Annual Payroll Reconciliation Instructions - Canton City Income Tm Department

ADVERTISEMENT

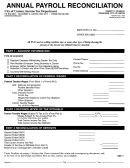

Annual Payroll

Instructions

Please fill out

this

form

completely,

aandfle it on or

before March 31. You may mail it

to the Canton City Income

Tm

Department, PO Box 8876, Canton

OH 44 711 -88 76, or hand deliver it

to our ofice at 424 Market Ave.,

North (4th Floor). Tke form must

be signed, and all

W-2's

and

1099 's (or a detailed computer

print-out of each employee b

W-2/1099 information) must be

attached, or the filing cannot be

accepted. Feelpee to call our ofice

with any questions (430-7900), or

visit us online:

cam

Part 1

-

Account

In formation

Enter current E N , and any other

E N used by a directly related

company for Canton City Income

Tax reporting purposes in the past

year.

If an entity is acting as a pay agent

for &liated companies, pursuant

to

Rev.

Proc. 70-06, please attach a

list of the names and EINs of the

mliates which currently are

conducting business, or are active

accounts, in Canton.

Enter account type.

Enter contact information. Most

issues and questions we have

regarding the Annual Payroll

Reconciliation can be addressed

with a quick phone call or e-mail.

Please help us to be more efficient,

by including

this important

information.

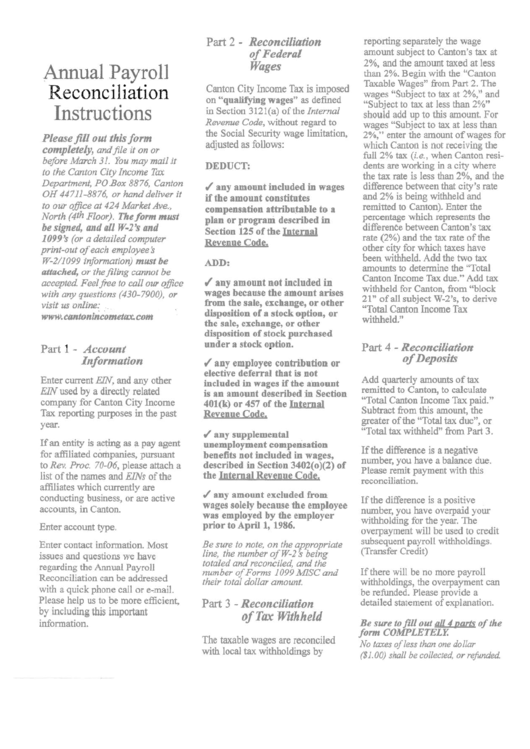

P a r t

2

-

Reconciliation

of Federal

Wages

Canton City Income Tax is imposed

on "qualifying wages" as defined

in Section 3121(a) of the Internal

Revenue Code, without regard to

the Social Security wage limitation,

adjusted as follows:

DEDUCT:

J any amount included in wages

if the amount constitutes

compensation attributable to a

plan or program described in

Section 125 of the Jnternal

&venue Code.

ADD:

J any amount not included in

wages because the amount arises

from the sale, exchange, or other

disposition of a stock option, or

the sale, exchange, or other

disposition of stock purchased

under a stock option.

J any employee contribution or

elective deferral that is not

included in wages if the amount

is an amount described in Section

401(k) or 457 of the Internal

Revenue Code,

J any supplemental

unemployment compensation

benefits not included in wages,

described in Section 3402(0)(2) of

the Internal Revenue Code,

J any amount excluded from

wages solely because the employee

was employed by the employer

prior to April 1,1986.

Be sure to note, on the appropriate

line, the number of W-2 b being

totaled and reconciled, and the

number of Forms 1099 M7SC and

their total dollar amount.

Part 3 - Reconciliation

of Tax Mthheld

The taxable wages are reconciled

with local tax withholdings by

reporting separately the wage

amount subject to Canton's

t a x

at

2%, and the amount taxed at less

than 2%. Begin with the "Canton

Taxable Wages" from Part 2. The

wages "Subject to tax at 2%," and

"Subject to tax at less than 2%"

should add up to this amount. For

wages "Subject to tax at less than

2%," enter the amount of wages for

which Canton is not receiving the

full 2%

tax (i.e., when Canton resi-

dents are working in a city where

the tax rate is less than 2%, and the

difference between that city's rate

and 2% is being withheld and

remitted to Canton). Enter the

percentage which represents the

difference between Canton's tax

rate (2%) and the tax rate of the

other city for which taxes have

been withheld. Add the two

t a x

amounts to determine the "Total

Canton Income Tax due." Add tax

withheld for Canton, from "block

21" of all subject W-2's, to derive

"Total Canton Income Tax

withheld."

Part 4

-

Reconciliation

of Deposits

Add quarterly amounts of

t a x

remitted to Canton, to calculate

"Total Canton Income Tax paid."

Subtract fiom this amount, the

greater of the "Total

tax

due", or

"Total tax withheld" from Part 3.

If the difference is a negative

number, you have a balance due.

Please remit payment with this

reconciliation.

If the difference is a positive

number, you have overpaid your

withholding for the year. The

overpayment will be used to credit

subsequent payroll withholdings.

(Transfer Credit)

If there will be no more payroll

withholdings, the overpayment can

be refunded. Please provide a

detailed statement of explanation.

Be sure to

fill

out

pi1

4 varts of the

form COWLETELK

No taxes of less than one dollar

($1.00) shall

be

collected, or refinded.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1