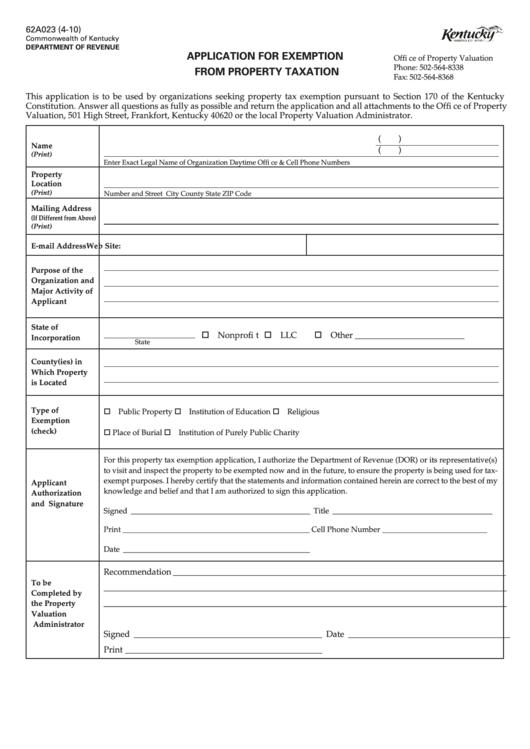

62A023 (4-10)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

APPLICATION FOR EXEMPTION

Offi ce of Property Valuation

Phone: 502-564-8338

FROM PROPERTY TAXATION

Fax: 502-564-8368

This application is to be used by organizations seeking property tax exemption pursuant to Section 170 of the Kentucky

Constitution. Answer all questions as fully as possible and return the application and all attachments to the Offi ce of Property

Valuation, 501 High Street, Frankfort, Kentucky 40620 or the local Property Valuation Administrator.

(

)

Name

(

)

(Print)

Enter Exact Legal Name of Organization

Daytime Offi ce & Cell Phone Numbers

Property

Location

(Print)

Number and Street

City

County

State

ZIP Code

Mailing Address

(If Different from Above)

(Print)

P.O. Box or Number and Street

City

County

State

ZIP Code

E-mail Address

Web Site:

Purpose of the

Organization and

Major Activity of

Applicant

State of

Nonprofi t

LLC

Other _________________________

Incorporation

State

County(ies) in

Which Property

is Located

Type of

Public Property

Institution of Education

Religious

Exemption

(check)

Place of Burial

Institution of Purely Public Charity

For this property tax exemption application, I authorize the Department of Revenue (DOR) or its representative(s)

to visit and inspect the property to be exempted now and in the future, to ensure the property is being used for tax-

exempt purposes. I hereby certify that the statements and information contained herein are correct to the best of my

Applicant

knowledge and belief and that I am authorized to sign this application.

Authorization

and Signature

Signed ______________________________________________

Title _________________________________________

Print ________________________________________________

Cell Phone Number ___________________________

Date ________________________________________________

Recommendation ____________________________________________________________________________

To be

____________________________________________________________________________________________

Completed by

____________________________________________________________________________________________

the Property

Valuation

Administrator

Signed ___________________________________________ Date _____________________________________

Print _____________________________________________

1

1 2

2 3

3 4

4 5

5