Certified Media Production Credit Worksheet For Tax Year - 2008

ADVERTISEMENT

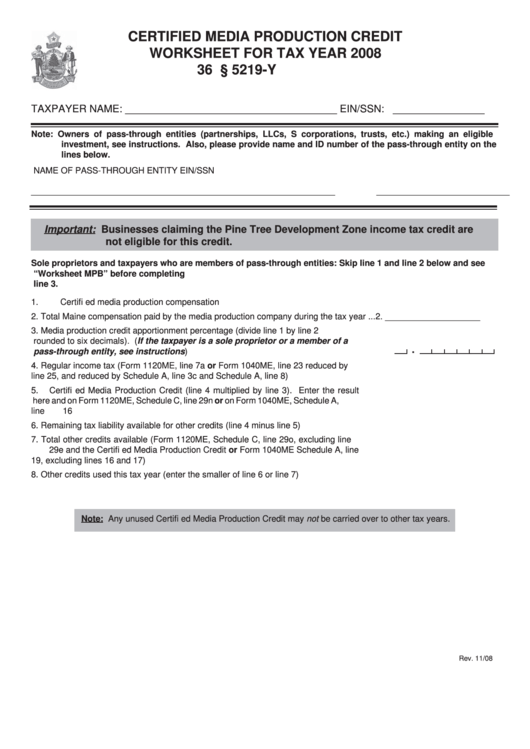

CERTIFIED MEDIA PRODUCTION CREDIT

WORKSHEET FOR TAX YEAR 2008

36 M.R.S.A. § 5219-Y

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Also, please provide name and ID number of the pass-through entity on the

lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

Important: Businesses claiming the Pine Tree Development Zone income tax credit are

not eligible for this credit.

Sole proprietors and taxpayers who are members of pass-through entities: Skip line 1 and line 2 below and see

“Worksheet MPB” before completing

line 3.

1.

Certifi ed media production compensation .......................................................................... 1. ____________________

2.

Total Maine compensation paid by the media production company during the tax year ... 2. ____________________

3.

Media production credit apportionment percentage (divide line 1 by line 2

rounded to six decimals). (If the taxpayer is a sole proprietor or a member of a

.

pass-through entity, see instructions) ........................................................................... 3.

4.

Regular income tax (Form 1120ME, line 7a or Form 1040ME, line 23 reduced by

line 25, and reduced by Schedule A, line 3c and Schedule A, line 8) ................................ 4. ____________________

5.

Certifi ed Media Production Credit (line 4 multiplied by line 3). Enter the result

here and on Form 1120ME, Schedule C, line 29n or on Form 1040ME, Schedule A,

line 16 ................................................................................................................................ 5. ____________________

6.

Remaining tax liability available for other credits (line 4 minus line 5) ............................... 6. ____________________

7.

Total other credits available (Form 1120ME, Schedule C, line 29o, excluding line

29e and the Certifi ed Media Production Credit or Form 1040ME Schedule A, line

19, excluding lines 16 and 17) ........................................................................................... 7. ____________________

8.

Other credits used this tax year (enter the smaller of line 6 or line 7) ................................ 8. ____________________

Note: Any unused Certifi ed Media Production Credit may not be carried over to other tax years.

Rev. 11/08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1