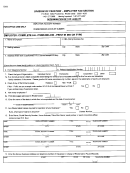

4.

Did your organization, currently or at any time, have any agents, independent representatives,

subcontractors,third parties, etc. who worked on your behalf in New Jersey?

No

Yes. Please state the names and addresses of all agents, independent representatives, sub-contractors, third

parties, etc. who worked on your behalf in New Jersey, on a separate rider.

5.

Provide the address where the books and records are located.

Street

City, State & Zip

Contact Person and Phone Number

If the books and records are located in New Jersey, please provide the date that the location was established.

Provide the address where the actual seat of Management and Control is located.

6.

Street

City, State & Zip

Contact Person and Phone Number

If located in New Jersey, please provide the date that the location was established.

7.

Is this entity related to any others (parent, subsidiary, etc.) with business activities in New Jersey

No

Yes; please provide the complete name and address of each related company, the manner in which it is

related and the type of business conducted in the State of New Jersey. Also, if this entity has or had at any

time, any activity at any related company's New Jersey address, please describe, in detail, any inter-company

transactions. Please provide the aforementioned on a separate rider.

8.

Is this entity a partner in a partnership or LLC doing business in or deriving income from New Jersey?

No

Yes; please provide the name and address of each partnership or LLC and all partners on a separate rider.

Also indicate the date that this entity became a partner, and when the partnership or LLC commenced business

in or began deriving income from New Jersey.

9.

Status of Business

Active

Dormant, Inactive

Dissolved (Attach Certificate of Dissolution)

Non Survivor of Merger (Please provide the following information on a separate rider: date of merger,

name, address and Federal ID# of surviving entity.)

Other (Please provide details on a separate rider.)

10.

Total gross revenue for past 4 years as reported to IRS:

Gross

Gross

Tax

Revenue

Revenue

Tax Year

Year

Gross

Gross

Tax

Revenue

Revenue

Tax Year

Year

11.

Total gross income from New Jersey for past 4 years:

NJ

NJ

Tax

Revenue

Revenue

Tax Year

Year

NJ

NJ

Tax

Revenue

Revenue

Tax Year

Year

Page 2 of 4

1

1 2

2 3

3 4

4