Form Dr 1285 - Licensed Distributor Reporting Form For Cigarettes Sales Of Non-Participating Manufacturer Brands - 2010 Page 3

ADVERTISEMENT

DEFINITIONS

INSTRUCTIONS

Column D: Convert the number of ounces of NPM

RYO sold in Colorado into sticks by dividing the ounces

“Cigarette” means any product that meets the defini-

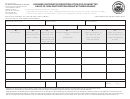

Form DR 1285 is designed to track all NPM cigarettes

in Column C by .09 and rounding to the nearest whole

and RYO that enter the State of Colorado. This report

tion found in C.R.S. § 39-28-202(4). The term “cigarette”

number. For RYO returned to the NPM, complete all

must be completed by a licensed distributor:

columns and enter the number of sticks in parentheses.

includes “roll-your-own” tobacco (RYO). For purposes of

•

Selling NPM manufactured cigarettes in Colorado

this definition of “cigarette,” 0.09 ounces of roll-your-own

List brands returned on a separate line from brands

and affixing the Colorado cigarette tax stamp;

tobacco constitutes one individual “cigarette.”

sold during the reporting month.

•

Selling tax paid NPM manufactured RYO in

Colorado; or

“Tobacco Product Manufacturer” means any

Column E: Enter the name and address of the NPM

•

Selling tax exempt NPM cigarettes and RYO in

person who meets the definitions found in C.R.S. §

of the brand listed in Column A.

Colorado.

39-28-202(9).

A separate form for each non-participating manu-

Column F: Enter the name and address of the entity

facturer is preferable, but not required. A computer

“Licensed Distributor” means any person who is

from whom each brand was purchased if different from

generated form is allowed ONLY if pre-approved by

licensed pursuant to C.R.S. § 39-28-102 (cigarette)

the entity indentified in Column E.

the Department.

and/or § 39-28.5-104 (tobacco products). This term

covers, but is not limited to distributors, distributor

Column G: If the product was tax exempt, place a

Identifying Information

subcontractors, wholesalers, wholesale subcontrac-

checkmark in the box. See definitions for meaning of

tors, and stamping agents.

“tax exempt.”

Enter the report month and year, your business name

and address as they appear on your license and your

“Non-participating Manufacturer” (NPM) as de-

Signature: Each report must be signed by an autho-

Colorado Business Registration Number. Enter the

fined in C.R.S. § 39-28-302(5) means any tobacco

rized individual.

name, telephone number, and FAX number, of the

product manufacturer who is not a signatory to the

individual responsible for the report. An e-mail address

MSA.

is required.

Page Numbers: Enter the page number and total

number of pages included in the submission.

“Certified Brands Directory” is the Department

Tax Paid Sales & Tax Exempt Sales

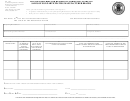

Column A: Enter the full brand name of the product

of Revenue’s listing of cigarette manufacturers and

Due Date: 20th day of each month following the

sold (do not abbreviate). Do not break down into sub-

brands that have been approved for sale in Colorado.

close of the reporting month.

categories, such as regular, menthol, light, etc. For

If a brand is not listed, it is contraband and may not

example, for a cigarette named “Alpha Bravo Gold

be sold or possessed for sale in Colorado. The Direc-

Retain a copy for your files. Mail (mail separately —

Menthol Lights” report as “Alpha Bravo Gold.” Do not

tory may be obtained at or by

do not include this form with other reports mailed to

report as “A B Gold” or “A B Gold Menthol Light.”

calling the department at (303) 205-8211, Ext. 6860

the Department of Revenue) or fax completed form to:

or Ext. 6848.

Column B: Enter the number of individual NPM

Colorado Department of Revenue

cigarettes sold in Colorado during the reporting month

“Tax Exempt” means sales to the United States

Excise Tax Accounting Section

in packages stamped with the excise tax stamp of

government or any of its agencies; sales in interstate

1375 Sherman Street, Room 237

Colorado. List only cigarettes contained in packages

commerce or transactions the taxation of which is

Denver, CO 80261

to which you have affixed the excise tax stamp of

prohibited by the constitution of the United States.

FAX: (303) 205-8204

Colorado. Do not list cigarettes that were purchased

C.R.S. § 39-28-111.

with the tax stamp already affixed. For cigarettes

returned to the NPM, complete all columns and enter

FAILURE TO FILE THIS REPORT AS

RECORDS RETENTION INFORMATION

the number of cigarettes in parentheses. List brands

REQUIRED MAY RESULT IN THE

returned on a separate line from brands sold during

REVOCATION OF YOUR CIGARETTE

Tobacco Product Distributors are required to maintain

the reporting month.

AND/OR TOBACCO PRODUCTS LICENSE(S)

all invoices and documentation of sales and other such

FOR A PERIOD OF TWO YEARS

information relied upon for certification for a period of

Column C: List the number of ounces of NPM roll-

5 years. C.R.S. § 39-28-305(1)(g).

your-own tobacco brought into Colorado during the

reporting month.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3