Form Dtf-620 - Application For Certification Of A Qualified Emerging Technology Company

ADVERTISEMENT

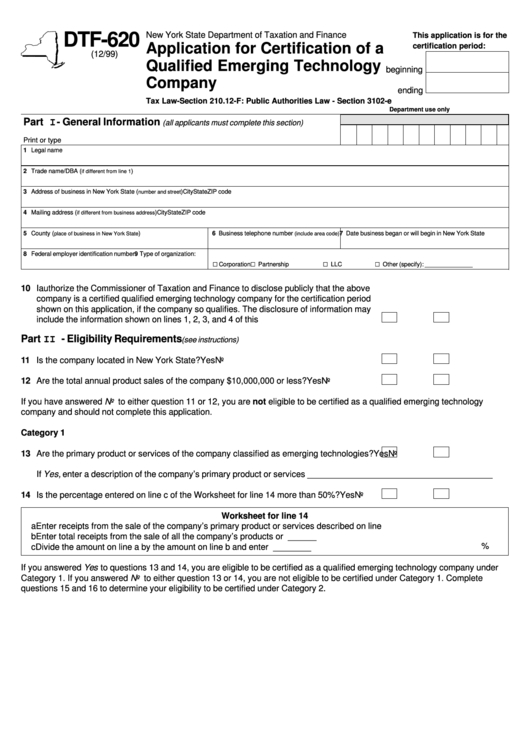

DTF-620

New York State Department of Taxation and Finance

This application is for the

Application for Certification of a

certification period:

(12/99)

Qualified Emerging Technology

beginning

Company

ending

Tax Law-Section 210.12-F: Public Authorities Law - Section 3102-e

Department use only

Part I - General Information

(all applicants must complete this section)

Print or type

1 Legal name

2 Trade name/DBA (

)

if different from line 1

3 Address of business in New York State (

)

City

State

ZIP code

number and street

4 Mailing address (

)

City

State

ZIP code

if different from business address

5 County (

)

6 Business telephone number

7 Date business began or will begin in New York State

place of business in New York State

(include area code)

8 Federal employer identification number

9 Type of organization:

G Corporation

G Partnership

G LLC

G Other (specify): ______________

10 I authorize the Commissioner of Taxation and Finance to disclose publicly that the above

company is a certified qualified emerging technology company for the certification period

shown on this application, if the company so qualifies. The disclosure of information may

include the information shown on lines 1, 2, 3, and 4 of this application.

Yes

No

Part II - Eligibility Requirements

(see instructions)

11 Is the company located in New York State?

Yes

No

12 Are the total annual product sales of the company $10,000,000 or less?

Yes

No

If you have answered No to either question 11 or 12, you are not eligible to be certified as a qualified emerging technology

company and should not complete this application.

Category 1

13 Are the primary product or services of the company classified as emerging technologies?

Yes

No

If Yes, enter a description of the company’s primary product or services _______________________________________

14 Is the percentage entered on line c of the Worksheet for line 14 more than 50%?

Yes

No

Worksheet for line 14

a Enter receipts from the sale of the company’s primary product or services described on line 13 .............. a __________

b Enter total receipts from the sale of all the company’s products or services ............................................. b __________

%

c Divide the amount on line a by the amount on line b and enter result ....................................................... c __________

If you answered Yes to questions 13 and 14, you are eligible to be certified as a qualified emerging technology company under

Category 1. If you answered No to either question 13 or 14, you are not eligible to be certified under Category 1. Complete

questions 15 and 16 to determine your eligibility to be certified under Category 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2