Print

Clear

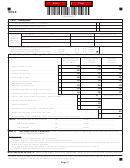

500X

Part I. - Exemptions

1.

1. Number of exemptions claimed on original return

2.

2. Number of exemptions claimed on this return

3.

3. Difference, if any

Dependents (children and other) not claimed on the original (or adjusted) return:

First Name

Last

Social Security Number

Relationship to you

If more than

three

additional

dependents,

attach a list

65 or over Blind

4. Additional Standard Deduction for Yourself and Spouse

Enter Number

[ ]

[ ]

(Check only those boxes not checked on

Yourself....................

of boxes

[ ]

original return and only if Standard Deduction is used).

[ ]

Spouse.....................

checked

Part II. - Computation of Georgia Taxable Income for part-year residents and nonresidents

GEORGIA

Income Not Taxable

Federal Income after

to Georgia

INCOME

Georgia Adjustments

COLUMN B.

COLUMN C.

COLUMN A.

.00

.00

.00

1. Wages, Salaries, Tips, Etc .....................................................

1.

.00

.00

.00

2.

2. Interest and Dividends ...........................................................

.00

.00

.00

3.

3. Business Income or (loss ......................................................

.00

.00

.00

4.

4. Other Income or (loss) ...........................................................

.00

.00

.00

5.

5. Total Income: Total Lines 1 through 4 .....................................

Adjustments to Income:

.00

.00

.00

6.

6. Total from Federal Form 1040 ................................................

.00

.00

.00

7.

7. Total Georgia Adjustments, explain in PART IV below ..........

.00

.00

.00

8.

8. Adjusted Gross Income: Line 5 plus or minus Lines 6 and 7

%

(Not to exceed 100%)

(

)

9.

9.

RATIO: Divide Line 8, Column C by Column A - Enter Percentage ................................

.00

10.

10.

Itemized or Standard Deduction ......................................................................................

.00

11.

11. Personal Exemptions ........................................................................................................

.00

12.

12. Total Deductions and Exemptions: Add Lines 10 and 11 ...............................................

.00

13.

13. Multiply Line 12 by Ratio on Line 9 and enter result ....................................................................................................

.00

14.

14. Georgia Taxable Income: Subtract Line 13 from Line 8. Enter on Line 5C on reverse side .....................................

Part III.

Disability OR retirement income exclusion

you____________________________spouse____________________________

Date of birth OR disability

you____________________________spouse____________________________

Type of disability

you____________________________spouse____________________________

Part IV.

EXPLANATION OF CHANGES

to Income, Deductions, Exemptions, and Credits. Show computations in detail.

Attach applicable schedules.

INSTRUCTIONS

1.

Attach a copy of your original and amended federal return.

2.

If the return is being amended due to a K-1, include the original and amended K-1.

3.

If you are filing an amended return to claim the low income credit, the claim must be filed by the end of the 12th month following the close of the

taxable year for which the credit may be claimed.

4.

If you want all or part of the refund applied to estimated tax, indicate this with the year and the amount on Line 19.

5.

If the return is being amended due to a W-2, include a copy of the W-2.

MAIL COMPLETED RETURN TO:

GEORGIA DEPARTMENT OF REVENUE, PROCESSING CENTER, P.O. BOX 740318, ATLANTA, GEORGIA 30374-0318

GEORGIA PUBLIC REVENUE CODE SECTION 48-2-31 STIPULATES THAT TAXES SHALL BE PAID IN LAWFUL MONEY OF

THE

UNITED STATES, FREE OF ANY EXPENSE TO THE STATE OF GEORGIA.

Page 2

1

1 2

2