Annual Payroll Reconciliation Sheet

ADVERTISEMENT

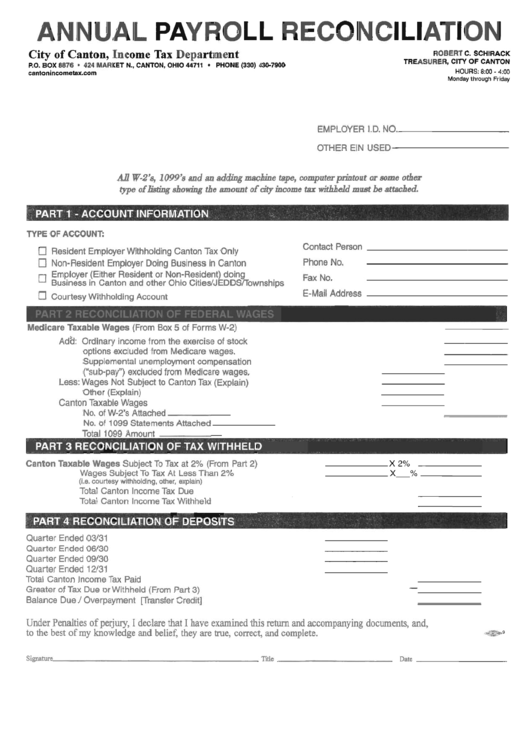

ANNUAL PAYROLL RECONCILIATION

City of Canton, Income Tax Department

P.O. BOX 8876

424 MARKET N . , CANTON, OHIO 44711

PHONE (330) 430-7900

ROBERT

C. SCHlRACK

TREASURER, CITY OF CANTON

HOURS: 8:00

-

4:00

Monday through Friday

EMPLOYER I.D. NO.

OTHER EIN USED

All

W-2'8,

1099's

and

an

adding

machine

tape,

wmputerprintout

or

some

other

type

of

lieting

lowing

the

amount

of

city

mwme

tax

withheld

mzut

be

d e d .

TYPE OF ACCOUNT:

Resident Employer Withholding Canton Tax Only

Contact Person

Non-Resident Employer Doing Business in Canton

Phone No.

Employer (Either Resident or Non-Resident doing

L

Business in Canton and other Ohio CitiesIJ DDSfTownships

Fax No.

Courtesy Withholding Account

E-Mail Address

1

PART

2

RECONCILIATION

OF

FEDERAL

WAGES

Medicare

Taxable

Wages

(From

Box

5

of

Forms

W-2)

~ d & : Ordinary income from the exercise of stock

options excluded from Medicare wages.

Supplemental unemployment compensation

("sub-pay") excluded from Medicare wages.

Less: Wages Not Subject to Canton Tax (Explain)

Other (Explain)

Canton Taxable Wages

No. of W-2's Attached

No. of 1099 Statements Attached

Total 1099 Amount

PART

3

RECONCILIATION OF

TAX

WITHHELD

I

Canton Taxable Wages Subject T o Tax at 2% (From Part 2)

Wages Subject To Tax At Less Than 2%

(i.e. courtesy withholding, other, explain)

Total Canton lncome Tax Due

Total Canton lncome Tax Withheld

Quarter Ended 03/31

Quarter Ended 06/30

Quarter Ended 09/30

Quarter Ended 12/31

Total Canton lncome Tax Paid

Greater of Tax Due or Withheld (From Part 3)

Balance Due / Overpayment [Transfer Credit]

Under Penalties of perjury, I declare that I have examined this return and accompanying documents, and,

to

the best

of

my knowledge and belief, they are true, correct, and complete.

Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1