Instructions For Preparing The Chicago Personal Property Lease/rental Transaction Tax Return For Lessors And Lessees - 7550

ADVERTISEMENT

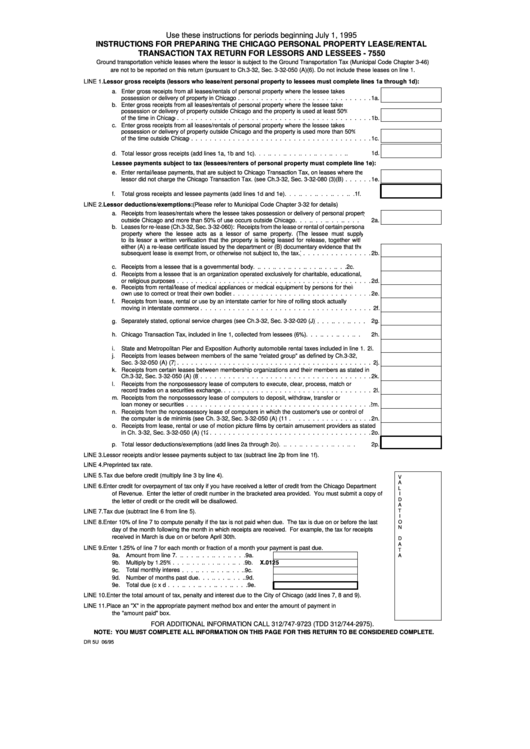

Use these instructions for periods beginning July 1, 1995

INSTRUCTIONS FOR PREPARING THE CHICAGO PERSONAL PROPERTY LEASE/RENTAL

TRANSACTION TAX RETURN FOR LESSORS AND LESSEES - 7550

Ground transportation vehicle leases where the lessor is subject to the Ground Transportation Tax (Municipal Code Chapter 3-46)

are not to be reported on this return (pursuant to Ch.3-32, Sec. 3-32-050 (A)(6). Do not include these leases on line 1.

LINE 1.

Lessor gross receipts (lessors who lease/rent personal property to lessees must complete lines 1a through 1d):

a. Enter gross receipts from all leases/rentals of personal property where the lessee takes

possession or delivery of property in Chicago . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11a.

b. Enter gross receipts from all leases/rentals of personal property where the lessee takes

possession or delivery of property outside Chicago and the property is used at least 50%

of the time in Chicago. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1b.

c. Enter gross receipts from all leases/rentals of personal property where the lessee takes

possession or delivery of property outside Chicago and the property is used more than 50%

of the time outside Chicago. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c.

d. Total lessor gross receipts (add lines 1a, 1b and 1c) . . . . . . . . . . . . . . . . . . . . . . . . .1d.

Lessee payments subject to tax (lessees/renters of personal property must complete line 1e):

e. Enter rental/lease payments, that are subject to Chicago Transaction Tax, on leases where the

lessor did not charge the Chicago Transaction Tax. (see Ch.3-32, Sec. 3-32-080 (3)(B)) . . . . . . 1e.

f.

Total gross receipts and lessee payments (add lines 1d and 1e)

. . . . . . . . . . . . . . . . . . 1f.

LINE 2.

Lessor deductions/exemptions: (Please refer to Municipal Code Chapter 3-32 for details)

a. Receipts from leases/rentals where the lessee takes possession or delivery of personal property

outside Chicago and more than 50% of use occurs outside Chicago . . . . . . . . . . . . . . . . 2a.

b. Leases for re-lease (Ch.3-32, Sec. 3-32-060): Receipts from the lease or rental of certain personal

property where the lessee acts as a lessor of same property. (The lessee must supply

to its lessor a written verification that the property is being leased for release, together with

either (A) a re-lease certificate issued by the department or (B) documentary evidence that the

subsequent lease is exempt from, or otherwise not subject to, the tax.) . . . . . . . . . . . . . . .2b.

c. Receipts from a lessee that is a governmental body . . . . . . . . . . . . . . . . . . . . . . . . . 2c.

d. Receipts from a lessee that is an organization operated exclusively for charitable, educational,

or religious purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2d.

e. Receipts from rental/lease of medical appliances or medical equipment by persons for their

own use to correct or treat their own bodies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2e.

f.

Receipts from lease, rental or use by an interstate carrier for hire of rolling stock actually

moving in interstate commerce . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2f.

g. Separately stated, optional service charges (see Ch.3-32, Sec. 3-32-020 (J)) . . . . . . . . . . . .2g.

h. Chicago Transaction Tax, included in line 1, collected from lessees (6%) . . . . . . . . . . . . . .2h.

i.

State and Metropolitan Pier and Exposition Authority automobile rental taxes included in line 1

. 2i.

j.

Receipts from leases between members of the same "related group" as defined by Ch.3-32,

Sec. 3-32-050 (A) (7).. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2j.

k. Receipts from certain leases between membership organizations and their members as stated in

Ch.3-32, Sec. 3-32-050 (A) (8).. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2k.

l.

Receipts from the nonpossessory lease of computers to execute, clear, process, match or

record trades on a securities exchange. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2l.

m. Receipts from the nonpossessory lease of computers to deposit, withdraw, transfer or

loan money or securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 m.

n. Receipts from the nonpossessory lease of computers in which the customer's use or control of

the computer is de minimis (see Ch. 3-32, Sec. 3-32-050 (A) (11)).

. . . . . . . . . . . . . . . .2n.

o. Receipts from lease, rental or use of motion picture films by certain amusement providers as stated

in Ch. 3-32, Sec. 3-32-050 (A) (12). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2o.

p. Total lessor deductions/exemptions (add lines 2a through 2o) . . . . . . . . . . . . . . . . . . . .2p.

LINE 3.

Lessor receipts and/or lessee payments subject to tax (subtract line 2p from line 1f).

LINE 4.

Preprinted tax rate.

LINE 5.

Tax due before credit (multiply line 3 by line 4).

V

A

LINE 6.

Enter credit for overpayment of tax only if you have received a letter of credit from the Chicago Department

L

of Revenue. Enter the letter of credit number in the bracketed area provided. You must submit a copy of

I

D

the letter of credit or the credit will be disallowed.

A

LINE 7.

Tax due (subtract line 6 from line 5).

T

I

LINE 8.

Enter 10% of line 7 to compute penalty if the tax is not paid when due. The tax is due on or before the last

O

N

day of the month following the month in which receipts are received. For example, the tax for receipts

received in March is due on or before April 30th.

D

A

LINE 9.

Enter 1.25% of line 7 for each month or fraction of a month your payment is past due.

T

9a. Amount from line 7 . . . . . . . . . . . . . . . . . . 9a.

A

9b. Multiply by 1.25% . . . . . . . . . . . . . . . . . . . 9b.

X

.0125

9c.

Total monthly interest . . . . . . . . . . . . . . . . . 9c.

9d. Number of months past due . . . . . . . . . . . . . 9d.

9e. Total due (c x d) . . . . . . . . . . . . . . . . . . . . 9e.

LINE 10. Enter the total amount of tax, penalty and interest due to the City of Chicago (add lines 7, 8 and 9).

LINE 11. Place an "X" in the appropriate payment method box and enter the amount of payment in

the "amount paid" box.

FOR ADDITIONAL INFORMATION CALL 312/747-9723 (TDD 312/744-2975).

NOTE: YOU MUST COMPLETE ALL INFORMATION ON THIS PAGE FOR THIS RETURN TO BE CONSIDERED COMPLETE.

DR 5U 06/95

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1