Personal Property Lease/rental Transaction Tax - 7550

ADVERTISEMENT

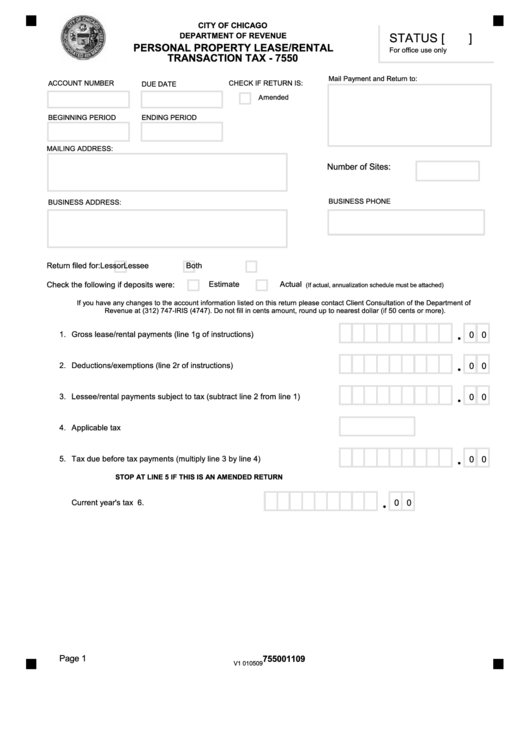

CITY OF CHICAGO

STATUS [

]

DEPARTMENT OF REVENUE

PERSONAL PROPERTY LEASE/RENTAL

For office use only

TRANSACTION TAX - 7550

Mail Payment and Return to:

ACCOUNT NUMBER

CHECK IF RETURN IS:

DUE DATE

Amended

BEGINNING PERIOD

ENDING PERIOD

MAILING ADDRESS:

Number of Sites:

BUSINESS PHONE

BUSINESS ADDRESS:

Lessor

Lessee

Both

Return filed for:

Estimate

Actual

Check the following if deposits were:

(If actual, annualization schedule must be attached)

If you have any changes to the account information listed on this return please contact Client Consultation of the Department of

Revenue at (312) 747-IRIS (4747). Do not fill in cents amount, round up to nearest dollar (if 50 cents or more).

1.

Gross lease/rental payments (line 1g of instructions).............................

0 0

2.

Deductions/exemptions (line 2r of instructions)......................................

0 0

3.

Lessee/rental payments subject to tax (subtract line 2 from line 1)........

0 0

4.

Applicable tax rate...................................................................................

5.

Tax due before tax payments (multiply line 3 by line 4)..........................

0 0

STOP AT LINE 5 IF THIS IS AN AMENDED RETURN

6.

Current year's tax payments....................................

0 0

Page 1

755001109

V1 010509

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6