Form Dr 1285 - Licensed Distributor Reporting Form For Cigarettes Sales Of Non-Participating Manufacturer Brands - 2010 Page 2

ADVERTISEMENT

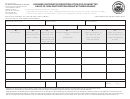

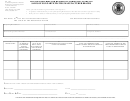

LICENSED DISTRIBUTOR REPORTING FORM FOR CIGARETTE SALES OF NON-PARTICIPATING MANUFACTURER BRANDS

DEFINITIONS

—

AND INSTRUCTIONS

In 1998, forty-six states, the District of Columbia

Under Colorado statute, it is the stamping agent,

and accurate certifications. The brands listed on the

and five U.S. territories (the states) entered into a

usually a licensed distributor, who is required to file a

Certified Brands Directory are the only brands that

settlement agreement with the four largest tobacco

monthly report of NPM cigarettes and RYO sold and

are legal for sale in Colorado. All other brands are

companies in the United States. Under this agreement,

an excise tax return with the Colorado Department of

contraband. All licensed distributors and stamping

called the Master Settlement Agreement (MSA),

Revenue (DOR). The information required by DOR

agents are required to provide an e-mail address

tobacco companies agreed to put restrictions on their

on the report includes, but is not limited to, a list by

to DOR to be notified of monthly updates to the

marketing practices and to pay a projected $206 billion

brand family of the total number of cigarettes and the

Directory.

over twenty-five years to the states to compensate

equivalent stick count for RYO sold in Colorado during

the states for costs arising from the health problems

the period for which taxes were paid. DOR uses the

If you have any questions regarding this information,

caused by the use of cigarettes and other tobacco

report to confirm the amount of excise tax due on

you may contact Brian Laughlin, Colorado Office of the

products.

cigarette and RYO sales.

Attorney General, Tobacco Settlement Enforcement, at

(303) 866-5079, or you may contact Jeanne Pletcher

More tobacco manufacturers have subsequently

In April each year, NPMs must file with the Colorado

at (303) 205-8211 extension 6848 or Anthony Muller

signed the MSA. All manufacturers who have signed

Office of the Attorney General (OAG) a Certificate

at (303) 205-8211 extension 6860 at the Colorado

the MSA are referred to as participating manufacturers

of Compliance by Non-Participating Manufacturer

Department of Revenue.

(PMs). There are a number of cigarette and roll-your-

Regarding Escrow Payments (NPM certificate). The

own tobacco (RYO) manufacturers who have not signed

NPM certificate is designed to capture the total number

As part of the Master Settlement Agreement and the

the MSA. They are referred to as nonparticipating

of units sold by brand name, the total amount of escrow

Colorado Tobacco Escrow Funds Act, the Department

manufacturers (NPMs). Under the Colorado Tobacco

to be paid based on those sales, the financial institution

of Revenue is required and authorized to compile

Escrow Funds Act, C.R.S. section 39-28-201 et seq.,

which holds the escrow funds and the signature of an

NPMs must put money into a qualified escrow fund “to

authorized agent.

information about cigarettes and roll-your-own tobacco

guarantee a source o f compensation and to prevent

sold in Colorado. C.R.S. §§ 39-28-201 – 203, and

DOR summarizes the information provided by

[NPMs] from deriving large, short-term profits and then

305. If you anticipate that you will only sell product

licensed distributors and provides the summary to the

becoming judgment-proof before liability may arise.”

manufactured by PMs, purchase only stamped and/or

OAG. The OAG compares the DOR information to NPM

The qualified escrow fund is an escrow arrangement

tax paid product from Colorado licensed distributors,

certificate filings to confirm that each NPM has made a

between the NPM and a federally or state chartered

or sell only tobacco products not subject to the MSA,

correct deposit into its qualified escrow fund. The OAG

financial institution, which, among other things,

you should complete Form DR 1286.

notifies NPMs of payment deficiencies based on the

prohibits the manufacturer from using, accessing or

comparison of manufacturer-provided information and

directing the use of the fund’s principal.

Form DR 1285 is designed to track all NPM cigarettes

distributor-provided information.

and RYO that enter the State of Colorado. Complete

The amount of money an NPM must contribute to

Form DR 1285 and submit it monthly if you are a

In conjunction with the Colorado Tobacco Escrow

the qualified escrow fund each year is based on the

cigarette distributor/wholesaler and/or a tobacco

Fund Act, the State of Colorado maintains the Colorado

number of units of cigarettes and RYO the NPM sold

products distributor/wholesaler:

Certified Brands Directory (Directory). Pursuant to

in the state during the year (units sold). The number

• Selling NPM manufactured cigarettes in Colorado

C.R.S. sections 39-28-301 et seq., all tobacco product

of units sold is measured by the number of individual

and affixing the Colorado cigarette tax stamp;

manufacturers that wish to sell cigarettes and RYO

cigarettes sold in the state by an NPM as measured

• Selling tax paid NPM manufactured RYO in

in Colorado must file an annual certification with

by excise taxes collected on RYO and on packs of

Colorado; or

DOR and the OAG. Tobacco Product Manufacturers

cigarettes. No escrow funds are required for other

• Selling tax exempt NPM cigarettes and RYO in

include both PMs and NPMs. The Directory is found

tobacco products.

Colorado.

online at and lists tobacco

product manufacturers that have provided complete

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3