s legal name is the name that appears on its articles of

Certification period

incorporation.

In the upper right corner of Form DTF-620, enter as the certification

Line 2 — Enter the trade name, doing-business-as (DBA) name,

period the beginning date and ending date for which you are

or assumed name if different from line 1. For a corporation, this

filing the application for certification. The beginning and ending

is the name that appears on the trade name certificate filed with

dates on the application for certification should coincide with the

the New York State Department of State. For an unincorporated

dates reported for the company’s tax year for federal income tax

business, this is the name filed with the county clerk’s office under

purposes. However, the beginning date cannot start before the date

section 130 of the General Business Law.

the company was located or began business in New York State.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4