Super Research And Development Tax Credit Worksheet - 2008

ADVERTISEMENT

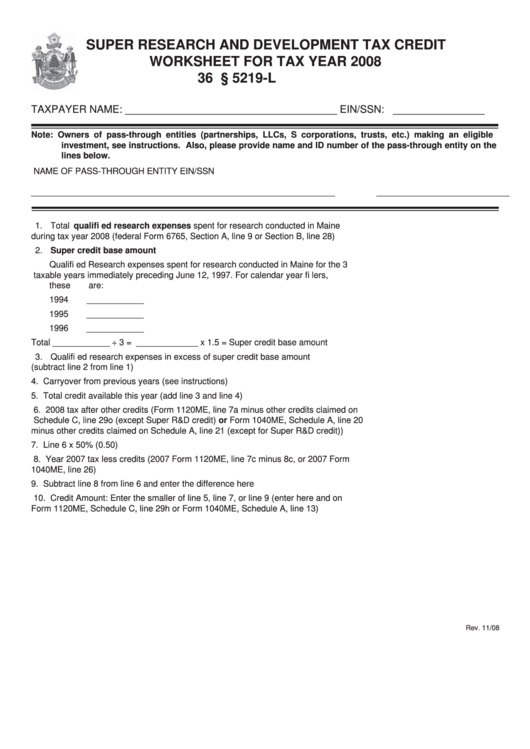

SUPER RESEARCH AND DEVELOPMENT TAX CREDIT

WORKSHEET FOR TAX YEAR 2008

36 M.R.S.A. § 5219-L

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Also, please provide name and ID number of the pass-through entity on the

lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

1. Total qualifi ed research expenses spent for research conducted in Maine

during tax year 2008 (federal Form 6765, Section A, line 9 or Section B, line 28) ................. 1. __________________

2. Super credit base amount

Qualifi ed Research expenses spent for research conducted in Maine for the 3

taxable years immediately preceding June 12, 1997. For calendar year fi lers,

these are:

1994 ____________

1995 ____________

1996 ____________

Total ____________ ÷ 3 = _____________ x 1.5 = Super credit base amount ................... 2. __________________

3. Qualifi ed research expenses in excess of super credit base amount

(subtract line 2 from line 1) ..................................................................................................... 3. __________________

4. Carryover from previous years (see instructions) ................................................................... 4. __________________

5. Total credit available this year (add line 3 and line 4) ............................................................. 5. __________________

6. 2008 tax after other credits (Form 1120ME, line 7a minus other credits claimed on

Schedule C, line 29o (except Super R&D credit) or Form 1040ME, Schedule A, line 20

minus other credits claimed on Schedule A, line 21 (except for Super R&D credit)) .............. 6. __________________

7. Line 6 x 50% (0.50) ................................................................................................................. 7. __________________

8. Year 2007 tax less credits (2007 Form 1120ME, line 7c minus 8c, or 2007 Form

1040ME, line 26) ..................................................................................................................... 8. __________________

9. Subtract line 8 from line 6 and enter the difference here ........................................................ 9. __________________

10. Credit Amount: Enter the smaller of line 5, line 7, or line 9 (enter here and on

Form 1120ME, Schedule C, line 29h or Form 1040ME, Schedule A, line 13) ...................... 10. __________________

Rev. 11/08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1